Further strengthening of milling wheat premiums in January: Grain market daily

Wednesday, 21 February 2024

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £163.00/t, up £3.00/t from Monday’s close. New crop futures (Nov-24) closed at £181.30/t, up £2.80/t over the same period. This slight rebound in the market filtered through from US wheat markets yesterday, with rising uncertainty regarding the upcoming spring growing season in the Northern Hemisphere.

- Competitive Black Sea exports combined with lacklustre export demand continue to cap any major gains in European and domestic wheat markets. However, tension over Ukrainian grain entering the EU and displacing polish grain has risen, with speculation regarding the introduction of quotas.

- Paris rapeseed futures (May-24) closed yesterday at €426.25/t, down €0.50/t from Monday’s close. The Nov-24 contract ended yesterday’s session at €428.75/t, up €0.25/t.

- Despite gains in US soyabean markets yesterday, old crop EU rapeseed prices moved down with the vegetable oil and crude oil markets. Nearby Brent crude oil futures were pressured 1.35% over yesterday’s session.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

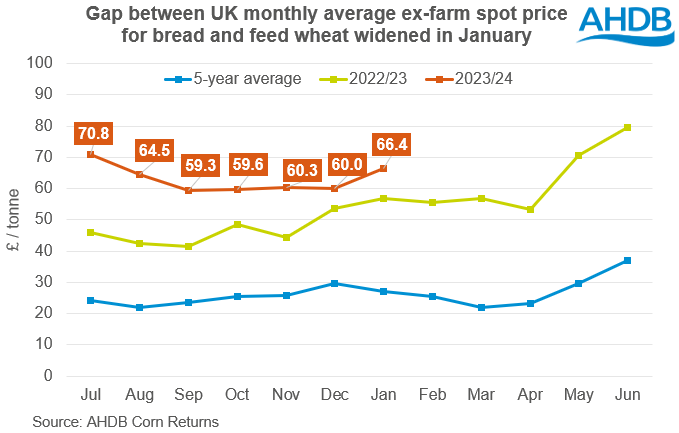

Further strengthening of milling wheat premiums in January

The gap between the UK monthly average ex-farm spot price for bread and feed wheat widened in January to £66.40/t. This was up compared to £60.00/t in December, and up from £56.70/t a year earlier. It is also well above the five-year average of £27.10/t for the month of January.

Since then, milling premiums look to have remained firm though have eased slightly. On 15 February 2024 (latest data), UK spot ex-farm bread milling wheat was at a £61.80/t premium to feed wheat.

As has been well reported, milling premiums remain historically firm due to limited availability but stable demand for domestic milling grade wheat. In AHDB’s latest UK supply and demand estimates, wheat usage for human and industrial consumption was forecast up 193 Kt (3%) on the year. While this increase is largely due to a strong start from the bioethanol and starch industries, relatively firm demand for wheat for milling also contributes to the yearly climb.

Due to the tight domestic milling wheat outlook and therefore rising premiums, it is expected that a greater proportion of imported wheat will be used this season compared to last. AHDB currently estimates full season wheat imports at 1.725 Mt. According to the latest UK trade data, this season to date (Jul-Dec) wheat imports (incl. durum) have totalled 1.037 Mt. up 45.1% on the year, and up 3.2% on the five-year average. In the month of December, wheat imports totalled 254.1 Kt, the highest for this month since December 2020 following the poor harvest that year.

Where next?

Looking ahead, it’s likely that premiums will remain at high levels as long as imported wheat doesn’t become more competitive. With growing concerns over next year’s domestic crop due to unfavourable weather, import pace is expected to continue, especially towards the end of the season. With the majority of imported milling wheat coming from Germany and Canada, imported prices will of course depend on conditions and output in these countries, something to watch over the next few months.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.