UK pork trade: First six months of 2023

Tuesday, 15 August 2023

Reduced production, higher pig prices and lower consumer demand has led to a challenging trading marketplace for pig meat in the UK.

-

June exports are up month-on-month but in decline year-on-year

-

Imports in June are down month-on-month but have grown year-on-year

-

For the first six months of 2023, both exports and imports are in year-on-year decline

Exports

UK pig meat exports totalled 24,200 t in June, a minor uplift (+200 t) from May but down 15% (-4,400 t) compared to the same month last year. For the year to date (Jan−Jun) pig meat exports totalled 151,800 t, the lowest volume since 2015.

In the first six months of the year, all product categories have seen year-on-year decline, except for processed pig meat where volumes have increase by 1,000 t in 2023. The overall decline in export volume is driven by a dramatic fall in fresh/frozen pork. Volumes for this category are at their lowest since 2010, totalling 64,000 t Jan−Jun, a year-on-year decline of almost 43,000 t (40%). The significant reduction in domestic production will be a dominant force behind this substantial change, paired with high pig prices reducing the price competitiveness of UK product. Exports of offal, bacon and sausages have recorded smaller declines of 1,900 t, 1,000 t and 500 t respectively.

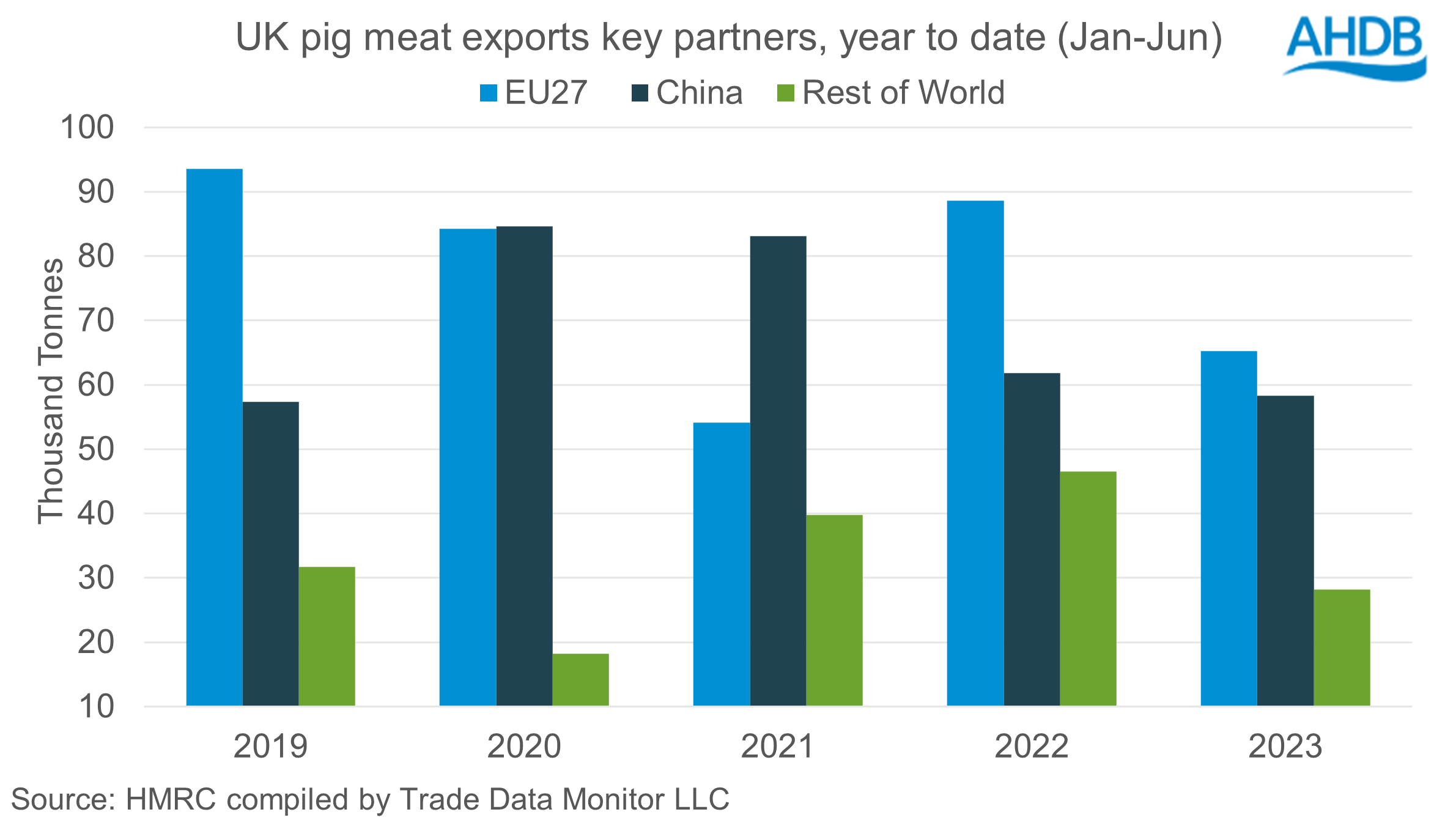

Unsurprisingly shipments to the EU and the wider world have recorded large declines year-on-year, down 26% (-23,400 t) and 39% (-18,300 t) respectively, following the trend in overall export volumes. However, shipments to China have only recorded a small year-on-year change, down 3,500 t (6%). This more subdued decline in shipments is down to 61% of imported product from the UK being made up of offal. Volumes of offal shipped to China have grown 16% year on year while volumes of fresh/frozen pork have declined by 26% as Chinese consumers look for more affordable cuts amid a slow economic recovery from the COVID-19 pandemic and associated government policies.

