What’s driving the market? Grain market daily

Tuesday, 1 August 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £197.85/t, down £4.75/t from Friday’s close. Nov-24 futures closed at £199.65/t yesterday, down £4.85/t over the same period.

- The decline in domestic futures followed pressure on Chicago and Paris wheat futures, as well as Chicago maize futures yesterday. US markets dropped as a result of a milder weather forecast for the Midwest and relief from no major attacks on Ukrainian grain infrastructure over the weekend.

- Lower prices in export markets for Russian wheat also added to the pressure, more on this below.

- Paris rapeseed futures (Nov-23) closed yesterday at £445.00/t, down £13.75/t from Friday’s close. The market followed Chicago soyabean and Malaysian palm oil futures down yesterday.

What’s driving the market?

Yesterday, we saw pressure on global and domestic wheat futures, with UK feed wheat futures (Nov-23) falling for the fifth consecutive day. US weather continues to be a key market driver (more below), as well as markets watching and assessing attacks on Ukrainian infrastructure closely.

Most importantly, market volatility continues as global supply for this season continues to be assessed – with prices reacting to new information. We can see our domestic physical market reacting to recent price spikes too, with larger volumes committed through Corn Returns, especially for feed wheat.

US crop conditions continue to fall but weather outlook improved

US weather continues to be watched closely by the market. This is because 59% of maize and 53% of soyabean crops remain in drought conditions (to 25 July). By 30 July, 84% of maize was silking and 50% of soyabeans were setting pods. Therefore, current weather is key for yield forming.

Yesterday, the latest US crop conditions were released. As of 30 July, 55% of US maize had a good to excellent rating, down 2 percentage points from the previous week. Soyabeans saw the same fall week-on-week, with 52% now rated as good to excellent.

We could see some market reaction to this today, though the forecast remains milder for parts of the Midwest over the coming week. Rain is forecast over much of the Midwest which could support yield potential.

Russian wheat globally competitive

Another factor pressuring global prices yesterday was competitive Black Sea wheat values. Algeria’s state buying agency is believed to have purchased 660 Kt or more of milling wheat yesterday. Most of the wheat is believed by traders to have been purchased at $276/t (cost and freight). Traders expect the wheat to be of Black Sea origin, including Russian, Romanian and Bulgarian (Refinitiv).

Yesterday, Tunisia’s state grains agency also issued a tender for 117 Kt of soft milling wheat. Eyes will be on which origin remains most competitive.

Domestic sales show farmers acting on price highs

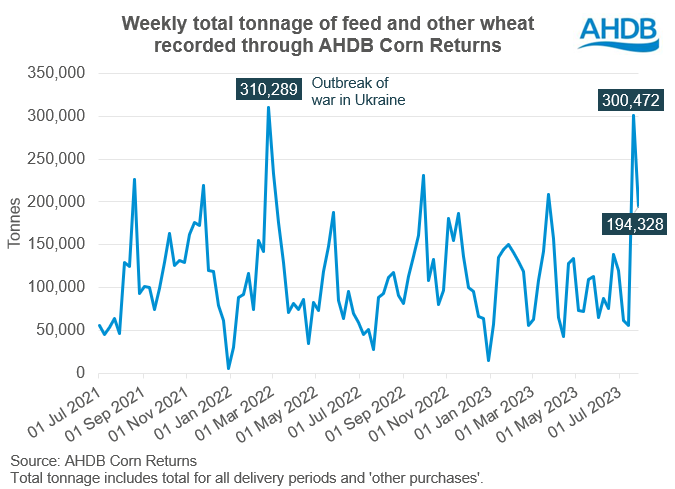

Looking closer to home, the volume of grain reported through the Corn Returns has seen a spike in recent weeks. Barley volumes have been increasing, as expected with harvest starting. So too have feed wheat volumes.

Prices rose in response to Ukrainian grain export uncertainty. This uncertainty came first from Russia’s withdrawal from the Black Sea Initiative, then from Russian strikes on Ukrainian infrastructure on the Danube. As this happened, we saw larger tonnages recorded through the Corn Returns, which reports ex-farm prices.

As you can see in the graph, the peak in selling in the week ending 20 July, saw total feed wheat traded volumes (for all delivery months) peaking at over 300 Kt; this is the largest weekly volume since week ending 23 February 2022. Large volumes continued in the week ending 27 July too. Excluding February 2022, this is the largest total weekly volume recorded since the week ending 5 August 2010. On 5 August 2010, Russia announced a ban on grain exports following a severe drought and wildfires across farmland.

The increased volumes recorded through Corn Returns can tell us that farmers look to be acting on the recent price highs and locking in sales.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.