Future trade deals: Australia - Livestock products

Wednesday, 20 January 2021

In the first of a series of articles around future trade deals, we set out some facts and figures to put into context the differences and similarities in scale between the UK and Australia. We also identify the key trading partners for Australia, in order to identify who the UK will be competing with in the event an FTA is signed. Furthermore, we assess where Australia currently sends product, laying the foundations to assess where the UK’s defensive positions may be in a negotiation.

Beef and veal

Beef production in Australia is heavily export focussed. Production totals 2.3 million tonnes, more than twice that of the UK. With a population of roughly 25 million people, and despite a large domestic appetite for beef, this means Australia have a large exportable surplus of beef, targeted to various markets. Production levels in Australia can be heavily influenced by the weather. For instance in the last few years, widespread drought has hit a number of cattle-producing regions in Australia, which meant that production increased temporarily as producers de-stocked from the land. As the land recovers from the drought, this has the opposite effect as producers re-stock, withholding cattle from the market and thus reducing production.

The main destinations for Australian beef is Japan and the United States. Over 70% of Australian beef exports come from beef animals that have been grazed on grass only and fed no grain[1]. Exports to Japan are more evenly split between grain and grass fed cattle while exports to Australia’s other major trading partners (US, China & South Korea) are overwhelmingly in favour of grass fed. With grass fed cattle being the predominant production system in Australia, this has multiple benefits from a marketing perspective, especially when competing in mature markets that require a greater point of difference for the consumer.

Australia annual exports of fresh/frozen beef to key markets, 2017–2019 average

|

Country |

Volume shipped (t) |

Value (£ million) |

Unit price (£/t) |

|

Japan |

298,000 |

1,242 |

3,900 |

|

United States |

238,000 |

1,058 |

4,100 |

|

China |

207,000 |

888 |

4,000 |

|

South Korea |

173,000 |

735 |

4,000 |

|

Indonesia |

68,000 |

186 |

2,800 |

|

Source: IHS Maritime & Trade - Global Trade Atlas®, Australian Bureau of Statistics |

|||

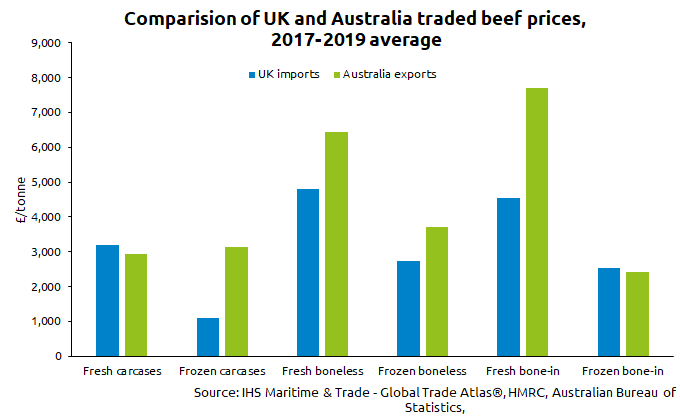

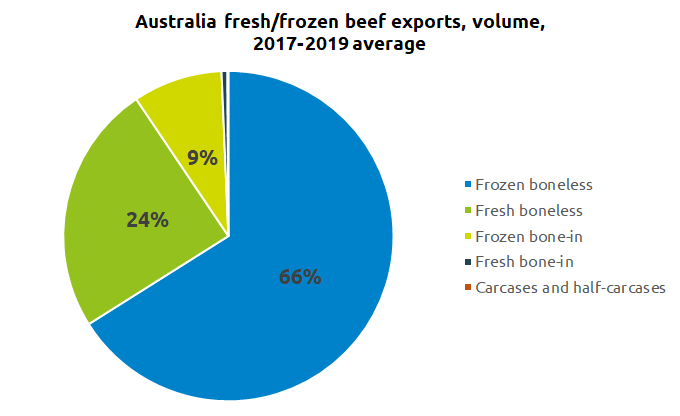

As can be seen from the graph above, across the product categories, Australian beef tends to be exported at relatively higher levels than the United Kingdom currently imports. The majority of UK imports come in the form of boneless cuts, so are relatively aligned with the product offering Australia has to offer. It should be noted that Australia exports beef to a variety of markets, with some markets being considerably lower value beef (£2,700/t), such as Indonesia.

