Fertiliser challenge continues for harvest 2024: Grain market daily

Thursday, 14 March 2024

Market commentary

- UK feed wheat futures (May-24) closed at £165.40/t yesterday, down £0.60/t from Tuesdays’ close. New crop futures (Nov-24) were also down by £0.60/t over the same period, ending yesterday’s session at £185.70/t.

- Russian wheat has continued to flood the market this week, as the country attempts to reduce its inventories in preparation for a bumper 2024 harvest. This has weighed down on both U.S. and European prices. Additionally, cheap Russian grain has prompted China to cancel the purchase of over 500 Kt of U.S. soft red winter wheat, the largest reported cancellation in over two decades (UkrAgroConsult).

- Paris rapeseed futures (May-24) closed yesterday at €440.25/t, down €75/t from Tuesday’s close. New crop futures (Nov-24) were down by €4.25/t over the same period, ending the session at €442.00/t.

- Despite a drought during the growing season, Australia’s rapeseed crop appears to have turned a corner, with late-season rain benefitting yield estimates. LSEG now estimate total Australian rapeseed production for 2023/24 at 5.31 Mt, up 7% on the previous estimate, adding some bearish sentiment to prices yesterday.

- However, old crop US soyabean markets were generally supported yesterday. Intense rainfall in Argentina could reportedly lead to losses to the country’s soyabean crop. Brazil has also seen adverse weather conditions this week, with Conab making a 2.6 Mt cut to its Brazilian soyabean production estimate, now at 146.9 Mt.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Fertiliser challenge continues for harvest 2024

After a wet autumn and winter, and concern surrounding spring seed availability, the UK planting campaign has and continues to see significant challenges. As such, the market is positioning to expect a tighter domestic wheat supply into the new season (harvest 2024), with a growing premium for the UK feed wheat futures new crop (Nov-24) contract over the old crop (May-24) contract.

Adding onto drilling challenges, global price pressure has been pushing UK ex-farm prices lower in recent months, and cost challenges remain on-farm, especially looking to fertiliser.

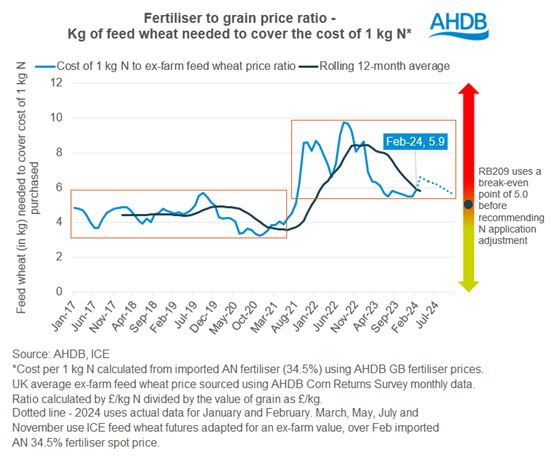

Given the historically firm fertiliser costs remaining and falling grain price, we can show this in a simple break-even ratio of the cost of 1 kg of Nitrogen (N) applied through an imported AN 34.5% fertiliser, to the price of UK average ex-farm feed wheat (per kg, using AHDB Corn Returns Survey data). This ratio shows the kg of feed wheat needed as output, to cover the cost of 1 kg of N input. Here, the lower the number the better, as you need fewer kg’s of feed wheat to cover the cost of 1 kg of N.

Since 2017 to before the end of 2021, historically this ratio sat mostly between 3 – 5.5, i.e., 5.5 kg feed wheat to cover the cost of 1 kg of N. RB209 uses a break-even point of 5 kg of grain to cover the cost of 1 kg of N, before recommending N application adjustment. Since the European energy crisis and outbreak of war in Ukraine, this increased to near 10 – i.e., 10 kg feed wheat needed to cover the cost of 1 kg N. Before this then settled back down to a still supported 5.9 in February 2024. Though these are average prices, they give an indication of cost impact on-farm, and what this may mean for decision making.

Worth noting, this season (2023/24), we have seen both milling and malting premiums rise significantly. With this large milling premium, the ratio of UK average ex-farm milling wheat (kg) needed to cover the cost of 1 kg of N, lies significantly lower than the ratio for feed wheat. This sit in February at 4.3 kg milling wheat to cover 1 kg of N, which is 1.6 kg of grain lower than that for feed wheat. Whereas in previous seasons these have been much more closely aligned, with the average difference over the previous past five seasons at 0.7 kg lower (2018/19 – 2022/23).

Fertiliser to grain ratio reflects continued cost challenge for businesses

Looking ahead, if we assume fertiliser prices remain relatively stable, as we have seen in recent months, we can project the ratio forward (see dotted line on the graph). This uses a spot imported AN 34.5% fertiliser price for Feb 24 and UK feed wheat futures taken on 08 March close for forward months, converted to an ex-farm price. As UK grain futures pricing currently stands, the number of kg’s of feed wheat needed to cover the cost of 1kg of N looks to increase slightly for old-crop values as we progress to the end of the season, considering recent old-crop feed wheat price pressure. Then staying supported for the new season too (using Nov-24 futures) the ratio signifies a costly environment remaining for businesses, but the ratio looks to remain significantly lower than late 2021 and 2022 levels.

Considering the crop potential for many crops for harvest 2024 after delayed planting and consistent rainfall, alongside high input costs remaining, could we see a change to application patterns this year? For example, looking back to 2020, after a wet autumn 2019, we saw average GB total N application in 2020 drop 4% in the British Survey of Fertiliser Practice year-on-year.

Though certainly changes in fertiliser price will also be important to consider when looking ahead for this ratio. Despite some price steadying, risks remain for nitrogen fertiliser markets surrounding key policy changes, as well as increasing reliance on imported products. Considering EU gas supplies as we head towards winter 2024 will be key for price direction.

With the kg of grain needed to cover cost of 1kg of N currently remaining elevated, this is something to consider when managing this key on-farm input. It would be worth calculating your own fertiliser to grain ratio, utilise benchmarking tools like Farmbench and consider your nitrogen use efficiency. AHDB’s RB209 information can help you make application decisions, based on your own break-even ratio calculated. Though important to remember, agricultural costs were pegged a key differential between top and bottom performers in the latest report for the Characteristics of Top Performing Farms. Despite spending more on variable costs like fertiliser, seed and crop protection, yield is often markedly higher for top performers.

Notes

- Cost for imported AN 34.5% fertiliser sourced using the AHDB’s GB fertiliser price series.

- Price of ex-farm UK feed wheat

- Jan 2017 to Feb 2024 uses data recorded in the AHDB Corn Returns Survey, average UK feed wheat price.

- February, May, July and November price is calculated using spot UK feed wheat futures, adapted using a previous 5-year average discount of UK average ex-farm prices to nearby UK feed wheat futures.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.