Wheat futures hit highest price since January: Grain market daily

Tuesday, 23 April 2024

Market commentary

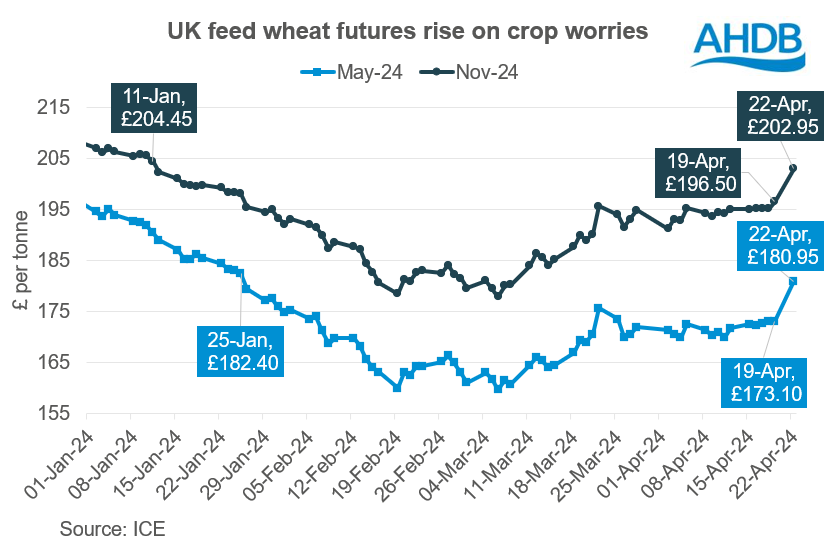

- UK feed wheat futures saw significant growth yesterday with the May-24 contract gaining £7.85/t, to settle at £180.95/t; the Nov-24 contact also saw support to prices, closing at £202.95/t, a rise of £6.45/t

- The European Union’s crop monitoring service, MARS, raised its forecast for cereal yields on Monday, with recent favourable weather benefiting crops; estimates for the average EU-27 soft wheat yield in 2024 were raised to 5.93 t/ha, up from initial forecasts of 5.91 t/ha

- Paris old crop (May-24) rapeseed futures were up €7.50/t yesterday, closing at €456.50/t; new crop prices were also up over the same period, closing at €466.75/t, rising by €11.25/t

- Rapeseed prices have risen, following support to Chicago soyabean prices yesterday from technical trading; however, weather remains a key watchpoint, with forecasters suggesting that the La Niña weather phenomenon will not reach full strength in time to impact US crops

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Wheat futures hit highest price since January

Wheat futures jumped yesterday following concerns regarding US wheat conditions and ongoing Black Sea tensions. UK feed wheat future for old crop (May-24) saw a jump of £7.85/t, to a closing price of £180.95/t; new crop prices also followed suit, up by £6.45/t over the same period.

This is the highest price seen for both old and new crop contracts since January this year, providing some relief from the lower prices we have seen recently. Prices have risen globally, with both Chicago wheat and Paris milling wheat also seeing increases.

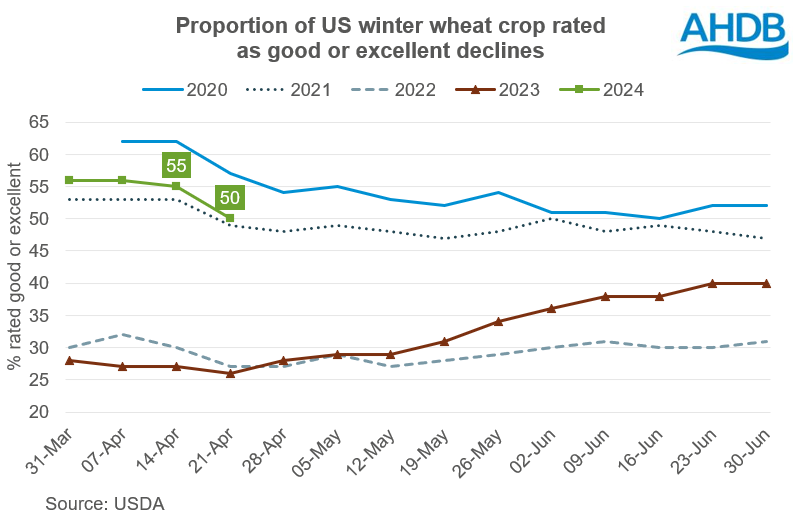

This rise comes of the back of news that US winter wheat crop ratings have been cut, as investment funds remain short on wheat. The concerns over supply and price rises are reportedly prompting funds to cover short positions.

The USDA’s most recent crop progress report showed that 50% of the US winter wheat crop had been rated in good-to-excellent condition, down 5% from last week. Despite this rating still being high for the time of year, concerns are growing about the current dry weather in the Southern Plains. On April 16, 24% of US winter wheat was situated within an area currently experiencing drought.

Ratings saw declines in key wheat-producing states, including Kansas, the top US winter wheat producer. The USDA has rated 36% of the Kansas winter wheat crop as good-to-excellent, down from 43% in the previous week. Declines were also seen in Oklahoma, Montana, Colorado and Texas.

Support for prices also came from the dry weather currently being seen in Russia, while tensions have continued to mount in the Black Sea. Russian attacks on the port of Pivdennyi in Ukraine destroyed grain storage facilities and foodstuffs (LSEG).

The global grain market looks to be finely balanced in terms of supply and demand, with weather remaining a key watchpoint for many large grain-producing countries. Questions are being asked as to how the current weather will impact this balance, while Black Sea tensions pose a risk to access to exportable supplies. Both will continue to be closely monitored.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.