SFI can provide substantial extra income for arable farms: Grain market daily

Wednesday, 15 November 2023

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £202.50/t, up £0.10/t from Monday’s close. Nov-24 futures fell £0.40/t over the same period, to close £209.50/t.

- Wheat markets on the continent felt a little pressure yesterday, as the euro strengthened against a weakening US dollar, though uncertainty over the impact on rain delays on French winter planting limited losses after days of heavy rain in some regions of northern France.

- Markets are seeing a string of tenders for wheat in recent days, including to the Philippines and Tunisia. Jordan's state grain buyer has issued a tender for up to 120 Kt of milling wheat from optional origins, according to European traders (Refinitiv).

- Paris rapeseed futures (May-24) gained €1.50/t yesterday, to close at €451.50/t. Nov-24 futures gained €3.00/t over the same period, to close at €457.25/t.

- Rapeseed prices gained yesterday with wider markets, including Chicago soyabeans and Malaysian palm oil. US soyabean markets continue to gain from concerns that unfavourable weather will impact soyabean production in Brazil.

- The latest domestic inflation data has been released this morning. The Consumer Prices Index (CPI) rose 4.6% in the 12 months to October 2023, down from 6.7% in September. The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose 4.7% in the 12 months to October 2023, down from 6.3% in September.

SFI can provide substantial extra income for arable farms

This week, the latest analysis on the Sustainable Farming Incentive (SFI) for arable farms has been released.

Results show that the SFI scheme alone is not going to be enough to mitigate the loss of Direct Payments, an intentional design of the scheme. But that taking part in the SFI scheme can provide substantial extra income for an arable business, and with the right combination of actions for their individual farm, could make up a considerable amount of the shortfall.

An increase in net profit is likely if ambitious actions are mainly done on unproductive land or without having to sacrifice land where profitable cash crops are grown. Such actions are also likely to help regenerate unproductive land, making it more productive in the long term. However, if the more ambitious actions can only be carried out by taking productive land out of production (i.e. reducing the area of cash crops to make way for environmental mixes), the net profit of the farm declines.

Ultimately, the SFI is understood to have a greater impact on farms with low gross profit margins, compared with those that have high gross profit margins. Though by diversifying farm income, entering the scheme can play a role in help stabilising farm income, especially for years where crop prices are below average, and margins feel squeezed. To read the full report, follow this link.

Three stacking options analysed: A, B and C

Option A: SFI ‘lite’ – a combination of SFI actions which do not require additional land

Option B: SFI ‘ambitious’ – option A plus a combination of SFI actions which require additional land

Option C: SFI and CS – option B plus specific CS actions

The analysis looks at a 455 ha arable virtual farm, and depending on whether actions under A, B or C were undertaken, the farm received between £15,000 and £46,000 in additional income. With the more ambitious the actions, the higher the extra revenue. Details of the actions and analysis can be read here.

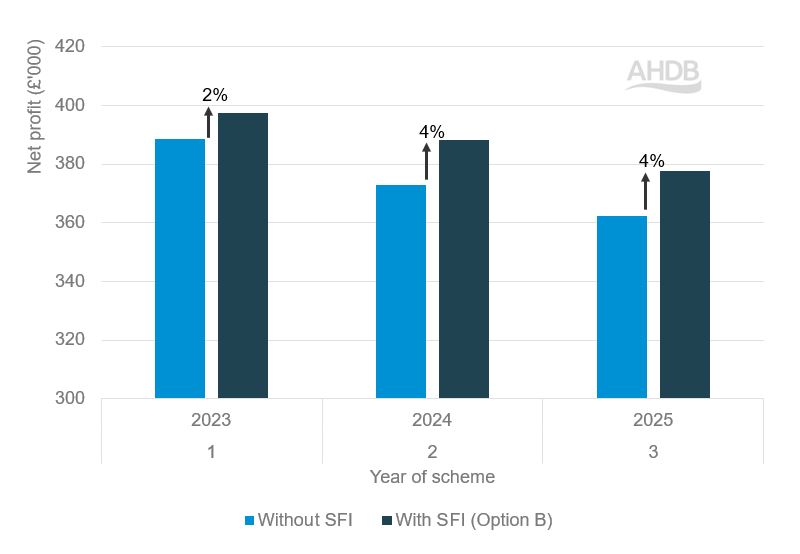

The following figure shows the three-year projected net profit level, by a 455 ha arable farm, after implementing SFI actions for option B on unproductive fields. The change in the farm’s net profit increases by 2–4% over the three years.

Effect on 455 ha arable farm’s net profit level after implementing option B on unproductive fields

Another option to explore is replacing unprofitable break crops with options such as SAM3 (herbal ley). This is something that is going to be investigated more closely and published at a later date.

What to do now? You can read the full report here, remember that more SFI actions will be made available to farmers as the scheme progresses, providing more choice and sources of income.

With applications now open for SFI 2023, it is important for farmers to investigate which options work for their farm and make the best-informed decision about their business.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.