Sheep market update: a look into the Middle East

Friday, 16 February 2024

Key points:

- Demand for lamb is expected to grow throughout 2024 and beyond in the Middle East region

- Australia provides a large majority of sheep meat to the region but could see trade disruption

- Conflict in the Middle East could see more Australian product on the global market

Demand for sheep meat in the Middle East is predicted to grow through 2024, up around 2.3% from 2023 to 2027 (GIRA) as the region continues to recover from the pandemic. The region produces small volumes of sheep meat, so it relies on global imports to meet demand. Wider factors for increased demand include growth in the population and number of tourists, which will boost consumption of sheep meat. Research by AHDB shows that overall buying behaviours in the Middle East are driven by quality (halal assurance) and taste. However, there are barriers to consumption, specifically for British lamb, such as price points and perception of halal assurance. Other exporting countries, such as Australia, may not face such pressure with lower prices on the global market.

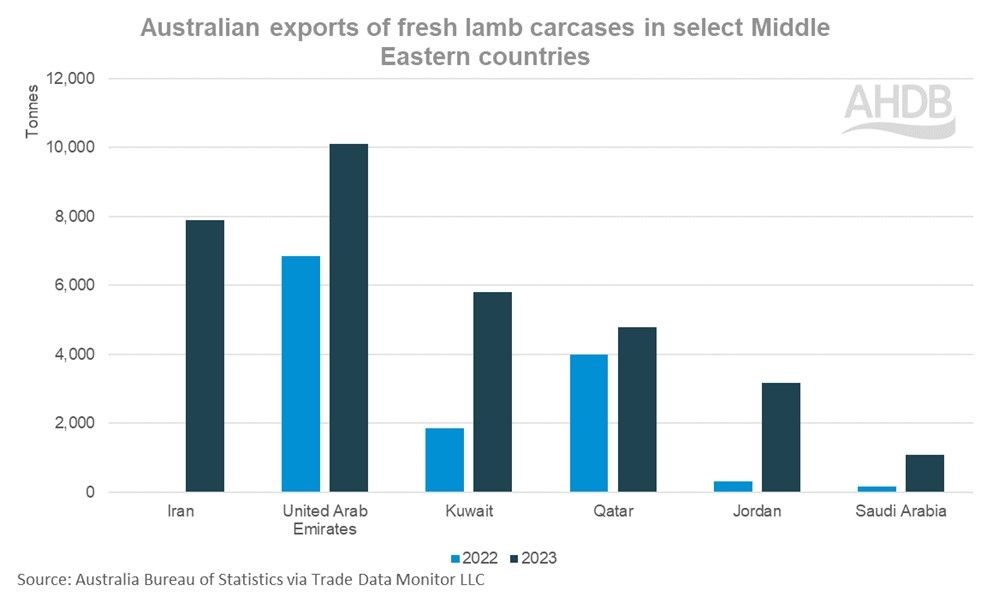

The Middle East has grown in importance for Australia, as the largest sheep meat exporter to the region. Reports note that the Middle East prefers lighter lambs (exported whole), which can be cheaper (c/kg) compared with heavier lambs. Exports of chilled lamb carcases grew by 150% (20,000 tonnes) from Australia to the globe to reach 33,300 tonnes for 2023. Exports from Australia to many Middle Eastern and Gulf countries have grown from 2022 to 2023. During this time, lamb carcase exports to the United Arab Emirates grew by 3,250 tonnes (47%) to 10,100 tonnes.

Australian exports of fresh lamb carcases in select Middle Eastern countries

Source: Australian Bureau of Statistics via Trade Data Monitor LLC

However, in recent weeks, exports to the Middle East from Australia have been interrupted by attacks on commercial ships in the Red Sea. This interruption has added an approximate ten days in order to reroute trade as a result. As the purchase of lambs has begun for Ramadan, which runs through March, supplies into the Middle East from Australia could be impacted. This may have a knock-on effect for volumes available on the global marketplace. As the Midde East is a lucrative market for Australia, a fall in the ability to export there could see more product available.

Our Agri Market Outlook for 2024 sees imports increasing by around 4% with growth from Australia. This is particularly in the first half of the year when domestic supplies are tightened. The conflict in the Middle East is a watchpoint to consider throughout 2024, with the potential for more Australian product needing a home on the international market.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.