Sheep market update: how could Australia impact the UK market in 2024?

Tuesday, 23 January 2024

Key points

- Australian sheep production dependant on El Nino in Q1 2024.

- Prices have started the year around the same as 2023, following a period of lower prices last year.

- Australian exports to China and the Middle East have grown as their market share increases.

- Exports to the UK make up around 2% of Australia’s exports (Jan – Nov).

Production

The Australian sheep flock currently sits at the highest level since 2007, with 78.75m head according to MLA. This is as a result of regrowth in the breeding flock, and better scanning rates, following years of destocking due to drought from 2019.

Following on from the record sized sheep flock, production and slaughter levels in Australia have grown throughout 2023. Commentary from ANZ Agribusiness shows that processing of lambs increased 9% year on year in November. Reports have shown that rain has boosted confidence in producers and processors, who were concerned about a season of dry weather from El Nino. The weather will play a large role in both production and prices in Australia, which could impact our domestic market. Continued rain for the rest of the Australian summer could benefit producers who are able to hold back lambs for a better carcase confirmation, which could steady out the stream of lambs for processing. This could provide some buoyancy to price especially in Q1. Industry commentary suggests that there may be fewer breeding ewes for 24/25, which could result in fewer lambs for processing, which would reduce some pressure on the market.

Prices

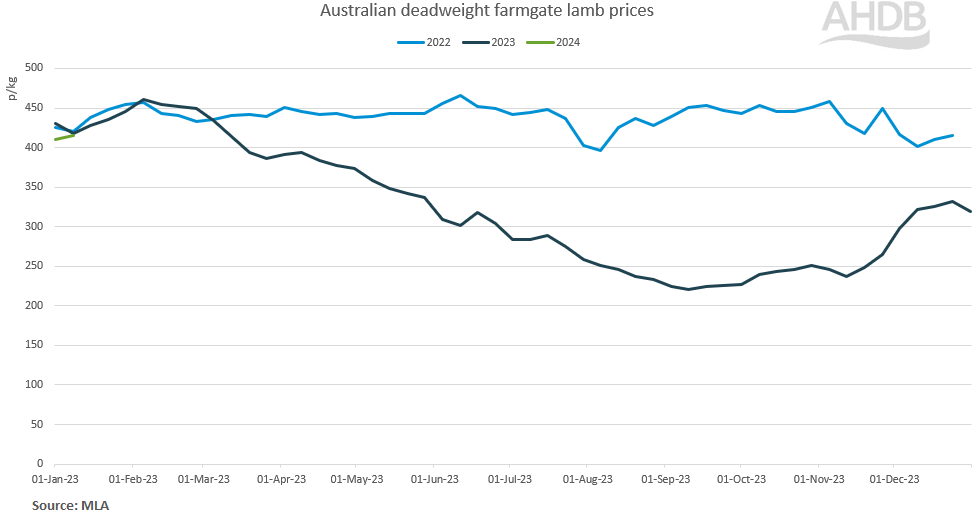

Deadweight lamb prices in Australia have rebounded recently following a period of declines, with a low of 221p/kg in mid-September 2023. More recently, prices have lifted 117p from the first week in December 2023 to second week in January 2024, to around 15p lower than where prices began in 2023.

Australian deadweight farmgate lamb prices

Source: MLA

Trade

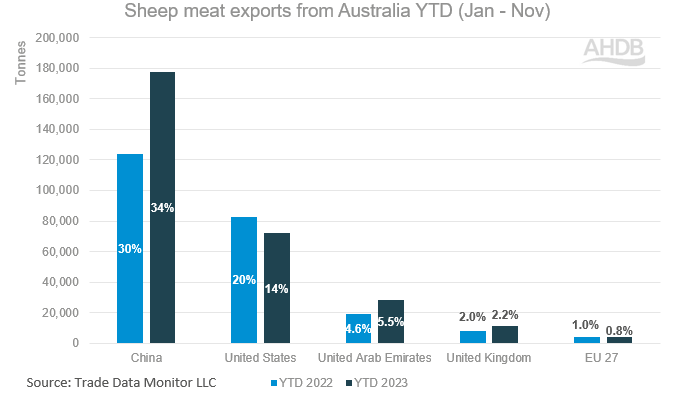

This high supply and lower prices have benefited Australian exports for 2023. Total export volumes in the year to date (Jan – Nov) have increased by 25% from 2022, to total 5.18m tonnes of sheep meat. This is growth of over 100,000 tonnes, the majority of which came from exports to China and the Middle East.

Export volumes to China have risen 44% from the same period in 2022, a volume increase of 52,250 tonnes. Exports to the Middle East have also grown, with a 48% boost in exports to the United Arab Emirates to total nearly 30,000 tonnes, as monthly volumes have been consistently higher than the year to date in 2022. There was similar percentage growth in Saudi Arabia (+64%), Kuwait (+110%), Jordan (+95%), and Oman (121%), however these have been from lower volumes in 2022. Exports from Australia to the United States has seen a shift, with volumes down 13% year on year (YTD), to total 72,000 tonnes as the market share has fallen 6% to 14% for 2023. This could indicate a desire to export to destinations such as China and the Middle East over the next year.

Sheep meat exports from Australia YTD (Jan - Nov)

Source: Trade Data Monitor LLC

What might happen in 2024?

With the new UK/Aus trade deal now in place, we could see a slight uplift in Australian product entering the UK throughout 2024, but at a 2% market share, the UK market is not a major destination for Australia. A growth in Australian exports to other parts of the world may indirectly impact the UK. We may see a growth in product coming from New Zealand, depending on the price difference between both Oceania countries. This is because both Australia and New Zealand compete to import into the same countries such as China and the Middle East. The lower prices in Australia have allowed for growth in imports into these countries at the expense of New Zealand product. Looking forward, we could see some more New Zealand product looking to find a market in the EU and UK marketplace depending on domestic demand.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.