What impact will input prices have in 2021?

Tuesday, 23 March 2021

By Mark Topliff and Carol Davis

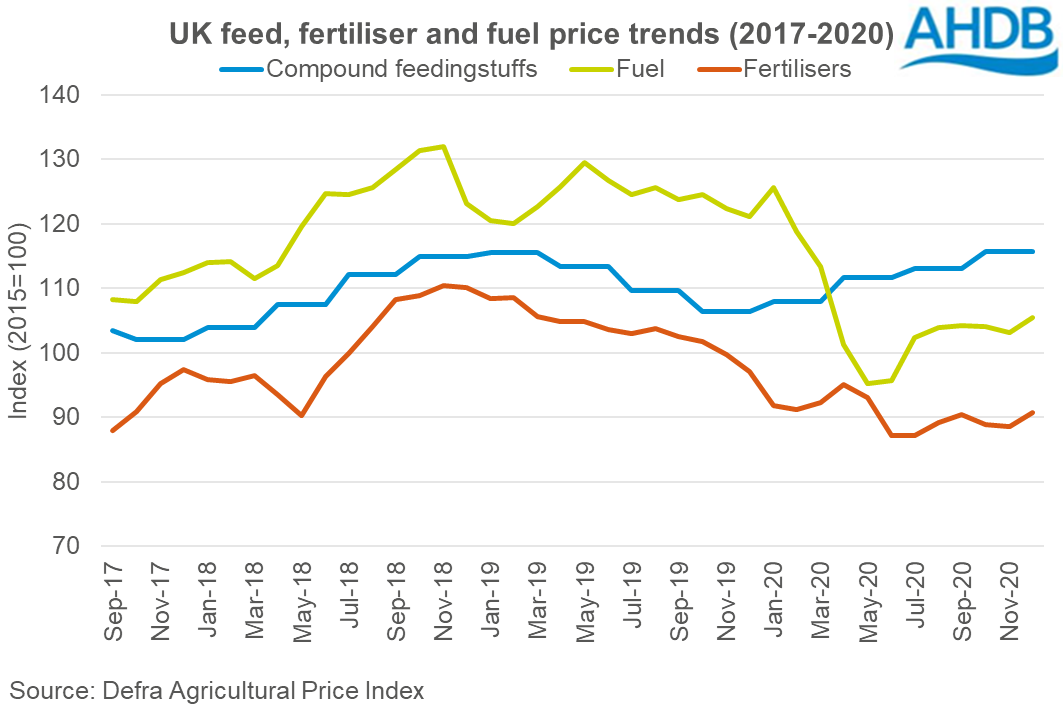

With margins tight for many farms, we take a look at the key input prices for feed, fertiliser and fuel, and where they might go in 2021.

Feed prices

Wheat prices have steadily increased in recent months to a high of over £200/t. However, wheat futures prices for the new crop are around £170/t. The outlook for feed wheat prices remains fairly high with global grain markets having support at the moment.

Barley production in the UK was higher in 2020, due to a large increase in the amount of spring plantings, after delays to drilling during the previous Autumn. Feed barley prices have also been increasing in recent months, although prices remain at a significant discount to wheat. The discount is expected to narrow again when the new crop arrives, with production of wheat and barley in 2021/22 likely to reach more “normal” levels.

Soyabean prices have increased lately, influenced by lower production globally. While, the USDA are forecasting higher production in 2021, demand from China’s pig sector is still strong keeping support for soyabean prices.

Likewise, maize prices were also higher during the year. Imported maize has been increasing in price since June 2020. Global demand for ethanol is still yet to return to pre-pandemic levels but could push maize prices higher once they do.

So feed commodities have experienced higher prices in the last few months and support is likely to continue in the coming months.

For the latest feed prices and forecast for the upcoming months go to Feed prices and markets | AHDB.

Fertiliser prices

Throughout January and into February, we have seen some sharp increases in the value of fertiliser. In part, due to a rise in the value of energy. This has been reflected in natural gas prices, where nearby natural gas futures have reached their highest levels for this time of year since 2017. Cold snaps in Asia, the UK and US have increased demand for gas as a heating fuel, supporting markets further. The US Energy Information Administration’s short-term energy outlook was for growth in US natural gas consumption, and so increased prices.

Energy costs will have an impact going forward, and are likely to support fertiliser prices. We may see ammonium nitrate (AN) exceed the £300/t level before levelling off, or coming back slightly, later in the year.

Fertiliser prices can be tracked at Fertiliser information | AHDB

Fuel prices

Red diesel prices have risen around 10p/litre in the last 5 months and are currently around 55p/litre.

OPEC+ recently agreed to keep the present cuts on crude oil production in place until at least April, based on the fragility of global demand recovery despite vaccination progress.

The next OPEC+ meeting is in the first week of April. If the global demand picture is healthier with lockdown measures eased, the outcome could be a staggered rise in crude oil production. A cautious return to full production is likely, to avoid the risk of ‘flooding the market’. But between now and April, increases to crude oil values could continue to push red diesel higher.

Therefore, demand is predicted to increase as COVID-19 restrictions are lifted and crude oil production is cautiously increased for the rest of 2021. So it’s unlikely that red diesel prices will drop any lower than they are at the moment for the remainder of the year and may increase further over the next few weeks.

Keep an eye on the latest fuel prices at Fuel prices | AHDB

What does this all mean for farmers?

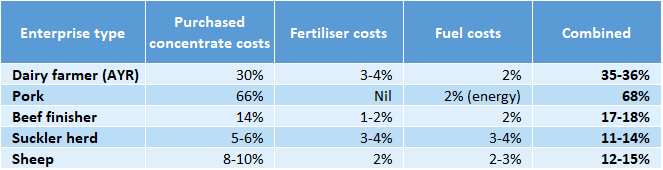

The table below shows the percentage of total cost of production* each element makes up for a typical farm:

Source: AHDB

Unless other input prices reduce we expect to see higher overall cost of production in 2021. The impact on individual farmers will vary based on farming approach and how far ahead they have purchased inputs. But, for example, a 10% increase in the prices of feed, fertiliser and fuel would typically add another 3.5-3.6% to overall cost of production for an all-year-round (AYR) dairy farmer.

*Total cost of production is defined in this article as full economic which includes all cash costs plus the value of unpaid labour, depreciation and a rental value of owned land.

Topics:

Sectors:

Tags: