What’s happening in our domestic grain market? Grain market daily

Friday, 8 September 2023

Market commentary

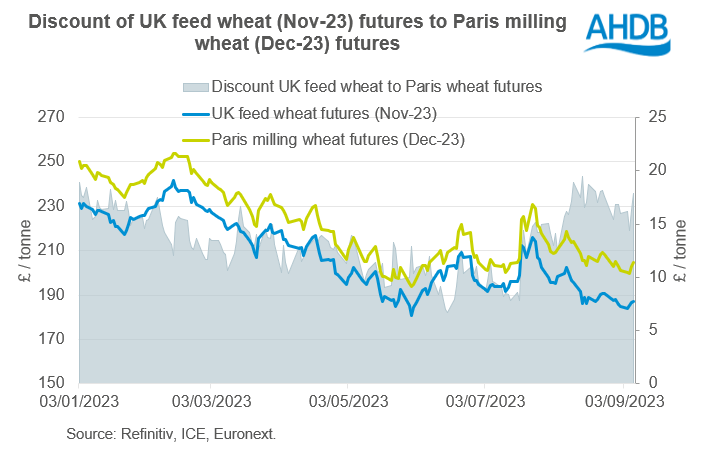

- UK feed wheat futures (Nov-23) closed yesterday at £187.00/t, up £0.40/t from Wednesday’s close. Nov-24 futures gained £2.00/t over the same period, to close at £199.50/t.

- Domestic feed wheat futures felt some support from Paris milling wheat futures yesterday, as Paris futures recovered from a seven-week low (Refinitiv). Paris futures were buoyed by a weaker euro and Australian supply concerns. Fuel shortages and wet weather across Russia are also in focus. Ongoing Black Sea exports capped any major gains.

- Paris rapeseed futures (Nov-23) closed yesterday at €454.50/t, down €5.25/t from Wednesday’s close. Paris rapeseed futures followed some movement downwards in the wider oilseed and oil complex yesterday, with pressure felt on Chicago soyabeans as well as slight pressure to Malaysian palm oil and Brent crude oil futures.

What’s happening in our domestic grain market?

UK feed wheat futures (Nov-23) have seen steadier price movements in recent weeks, trading in and around the £185.00/t mark, with small movements continuing to follow global markets. As Northern Hemisphere harvest progresses and news emerges on Southern Hemisphere harvest prospects (with some trims to the Australian wheat crop), the market seems to be assessing supply moving forward – both quantity and quality.

Global markets cross roads

On one hand, the war in Ukraine remains ongoing. We have seen trims to major grain exporters (Australia and Canada) and quality remains in focus – especially in the EU after a wet harvest, with some countries seeing weather much like here in the UK.

On the other hand, Black Sea supplies continue to move, taking some price risk out of the market. Despite continued Russian attacks on Ukrainian ports, Ukrainian exports continue to flow. This week, we saw reports of Ukrainian export potential via Croatian ports. UN conversations continue with Russia to restore the Black Sea Initiative grain deal, though progress is yet to be seen. Russian wheat continues to weigh on global grain prices, as it remains competitive for global demand. Russia is forecast to account for 23% of global wheat exports this season, up from 21% last season (USDA) – as such Russian supplies can move global sentiment.

So, where does this leave the UK? Well, much like global markets, the domestic market is currently assessing the quantity and quality of harvest 2023. This year, yields have varied by region and land type, with planting date a key factor for spring crops too. Wet weather caused delays and issues for harvesting this season; although with recent drier weather, GB harvest has been able to make good progress. Quality too remains in focus, with some early indications of some lower Hagberg Falling Numbers and malting barley germination rates. You can find more information on the GB harvest page, with another report provisionally forecast for publish next Friday (15 September).

Quieter domestic markets

We are hearing anecdotally that domestic grain markets are quieter. Ex-farm UK feed wheat and feed barley prices were reported on 31 August (latest data) at £179.20/t and £160.90/t, according to AHDB’s Corn Returns data.

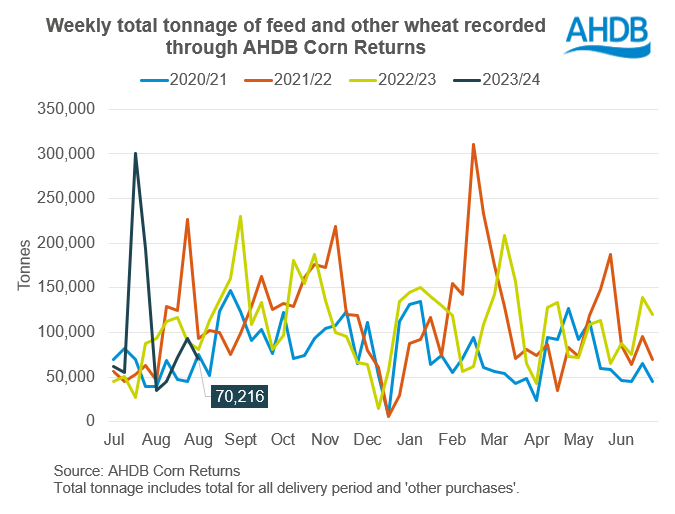

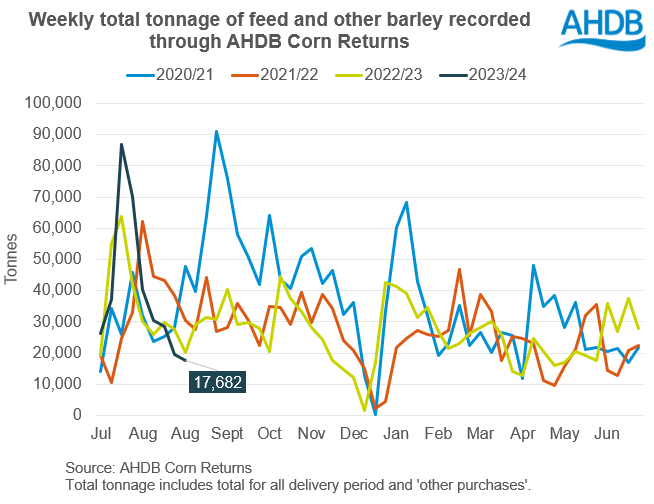

The volume of feed wheat and barley reported through the Corn Returns has seen slowing in recent weeks, as you can see in the graphs below. This is after a flurry of domestic movement recorded in Corn Returns following the expiry of the Ukraine grain corridor in early July.

Currently, the discount of Nov-23 UK feed wheat futures to Dec-23 Paris milling wheat futures remains c.£18/t. This has widened slightly this season, helped by sterling movement. Compared to the same time last year (7 September), the discount of Nov-22 UK feed wheat futures to Dec-22 Paris milling wheat futures was around £13/t, but then saw a widening as the weeks developed.

As we learn more in upcoming weeks of the quantity and quality of this season’s harvest 2023, domestically, in the EU and globally this will be key for domestic pricing to the continent.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.