Sheep market update: Australia’s sheep production and free trade

Friday, 25 August 2023

As the free trade agreement with Australia is under way, we explore the current trade situation for sheep meat, and what Australia’s production may look like in the coming years.

Key points:

- Imports from Australia in June show little change from previous months

- The quota from the Free Trade Agreement is 13% full from 31 May - 16 August

- Australian sheep flock hits record levels in 2023, as production is set to grow through to 2024

Trade with Australia

Free trade of sheep meat without tariffs is now allowed under the Free Trade Agreement (FTA) with Australia. The agreement removes barriers to trade such as tariffs, that would usually increase the cost of shipping to the UK. The FTA agreement includes a specific, allocated volume (tariff-rate quota or TRQ) of sheep meat that can be shipped, which increases every year. The first year (31 May – 31 Dec 2023) is just over 14,700 tonnes, up to 75,000 tonnes in year 10. The allocated quota is for large exporters with an allocated tonnage they can import and are based on the size of the company, and the volumes they have previously imported. As of 16 August (latest data available at time of writing), 1,870 tonnes of sheep meat has been shipped from Australia to the UK under the TRQ since the end of May, which equates to 13% of the total TRQ volume. There is a further 12,855 tonnes that can be shipped until the end of the calendar year.

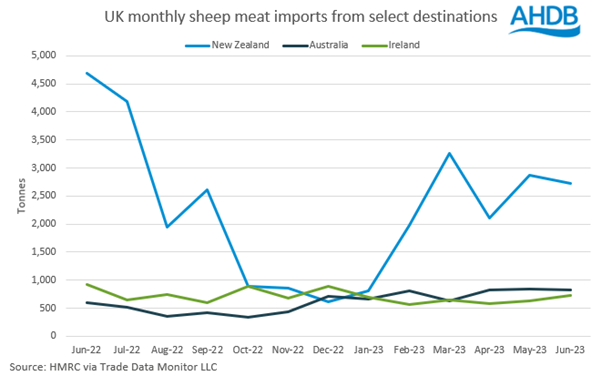

The latest HMRC import data currently available is for the month of June. This shows that the UK imported 830 tonnes of fresh and frozen sheep meat from Australia. This would equate to the first four weeks of the TRQ being in place, and is of a similar volume recorded in April and May. To compare, the UK imported 723 tonnes of sheep meat from Ireland during the same month, the closest trading partner volume-wise. Any increases in product from Australia therefore did not arrive in the UK in June, according to HMRC data, but we will continue to monitor the estimated shipped quantities from the TRQ.

Australia sheep outlook

The Australian sheep flock is set to reach 78.75m head in 2023, the highest level since 2007, according to the latest MLA outlook. The flock has benefitted from higher-than-average rainfall in the last three years, allowing for greater feed availability, coupled with improved genetics. These have both also driven higher than average carcase weights for the past years. Looking to 2024, growth in the flock is expected to continue, albeit at a slower rate. This expansion is anticipated to contribute to record lamb production in 2023. Lamb production will reach 540,000 tonnes this year, with further growth expected in 2024 if conditions remain favourable.

With a declining New Zealand flock and increased export reliance on China, Australia’s expanding production could create further opportunities for their exports to markets such as the US and continental Europe. Australia already has a large stake in the US market, with 22% of their exports shipped there in 2022 (102,800 tonnes). By comparison, exports to the EU are small (4,100 tonnes in 2022), and also compared to those from New Zealand (53,100 tonnes in 2022), but a declining New Zealand flock may present slightly less competition long-term.

What does this mean for the UK?

As the free trade agreement continues with Australia, we will be keeping a close eye on the quantities of product entering the UK. The UK remains a key export destination for New Zealand, however increased Australian production isn’t expected to significantly increase total import levels. Our trade modelling analysis suggests that an increase in Australian volumes is more likely to displace some UK imports from other suppliers. This assumes Chinese-Australian trade relationships stay the same, as Australia are China’s largest sheep meat supplier. If trade flows are disrupted, we could see more Australian sheep meat looking for a home on the global market.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.