Malting barley premiums remain elevated: Grain market daily

Tuesday, 9 January 2024

Market commentary

- UK feed wheat futures (May-24) closed at £192.75/t yesterday, down £1.10/t from Friday’s close. The Nov-24 contract fell £0.90/t over the same period, closing at £205.40/t.

- Domestic wheat futures followed European wheat futures markets lower yesterday, with ongoing concerns over sluggish EU export demand so far after Christmas. There are concerns that some French shipments could be postponed (LSEG).

- Paris rapeseed futures (May-24) ended yesterday’s session at €420.25/t, down €4.00/t from Friday’s close. The Nov-24 contract was down €3.25/t over the same period, ending the session at €427.50/t.

- Paris rapeseed prices followed the US soyabean market down yesterday on the back of improved weather in Brazil. Losses in crude oil markets also pressured the wider oilseed complex. Nearby Brent crude oil futures were down 3.35% yesterday.

Malting barley premiums remain elevated

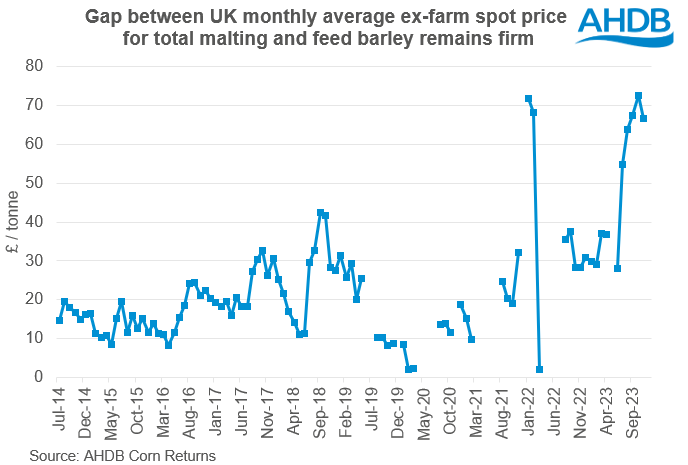

As has been outlined in previous analyses, malting barley premiums reached record highs throughout the first few months of the season. In November, on average, the gap between feed and malting barley eased slightly, though it remained historically firm. So, can we expect this to continue moving forward?

In the week ending 4 January (latest data), UK spot ex-farm premium malting barley was at a £78.40/t premium to feed barley – the highest recorded price gap so far this season.

Looking at the supply and demand outlook of malting barley for the 2023/24 season, it can be expected that premiums will remain strong in at least the short to midterm. Barley production this season was down 5% on the year and AHDB’s Cereal Quality Survey showed lower specific weights and screening levels compared to the previous season. Due to the poorer quality of the domestic crop, in AHDB’s latest supply and demand estimates, imports are expected to be above the five-year average at 87 Kt. However, total availability is still expected to be down slightly.

Despite the ‘cost-of-living crisis’, domestic human and industrial consumption of barley this season is forecast to remain steady and in line with last season at 1.985 Mt. This is largely due to expectations that demand for distilling will remain robust from increased capacity coming online last season. This season to date (Jul–Oct), total barley usage by brewers, maltsters and distillers is up 1.7% on the year.

Looking ahead

Longer term, the strength in premiums will depend largely on the 2024 domestic barley crop. As it stands, in AHDB’s Early Bird Survey, the total barley area is forecast to rise 4% year-on-year, with a climb in spring barley planting intentions outweighing a loss to the winter barley area. However, continued wet weather since the survey was first carried out means many farmers may not have been able to plant what winter crops they had intended. Therefore, it could be that we see an even larger spring barley area than initially estimated due to a lack of winter drilling (subject to seed availability). Similar patterns are projected for top European growers France and Germany. In this case, as long as spring and summer growing conditions are favourable, heavier supplies next harvest could weigh on premiums longer term, though demand will remain a watchpoint.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.