Summer 2023 outlooks for global beef and lamb markets

Thursday, 27 July 2023

Global outlooks for beef and lamb markets for the remainder of 2023 suggest that production is set to increase for both meats, as key players such as Brazil, Argentina and Australia grow their output. Closer to home, the EU short-term outlook shows a decline in beef and sheep production for the remainder of the year, following contraction in breeding stock numbers.

Beef

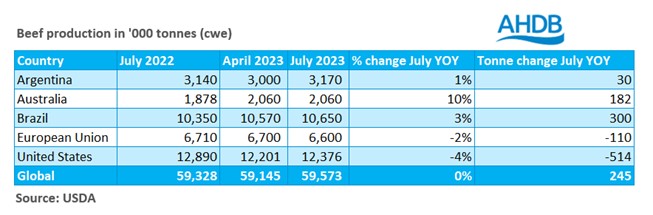

Global beef production for 2023 is forecast to reach 59.6 million tonnes (+0.4% vs 2022), up 1% from April’s forecast, according to the USDA’s latest outlook. The key players have shifted slightly, as production is expected to grow in Argentina, USA and New Zealand. Drought in Argentina has reduced available forage, forcing further liquidation in the herd, as the production forecast has risen by 6% since the previous USDA forecast.

Compared to previous estimates, July’s forecast sees US beef production grow by 1% with higher cow slaughter and greater movement to feedlots. New Zealand’s beef production is set to grow by 3% from April’s forecast as more calves come forward from the dairy sector to be produced for beef.

In terms of international trade, exports are unchanged from the previous forecast, at 12.1m tonnes. However, there are key winners and losers as export forecasts have been revised upwards for New Zealand, Australia, Argentina and Brazil. Demand from China will boost exports from South America, while Australia will benefit from exports to Japan and South Korea. Boosted demand for processing beef in the USA will allow for additional exports from Australia and New Zealand.

Export forecasts have fallen for the EU, UK and Mexico as falling demand from the EU reduces UK exports, lower EU production dampens its export capacity, and a challenging exchange rate hampers Mexican exports.

EU beef production continues to decline, as production is expected to fall by 1.8% in 2023. The previous EU outlook showed production falling due to contractions in the dairy and suckler herds. Despite lower beef supplies, prices have eased since January as consumer demand struggles. However, globally EU prices are relatively firm, weighing on the competitiveness of exports into other markets. EU exports are predicted to fall by 5% in 2023 as a result.

Inflation and the cost of living continues to weigh on consumption, as consumers reduce their purchases of beef, and switch from eating-out to eating-in. There has been little change from the previous outlook that saw consumption falling by 10kg (-1.7%) from 2022 levels.

Sheep meat

Looking globally, the FAO note that production of sheep meat* is predicted to reach 17 million tonnes in 2023, up by 1% from 2022.

Growth in production is expected in Australia, China, Turkey and the UK, as production drops in the EU (as discussed below). New Zealand’s production is predicted to remain relatively stable as heavier carcase weights almost offset lower slaughter, while Australia is expecting a boosted year of production thanks to favourable conditions. Higher demand and higher prices in China and Turkey throughout 2023 may boost production there also. As detailed in our latest outlook, growth in the breeding flock and greater carryover are expected to increase UK production.

Sheep meat exports are predicted to increase by 5.2% to 1.1 million tonnes, as shipments from Australia and New Zealand grow into Asia. Australia’s exports are set to increase by 9% to 521,000 tonnes as production increases and more opportunities present themselves through free trade agreements. New Zealand’s exports are set to grow to the EU and China, driven by lower production and demand growth, respectively.

EU sheep meat production had benefitted from the seasonal religious festivals such as Eid and Easter during the spring, but is still predicted to fall by 1.5% overall as flock size falls. Lower domestic production combined with internationally strong price competition may lead to a fall in exports of 5%, as imports may rise by up to 12% as shipments from the UK and New Zealand grow.

Compared to beef, sheep meat consumption is likely to be least impacted by inflationary pressures given the importance of the product in religious and cultural contexts, with expected growth of 1.4% per capita in 2023.

*Includes goat meat

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.