Black Sea contrasts – expanding crops but access uncertain: Grain market daily

Tuesday, 8 August 2023

Market commentary

- UK feed wheat futures (Nov-23) rose £1.20/t on Monday to close at £199.50/t. The main factor was worries about Black Sea shipping after a Ukrainian strike against a Russian tanker near Crimea over the weekend.

- However, Chicago maize and soyabean futures prices fell due to improved US crop conditions. The proportion of maize rated good/excellent rose from 55% a week ago to 57% as of 6 August. For soyabean crops, the proportion rated good/excellent rose from 52% to 54% over the same time period. Earlier planted maize crops are starting to approach maturity, while soyabean crops are still in their critical growth stages.

- The falls in Chicago soyabean futures, along with weaker palm oil futures, pulled Paris rapeseed futures down as well. The Nov-23 Paris rapeseed futures contract lost €7.50/t and closed Monday at €466.25/t.

- The second (Safrinha) Brazilian maize crop continues to yield well as harvest reached 64% complete as of 5 August (AgRural, Conab). As a result, AgRural increased its total maize output forecast by 3.1 Mt to 135.4 Mt. These are now higher than the forecasts made in July by the USDA (129.0 Mt) and Conab (127.8 Mt); both of which release their next forecasts this week.

Black Sea contrasts – expanding crops but access uncertain

Reports of good yield results for both Ukraine and Russia suggest larger crops. But the latest developments in the war put renewed uncertainty on access to their grains and oilseeds.

Larger crops

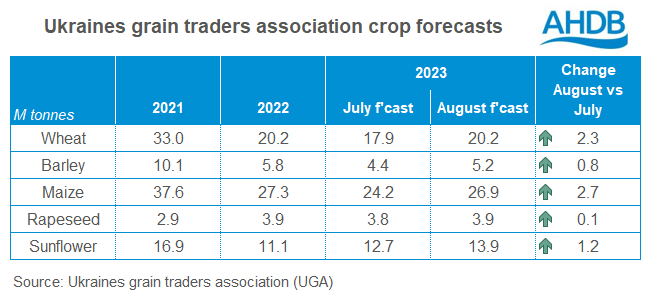

The Ukrainian grain traders’ union (UGA) added 7.8 Mt to its total grain and oilseed crop forecast for the 2024 harvest, following good yield results so far – 60% of wheat, 66% of barley and 86% of rapeseed were harvested by 3 August (Ministry of Agrarian Policy).

UkrAgroConsult echoes the strong yield results in Ukraine so far and raised its crop estimates as well, though not as high as UGA. The analysts’ caution that a lower proportion of wheat will make milling grade this year due to high yields diluting protein content, plus rain impacting later harvested crops.

Meanwhile, Russian crop forecasts are also rising. IKAR now estimates total Russian grain production at 137.0 Mt, up 2.5 Mt from the previous figure. A large proportion of this increase is due a larger wheat crop, which is pegged at 88.0 Mt, 1.5 Mt more than previously. SovEcon raised its wheat production forecast by 0.9 Mt, and projects wheat exports could rise to 48.1 Mt as a result. In July, the USDA forecast 2023/24 exports at a record 47.5 Mt.

Uncertain access

Since the Black Sea Initiative, more commonly known as the Ukrainian export corridor, ended last month, the risk of disruption to shipping has escalated.

Ukraine – Russian attacks on Ukraine’s Black Sea ports halted shipping from there for now. Without the Black Sea ports, the Danube is key to Ukrainian exports. Recent Russian strikes against these river ports mean the cost and availability of insurance is affected. Ships are still loading there, but that could slow if the risks to ships and their operators increase due to further strikes.

There are also questions about what volume of exports through Ukraine’s EU neighbours will be possible. For example, Poland is looking to extend its ban on Ukrainian imports (other than for direct exports).

Russia – Within the past few days there has been strikes against Russia that raise the risk of disruption to Russian grain exports. SovEcon highlights the importance of the Crimean bridge and the Kerch Strait in particular. Refinitiv estimates approximately 70% of Russian grain exports are through the Black Sea ports, so any disruption to shipping would quickly impact exports.

The impact

As the past nearly 18 months have proved, markets can and do find a way even in times of war. But this is likely at higher costs, for example from shipping or insurance. Higher costs for accessing Ukrainian grain will be reflected in the price.

On paper, total grain supplies for 2023/24 look comfortable due to the large global maize crop forecasts. In peacetime, crops of this magnitude would usually mean pressure on all grain prices as wheat and barley lose animal feed demand to maize. But how much of this pressure we see depends on the war.

Any limitations on exports from either Russia or Ukraine puts more pressure on other major exporting nations to meet global demand.

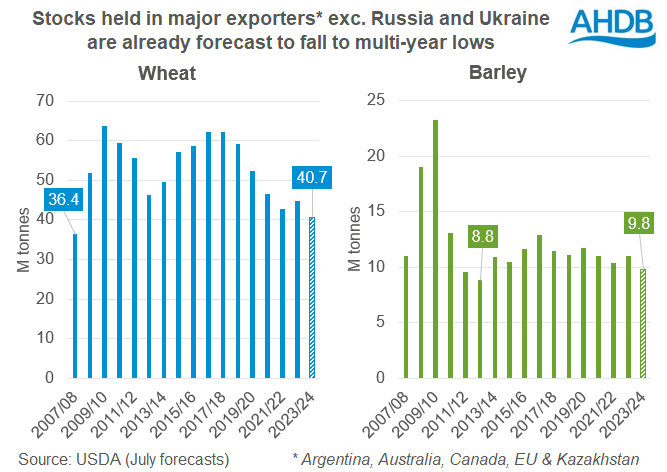

For barley and wheat, stocks in other exporting nations are already expected to fall to their lowest levels in many years, potentially limiting what extra exports they can absorb. So, the risk of disruption to access to Black Sea grain will likely keep an underlying level of support in the market, with the potential for rises if sustained disruption happens.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.