[1] MLA Global Snapshot: https://www.mla.com.au/globalassets/mla-corporate/prices--markets/documents/os-markets/red-meat-market-snapshots/2020/global-beef-snapshot-jan2020.pdf

|

Annual production and trade, 2017–2019 average |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

2.3 million tonnes (cwt) |

906,000 tonnes (cwt) |

|

TOTAL EXPORTS (3-yr avg) |

1.4 million tonnes |

171,000 tonnes |

|

TOTAL IMPORTS (3-yr avg) |

<10,000 tonnes |

362,000 tonnes |

|

Source: Australian Bureau of Statistics, HMRC, IHS Maritime & Trade - Global Trade Atlas® |

||

Sheep meat

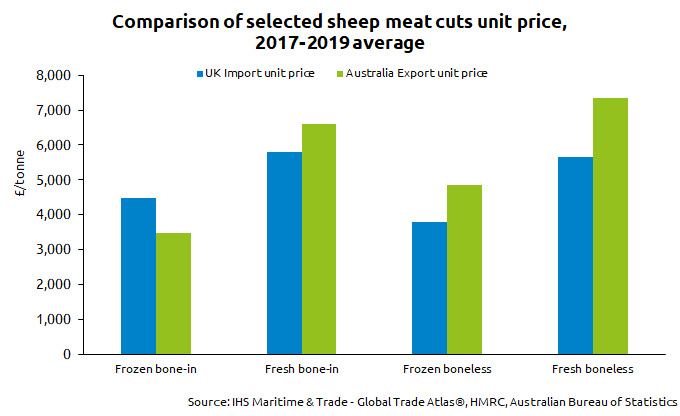

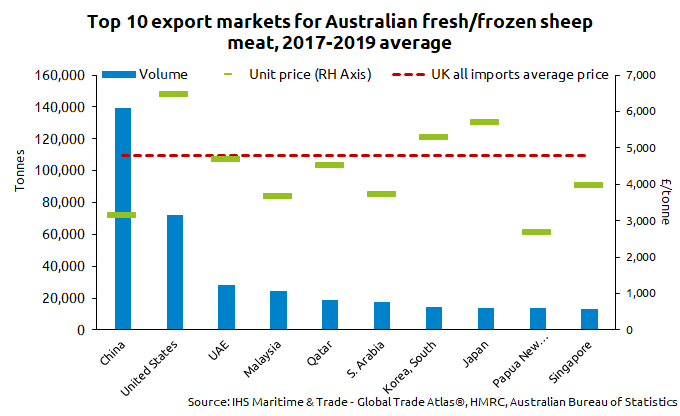

Like beef, Australia is also a substantial producer and exporter of sheep meat. Australia has a wide variety of products that it supplies to a range of markets. In recent years, exports to China have increased substantially. Between 2017-19 exports to China averaged 140,000t, however in 2019 exports totalled 180,000t. The US and UAE are also major markets for Australian sheep meat. Again, much of Australia’s sheep flock are finished on pasture only diets[1] and as such are subject to a cyclical nature of production following weather patterns. In recent years the sheep flock has shrunk, and is currently entering a rebuilding phase, which is a contributing factor to high global sheep meat prices in the past 12-18 months. Unit prices between UK imported product (predominately NZ lamb) and Australian exports are relatively similar across the product categories, with Australian lamb generally being slighty higher in cost.

Below, the top 10 export markets for Australian lamb, which shows the variation in unit price more clearly. It also shows how reliant on China Australia lamb exports have become. It is forecast that sheepmeat production in China will increase in the short term, to try and satisfy domestic demand. On top of this, it is likely that pork production in China will also recover after having been devastated by African Swine Fever. This will likely contribute to declining per capita consumption of sheepmeat as Chinese consumer pivots back to pork as prices become more affordable. This will potentially mean that Australian lamb, as well as other suppliers to the Chinese market may switch to other destinations in the not too distant future.

