Latest update on the global beef market - USDA

Friday, 5 May 2023

Production

Global beef production is set to remain virtually unchanged for 2023, according to the latest USDA world market update. This is against a backdrop of falling United States (US) beef production, and increasing production elsewhere around the globe. Production in Australia, Brazil, China, and India is set to overall increase by 1%, as higher global prices drive higher slaughter levels.

Production in Australia will grow as improved pastures allow for increased carcase weights, driving overall production growth by 10% for 2023. See our MLA outlook summary for more information. Brazil’s production is forecast to increase by 2% as a firmer domestic market and lower calf prices drive more slaughter. A lift in covid restrictions is forecast to increase demand for foodservice in China, upping their production by 3% in 2023.

Trade

Global beef exports are predicted to be fractionally higher for 2023, as declines in US exports are offset by increases from Australia and Brazil.

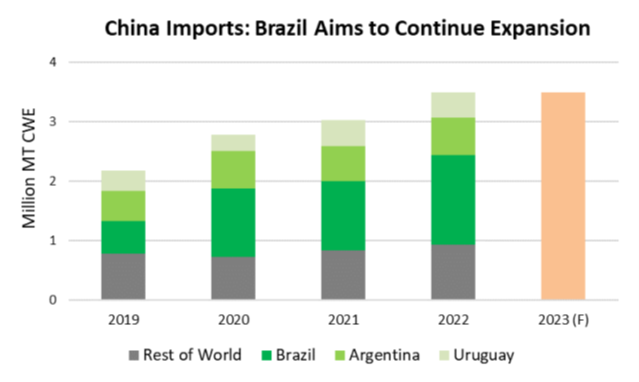

Tighter supplies and exportable surplus in Argentina and Uruguay mean Brazil have more of a chance to export. Brazil expects to increase its exports of beef over the next year, with predictions of +4% from 2022. Brazil is set to slightly increase its exports to China, despite 4-week loss of market access due to a case of atypical BSE. There is expected to be reduced competition for exports to China due to lower availability of supplies in Argentina and Uruguay, with a weaker exchange rate meaning that Brazilian imports to China will be cheaper.

Source: USDA

Source: USDA

Exports from Australia are set to increase by 13% from 2022 levels, following on from greater production and more price competitive carcases, which will move shipments to the US and East Asia. The increased export capacity of Australia is expected to take market share away from the US in East Asia, and more product is expected to move to the US from Australia.

US focus

US beef production is set to decline by 5% from 2022 levels, a result of lower cattle availability following widespread herd liquidation in recent years, due to drought. Fewer cattle are predicted to pass through feedlots, with March feedlot inventory 4% lower than the same period in 2022. The tighter supplies see the size of the cattle herd fall by 3% compared to 2022. There are reports of more heifers on farm, as prices strengthen for heifer calves and to rebuild herd size.

With lower domestic production, US beef exports are set to fall by 11%, as there is a lower exportable surplus. This is further hampered by previously mentioned lower priced Australian beef, with US beef seeming like a higher priced product in comparison in East Asia. The US is the sixth largest beef exporter to China so far in 2023, but this could reduce throughout the year as China moves the destination of its imports to cheaper suppliers, as demand rebuilds throughout the year following covid.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.