Imports

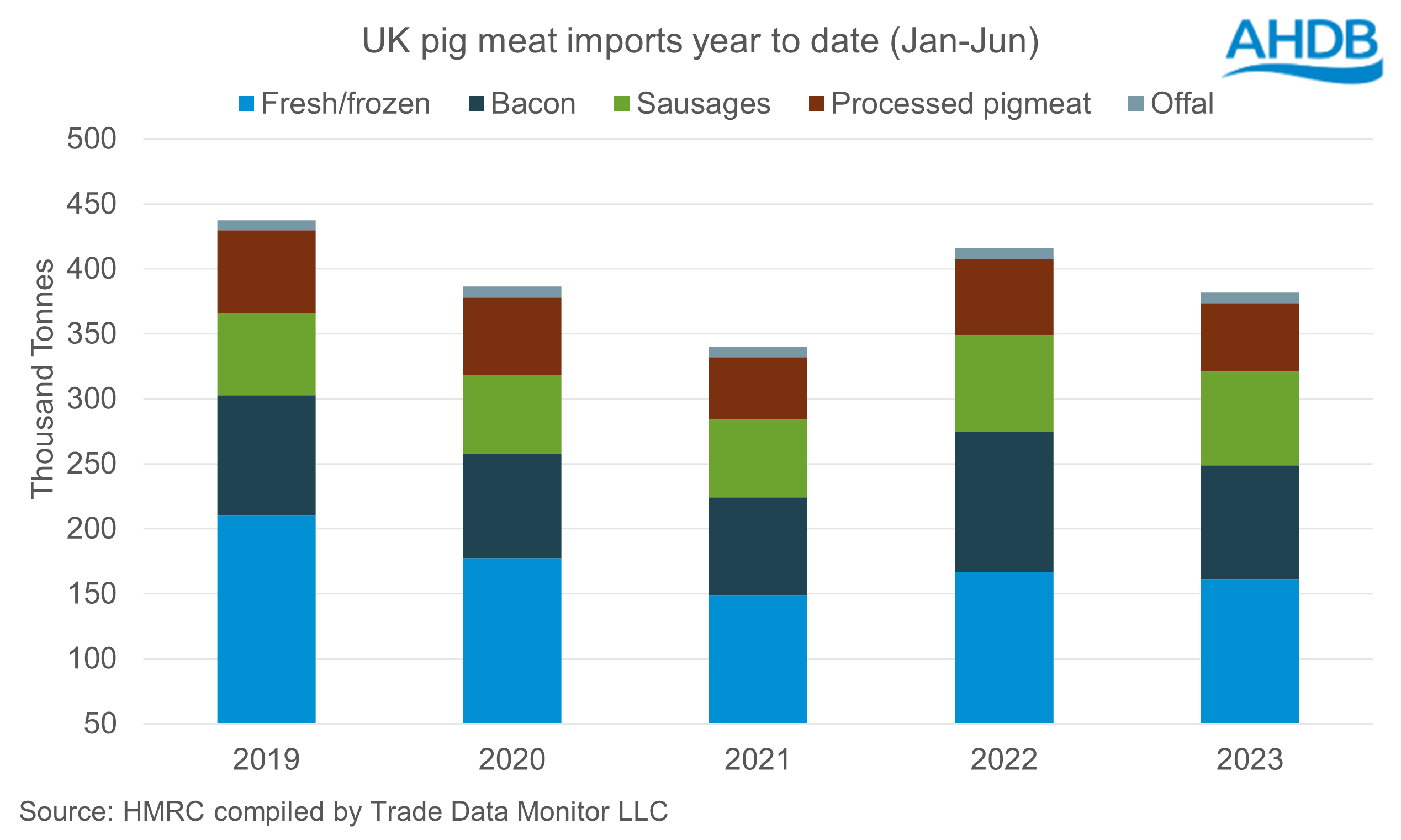

Imports of pig meat to the UK totalled 68,100 t in June, only 600 t behind volumes recorded in May. However, this is an increase of 5,000 t compared to June last year, the second month in a row to record year-on-year growth. For the year to date (Jan−Jun) UK pig meat imports totalled 381,900 t which is down 8% (-34,200 t) compared to the same period in 2022.

All product categories have recorded year-on-year declines in 2023. Bacon has seen the largest volume change, down 20,400 t (-19%), while processed pig meat and fresh/frozen pork have seen volumes down by 6,000 t (-10%) and 5,500 t (-3%) respectively. Sausages have seen the smallest decline, just 2,100 t (3%) behind volumes from last year.

There is a combination of factors behind this loss in import volume. European pig meat production for the year so far (Jan−May) is sitting 9% behind last year, following a similar trend to the UK, limiting the amount of product available for export on the continent. Added to this, European pig reference prices have seen significant upwards movement since the new year. This has closed the price differential between UK and EU product, making EU imports to the UK more expensive. On top of this, consumer demand remains negative due to the cost-of-living crisis with volumes of pig meat purchased in retail down 2.5% year-on-year (52 weeks ending 9 July).

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.