Teething problems or permanent toothache? Latest UK agri-food trade data

Tuesday, 13 April 2021

The Office of National Statistics (ONS) has released its latest UK trade data, covering February 2021. Evidence from the Business Insights and Conditions Survey (BICS) suggested that additional paperwork and higher transportation costs were the biggest challenges currently facing UK importers and exports in February.

While this gives us some further indication as to the impact of the end of the transition period, the ONS has stated that other issues still persist and so it is hard to precisely quantify the impacts of EU Exit so far;

‘’Trade patterns are likely to also reflect the impacts of the unwinding of stocks, coronavirus (COVID-19) pandemic restrictions, and lower demand due to the UK and global economic recession. It is too soon to be able to assess to what extent recent trading patterns are short-term or reflect more lasting structural changes.’’ Source: ONS

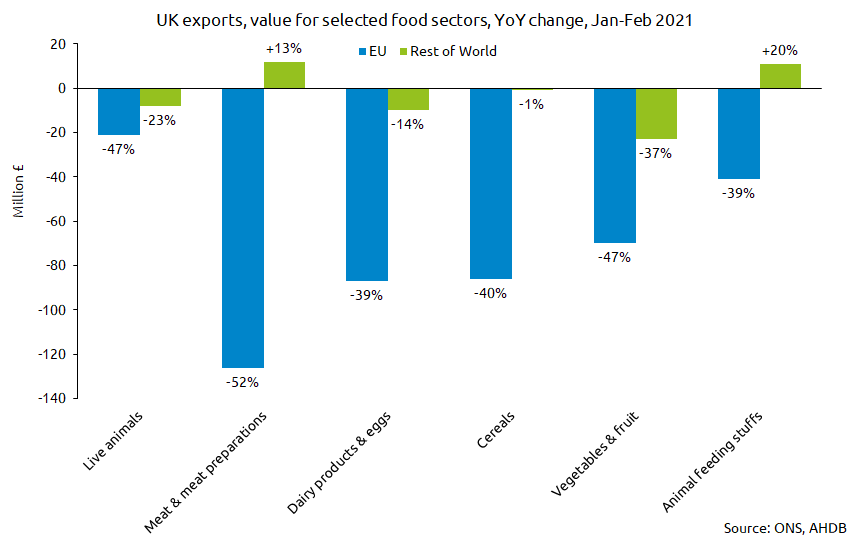

Looking at the trade data, trade for the agriculture sector has improved on the historic lows recorded in January 2021, however trade still remains relatively depressed for the first two months of the year, and is significantly lower in February 2021 when compared to February 2020. For the first two months of the year, exports of food and live animals[1] are down around 31% (-£713m) compared to the first two months of 2020. In absolute value terms, exports of meat and meat preparations to the EU have been particularly affected, down £126m (-52%) compared to a year earlier. Contrastingly, exports of meat preparations to Rest of World (ROW) have more than made up losses suffered in January. Exports in February 2021 total £65m, £23m more (+55%) than February 2020 which means that exports for the first two months of the year are now up 13% in total. Despite this, overall agri-food exports in February were lower than the previous year, therefore exports for 2021 are 10% lower year-on-year so far.

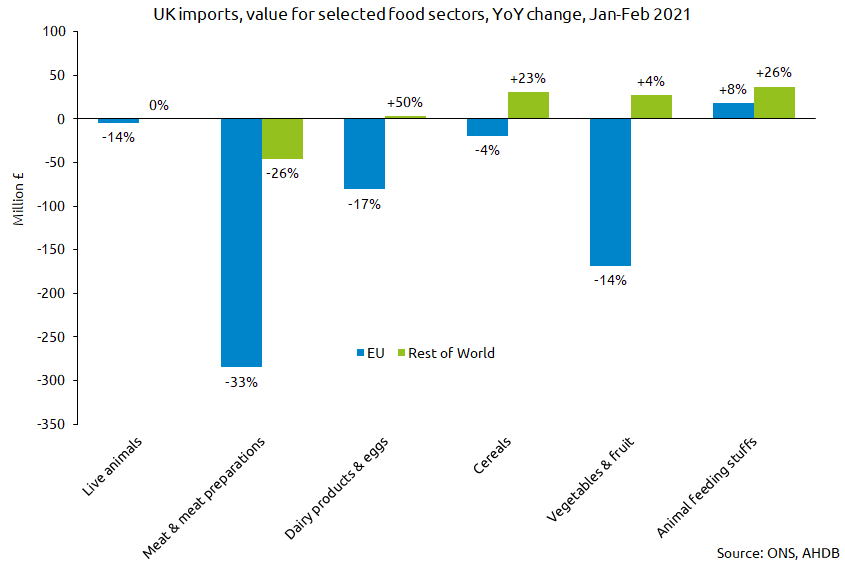

Meanwhile, in the other direction, imports of agri-food products to the UK are also continuing to report lower amounts of trade. The value of food and live animal imports are down 11% (-£673m) for the first two months of the year. The vast majority (£655m) of these declines have come from EU trade, with meat and meat preparations, as well as vegetables & fruit being particularly hit. The announcement last month of the delay to implementing the border control plan will be welcome news to a number of importers. However this could mean that further disruption is recorded down the line when these controls come in:

- Pre-notification and export health certification for animal products will not be required until 1 October 2021, and for low-risk plant and plant products until 1 January 2022.

- Physical checks at the border will not take place on a range of agri-food products and high-risk plants until 1 January 2022. These will be carried out at Border Control Posts.

- Physical checks on live animals and low-risk plants and plant material will not take place until March 2022. These will be carried out at Border Control Posts.

The continued stop start of Covid lockdowns on the continent is likely to continue to affect trade going forward, with demand fluctuating as food service outlets open and close. The path out of lockdown in the UK, if smooth and uninterrupted, should see food service demand pick up in the coming months, which would add further support to domestic prices, but will also likely lead to an increase in imports due to imported products over-indexing in the food service sector, especially for meat and meat preparations. It is worth noting that some sectors are experiencing changes in farm gate prices that were relatively unexpected in the run up to EU exit. Supply and demand fundamentals, as well as trade developments in other markets have impacted a number of sectors – click below to watch our most recent market update videos for the respective sectors to understanding what is influencing the markets beyond EU exit:

Going forward, our market specialist teams will be looking in more detail into sector specific changes in trade so watch out for these in the weekly newsletters, which can be subscribed to here.

[1] Food and live animal products consist of products 00-09, based on the statistical classifications set out by the Standard International Trade Classification (STIC), as opposed to the Harmonised System of Commodity Codes used when reporting trade.

As of January 2021 data, the way HMRC collects trade data has changed, which will be reflected in the trade statistics. Comparisons between this and historic data should be treated with caution, and may well be subject to future revisions

Topics:

Sectors:

Tags: