How much grain is leaving Ukraine? Grain market daily

Wednesday, 23 August 2023

Market commentary

- UK feed wheat futures (Nov-23) gained £0.65/t yesterday, ending the session at £187.90/t. The Nov-24 contract ended the session at £196.50/t, up £0.80/t over the same period.

- Domestic wheat futures followed support in US prices yesterday, on the back of declining US spring wheat conditions. In Monday’s crop rating, spring wheat fell by four points to 38% in excellent/good condition, against expectations it would be unchanged.

- Paris rapeseed futures (Nov-23) closed at €465.25/t yesterday, down €3.75/t from Monday’s close. The Nov-24 contract fell €2.50/t over the same period, ending the session at €476.75/t.

- Concerns over the US soyabean crop subsided yesterday, pressuring the wider oilseed complex. While hot and dry weather is expected across the US Midwest over the next few days, the start of the US crop tour has showed promising results for the crop.

How much grain is leaving Ukraine?

Global grain markets remain reactive to any news on Ukrainian grain exports. Ukraine’s military and local authorities said this morning that ports in the southern Odesa region and the Danube River area were targeted overnight in drone attacks, setting at least one grain storage facility on fire (Refinitiv). With attacks on grain export facilities becoming more frequent as of late, how much grain is Ukraine managing to get out? And what route is it taking?

How does pace compare to last season?

In the first month of this season (July 23), Ukraine exported 821.3 Kt of wheat, and 1.152 Mt of maize. This meant wheat exports were up 118% compared to July 2022, though maize exports for that month were down almost 2%. However, up to 17 July, Ukraine was still using the Black Sea grain export corridor, and so focus is more on how much has come out since the expiration of the deal.

According to UKrAgroConsult, up to 16 August, 577.5 Kt of wheat had left Ukraine throughout the month so far. While there is no exact comparison for these dates last year, in the month of August 2022 wheat exports totalled 883 Kt. For maize, up to 16 August, Ukrainian maize exports totalled 475.8 Kt for that month. In August 2022, maize exports totalled 1.544 Mt; this suggests maize exports are lacking pace compared to this time last year.

A change in logistics

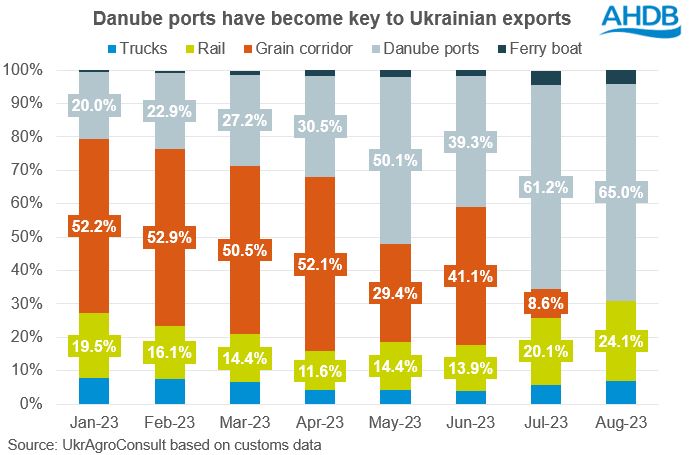

Since the expiration of the UN-backed Black Sea Initiative, Ukraine has been looking for alternative export routes for its agricultural commodities. There has been a shift over the last few months in export flows, with the Danube ports and railroads now being the primary routes.

Looking ahead, Ukraine is hoping to improve the efficiency of its Danube ports by increasing the tonnage of the fleet used for grain transport in the area. The Ukrainian Prime Minister has also met with the Romanian Prime Minister to discuss increasing the volume of exports transited through the country by improving rail, road, river, and sea infrastructure. As mentioned in Monday’s Market Report, Ukraine is also considering using it’s newly set up ‘humanitarian corridor’ for grain shipments too. There are reports that Ukraine is finalising a plan with global insurers to cover Black Sea grain ships using this route, after the first ship successfully used this passage last week (Refinitiv).

What does this mean for global grain prices?

In terms of what this means for global prices, the ongoing attacks on Danube River ports and in the Odesa region will likely keep prices volatile. However, Ukraine seems to have found alternative routes for its exports and is working quickly to improve efficiency of these routes. Although we cannot predict what will happen with this war, providing that there aren’t any mass disruptions that completely halt trade out of Ukraine, it’s unlikely that we will see any major price spikes from the ongoing conflict in the near future. This, combined with the fact that there is a heavy global supply outlook of maize (especially this season), points to the fact that markets may not be able to reach the volatile highs experienced last year.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.