The effect of tariffs on consumer food prices

Thursday, 17 December 2020

The UK officially left the European Union on 31 January 2020. However, as per the withdrawal agreement, the UK continued to remain part of the EU single market and customs union, through a ‘transition period’. The deadline is fast approaching the end of this transition period and on 31 December 2020 the UK will leave the EU customs union and single market, with either a Free Trade Agreement (FTA) or no deal and trade on WTO terms.

Background

In a no deal scenario, the UK Global Tariff (UKGT) will come into force with tariffs placed on products imported from the EU, as well as anywhere else the UK doesn’t have a FTA with. Likewise, the EU common external tariff (CET) will be applied to UK goods imported into the EU.

The outcome of a no deal scenario is likely to have an impact on consumer food prices here in the UK. Price transmission in agricultural supply chains is not straightforward. Often when food price inflation is discussed, what is actually meant is changes in raw commodity prices, which is fundamentally different from the food that consumers buy, which has undergone varying degrees of processing. In addition, imbalance in power and imperfect knowledge in the supply chain, retailer and processor margins, transport and marketing costs and macro-economic variables, including exchange rate movements will all impact retail prices. Therefore, in addressing food price inflation at the consumer level as distinct changes in world market ‘food’ prices, economists and policy-makers need to address how world market prices are transmitted through to retail prices.

This article will explore the relationship between the prices of raw materials, (commodities) and retail prices.

So what causes retail prices to rise?

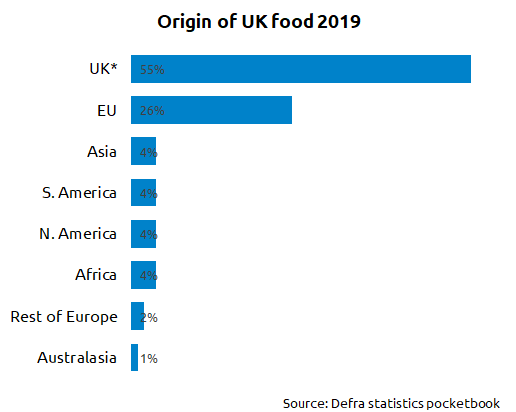

Around half of all food consumed in the UK is imported, with the vast majority of that being imported from the EU. Consequently, both world commodity prices and relative exchange rates, known as the ‘terms of trade’ are a key determinant in food prices. When sterling weakens against other currencies, the price of imported goods rises, pushing up the price of the raw materials imported for processing, and allowing domestic prices to rise to the same level as imported goods. Conversely, goods exported from the UK become more competitive when sterling is weaker.

In the event there is no deal on trade with the EU most economic forecasters suggest that the pound would fall in value against major global currencies. This would act to increase the cost of food imports.

However, retail food prices are affected by more than just the cost of raw materials - typically, only 11% of the price of a loaf of bread is accounted for by wheat, for instance. Processing, packaging, transport, labour, wholesale and retail margins and the competitive retail environment will all have a part to play in determining consumer prices as well as macro-economic variables described below.

The effect of tariffs

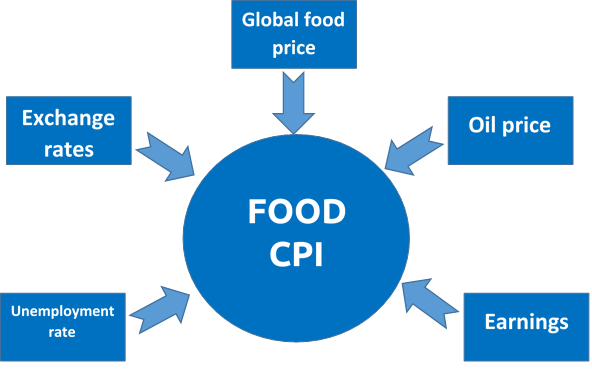

So there is not a direct price transmission mechanism between the cost of commodities and retail prices. Several studies in recent years have looked at the effect that a change in the price of commodities, for example through addition of a tariff, might have on retail prices. In 2011 Defra published a study[1] into drivers of the UK’s Food Consumer Price Index (Food CPI), a component of the overall Consumer Price Index (CPI). The model developed in that study (the academic model) estimated the relationship between Food CPI and a number of factors, including global food commodity prices (represented by the International Monetary Fund’s world food price index).

The academic model estimates that every 1% increase in global food commodity prices leads to an increase in the food component of CPI of 0.27% after two years. Accordingly, an increase of 11% in global food commodity prices is estimated to lead to an increase in food CPI of 11% x 0.27= 2.9%.

The 0.27% figure is an average across a range of foodstuffs. In reality, this differs between food groups, with the figure for bread being estimated at 0.331%, Meat 0.377%, Fruit 0.251% and vegetables 0.456%.

Unprocessed food products, such as whole cuts of meat and fish, as well as fresh fruit and vegetables will likely feel the effects of tariffs more-so than processed goods, as the 'commodity' component of these foods make up a larger percentage of the overall costs.

Retailers influence

The reason that consumer prices rise less than commodity prices, is that the cost of the commodity is only part of the total cost of the finished product. There will be processing, packaging costs, wholesale and retail margins, storage and transport costs included in the final price. Complex supply chains and retailers’ ability to mitigate cost pressures will all impact on the actual path of inflation. Retailers typically have three main options when facing rising input costs;

- Pass costs onto consumers

- Reduce profit margins

- Mitigate the impact through the supply chain and re-engineer products

Most retailers will use a combination of all three options to remain competitive. However, complexities arise when looking at specific sectors, market position, pricing power, elasticity of demand, length of supply chain are all important factors to consider when assessing the magnitude of the price transmission through to consumers.

However, in the current climate for UK retailers it is expected that consumers would have to bear at least part of the burden of rising costs.

Conclusions

It is clear that the relationship between commodity prices and retail food prices is complex. Various studies have attempted to quantify the impact of changes in commodity prices on CPI and results vary.

Overall, the results suggest that in the event of a no deal Brexit, lowering tariffs on imported goods may go some way to mitigate food price inflation. However, commodity prices are not the only factor at play, and in the event of a no-deal Brexit there are likely to be other factors, notably exchange rate changes, which will also impact on food prices.

It is also clear that the effect of tariffs is on the commodity value of products – and these tend to represent a small proportion of the value of food products in the retail market.

[1] Lloyd et al. (2011) “Retail Food Price Inflation Modelling: Final Report to Defra”. http://randd.defra.gov.uk/Document.aspx?Document=FinalDefraReport280411.doc