[1] MLA grassfed and grainfed: https://www.mlahealthymeals.com.au/faqs/grassfed-and-grainfed/#

|

Annual production and trade, 2017–2019 average |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

722,000 tonnes (cwt) |

299,000 tonnes (cwt) |

|

TOTAL EXPORTS (3-yr avg) |

464,000 tonnes |

95,000 tonnes |

|

TOTAL IMPORTS (3-yr avg) |

N/A |

83,000 tonnes |

|

Source: Australian Bureau of Statistics, Defra, HMRC, IHS Maritime & Trade - Global Trade Atlas® |

||

Pig meat

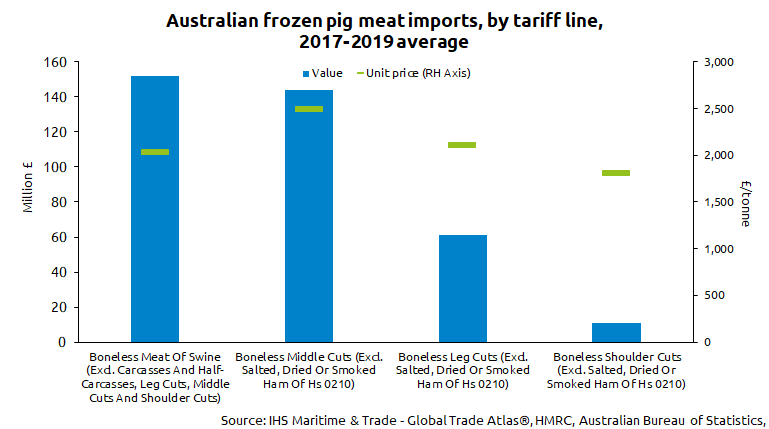

At 410,000 tonnes, pig meat production in Australia is comparatively small compared to the other red meat sectors. Also, in contrast to beef and lamb, Australia is a net importer of pork products, importing around 182,000 tonnes per annum (2017-19 avg.). Australian pork imports, like many agri-food products imported to Australia, are subject to rigorous Sanitary and Phytosanitary (SPS) measures, with virtually all pork required to be imported off the bone as well as being required to go straight to a processing plant once in Australian in order to be cooked at a specified temperature and length. However import tariffs for fresh frozen boneless pork to Australia are 0% and the UK does have permission to export cooked pork to Australia as well.

Currently, major exporters to the Australian market include the US, Denmark and the Netherlands. Denmark and the Netherlands predominantly send frozen boneless middle cuts of pork at around £2,400/t - £2,600/t (2017-19 avg.). The total Australian market is worth £368m/year and only a select few countries currently have access to the Australian market:

Uncooked pig meat:

Canada, Denmark, Finland, Great Britain (England, Scotland and Wales), Republic of Ireland, Netherlands, New Zealand, Northern Ireland, Sweden and the United States of America.

Cooked pig meat:

Canada, Denmark, Great Britain (England, Scotland and Wales), New Zealand, Sweden and the United States of America.

Cured pig meat:

Italy and Spain.

|

Annual production and trade, 2017–2019 average |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

410,000 tonnes (cwt) |

930,000 tonnes (cwt) |

|

TOTAL EXPORTS (3-yr avg) |

41,000 tonnes |

353,000 tonnes |

|

TOTAL IMPORTS (3 yr-avg) |

182,000 tonnes |

966,000 tonnes |

|

Source: Australian Bureau of Statistics, Defra, HMRC, IHS Maritime & Trade - Global Trade Atlas® |

