Weekly cattle & sheep market wrap - 20 February 2025

Thursday, 20 February 2025

Key points

Prices for week ending 15 February

- GB deadweight cattle prices continued to push northwards as supply remains tight.

- Deadweight lamb prices ticked upwards again, as numbers grew.

Cattle

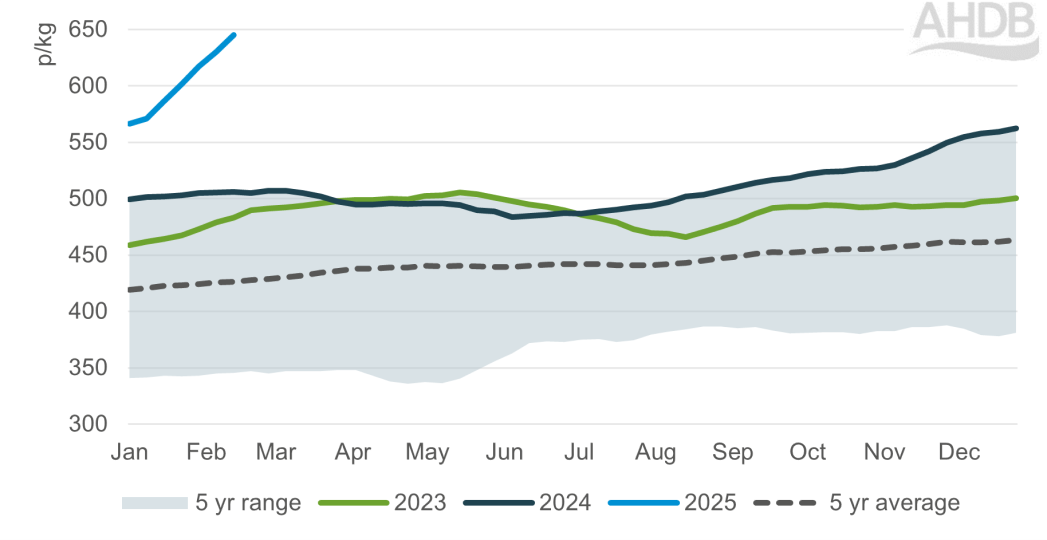

Deadweight finished cattle prices continued to push northwards in the week ending 15 February, as tight supply drives the market. The GB average R4L steer price gained nearly 15p from the week before to stand at 645p/kg. This was up a substantial £1.39/kg year-on-year. Across prime cattle, prices were up for all types and regions bar southern young bulls.

Estimated GB prime cattle slaughter stood on from the week before, at 34,700 head. This was largely flat compared to the same week a year ago, following several weeks of annual growth.

GB average deadweight R4L steer price

Source: AHDB

Meanwhile, average cow prices showed similar sharp increases. The overall GB deadweight cow price averaged 473p/kg, up nearly 15p from the week before. Looking at cow throughputs, numbers continued their seasonal downturn, and stood 500 head lower year-on-year.

Reports suggest demand for beef is firm, with Valentine’s Day driving positive performance for steaking cuts. Indeed, retail figures from the weeks previous showed annual uplift in volumes of this category sold, as well as staples such as mince, and value-add including sous vide and marinades.

Sheep

Deadweight sheep prices also showed upwards movement in the week ending 15 February, with the GB old season SQQ climbing 8p to 737p/kg. While more muted price growth than the previous week, the measure was 47p above the same week a year ago.

More lambs came forward during the latest reporting week, with GB slaughter estimated at 207,100 head (+14,300 head week-on-week). This continued growth in numbers seen the week before, and further closed the gap to 2024’s slaughter. However, throughput was still 1% lower year-on-year.

In our latest lamb market outlook, we discuss our forecasts for a greater carry-over of hoggets in the first half of 2025, based on flock inventory and previous slaughter levels. We will be monitoring the data closely to see whether these recent moves signal the bulk of this carry-over coming to market.

On the demand front, the latest retail data from Kantar shows sluggish trade for lamb in recent months compared to a year ago, particularly for the roasting category. Nevertheless, spend is largely stable as average prices have increased nearly 5%. Looking ahead, Ramadan begins at the end of the month, while Easter falls in late April. Just how the timing of these religious events draws lambs to market, and where prices subsequently peak this year will be key watchpoints.