||

Dairy products

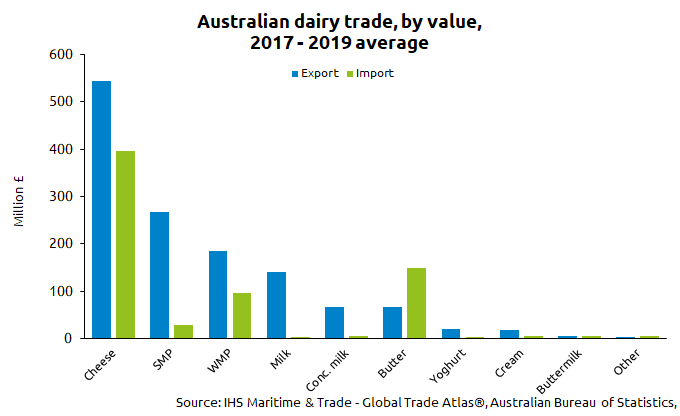

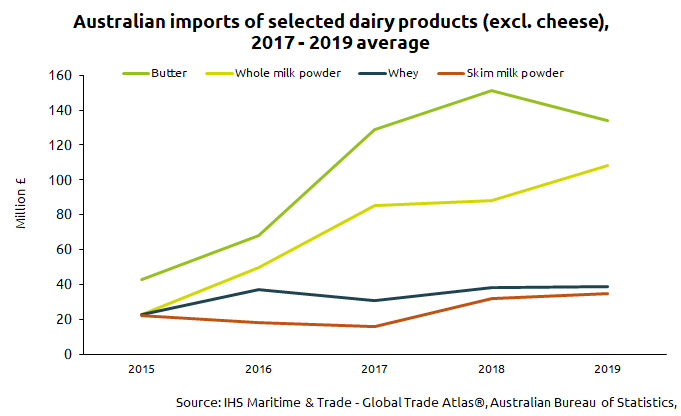

Australia dairy production is sizeable, averaging 9.2m tonnes (2017-19). However production has been steadily declining over the past decade as farmers struggle with climate and profitability issues. Again, weather is major contributing factor to cost of production and Australian dairy farmers are heavily reliant on water availability, which was lacking between 2018 and 2020. Forecasted production for 2021 is up on 2020 slightly. Recently, for manufactured dairy goods, cheese production has been increasing while milk powders and butter production have decreased. Whey powder production is flat.

Asian markets are the largest destination for Australian exports with cheese being the predominant export in value terms, followed by skim milk powders and milk, which tend to be in the form of added-value UHT milk. Cheese exports are relatively low in value due to the high proportion of unprocessed fresh cheese, much of which enters the Japanese market. China, again, is a key trading partner for Australia which takes a mixture of products.

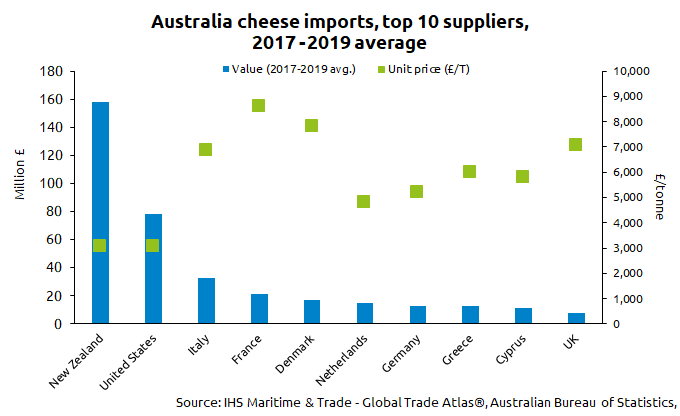

In terms of imports, the Australian dairy market is worth around £725m per annum. New Zealand is a major supplier of dairy products, and is almost the sole supplier of butter, whole and skim milk powders to the Australian market. The US and a number of key EU suppliers also supply significant amounts of product; US (cheese and whey), Italy (Cheese) and Austria (Whey, whole and skim milk powder). Austrian exports are quite sporadic in value terms however other EU suppliers are recording strong growth in export value to Australia. The United Kingdom currently suppliers a small amount of cheese (£8m), butter (£2m) as well as some skim milk powder and whey.

|

Annual production and trade, 2017–2019 average |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

Liquid Milk: 9.2m tonnes |

Liquid milk: 6.7m tonnes |

|

TOTAL EXPORTS (3-yr avg)

|

£1.35bn Top exports: |

£1.66bn |

|

TOTAL IMPORTS (3-yr avg) |

£735m Top imports: |

£2.86bn Top imports: |

|

Source: Defra, HMRC, IHS Maritime & Trade - Global Trade Atlas®, USDA Foreign Agricultural Service, Australian Bureau of Statistics |

||