Arable Market Report - 13 November 2023

Monday, 13 November 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

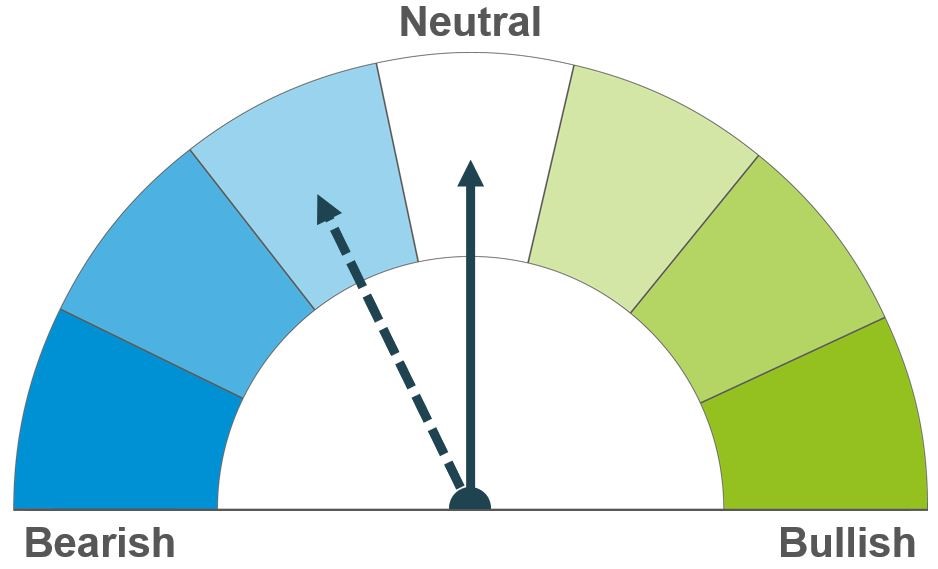

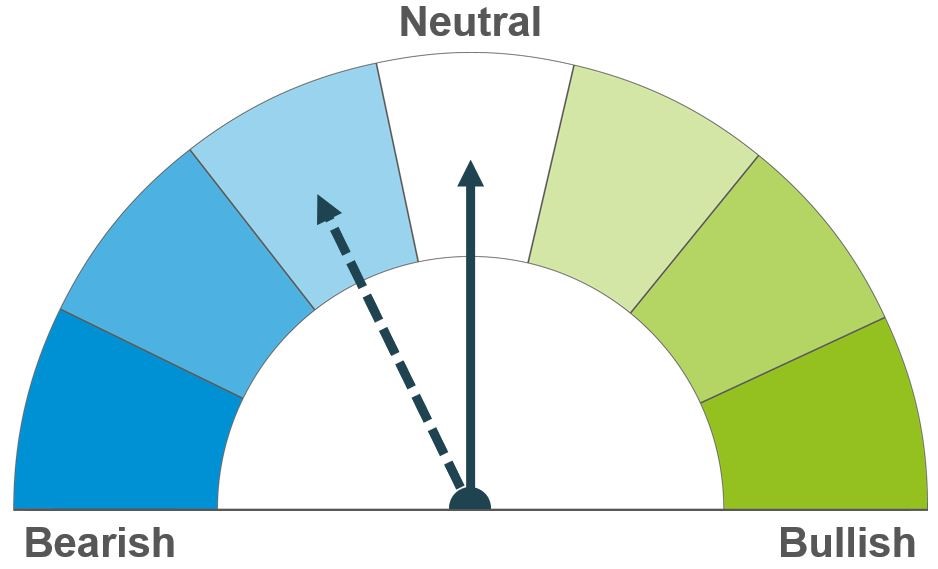

News from the Southern Hemisphere is still an important driver for market direction, along with global export competitiveness. The potential for large maize supplies keeps a bearish undercurrent in markets for now; emerging insights for harvest 2024/25 will start to influence market sentiment over the coming months.

The South American maize crops are key to the expected global grain surplus in 2023/24, which is keeping a bearish tone to the outlook. If confirmed, this pressure will continue but recent weather conditions create uncertainty.

Wider trends in the global grain market continue to set the overall price direction. Domestically, UK ex-farm feed barley prices are at a bigger discount to feed wheat than earlier in the season; could this potentially boost demand?

Global grain markets

Global grain futures

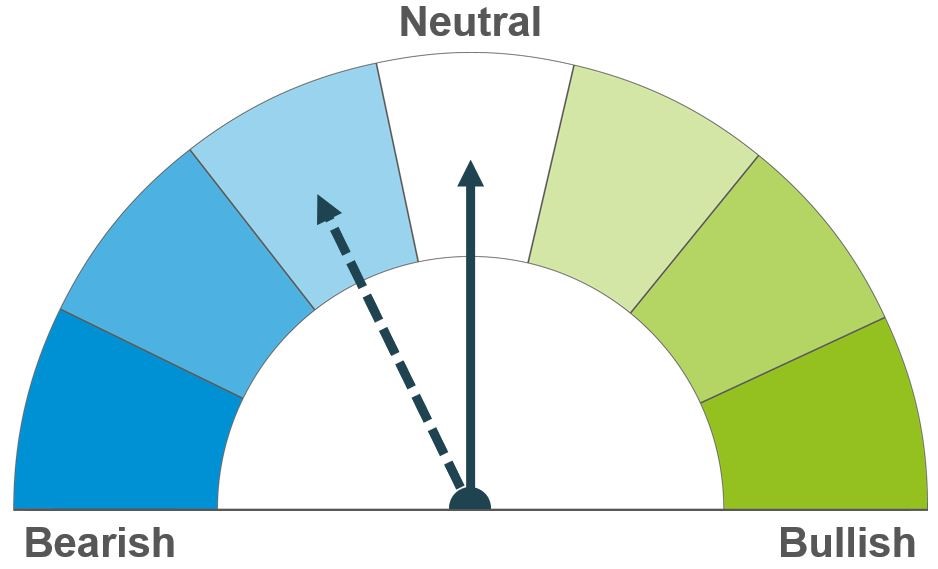

It was a mixed week for global grain prices. Current season (2023/24) wheat futures were generally supported mid-week by downgrades to the Argentinian wheat crop and reports that Algeria bought French wheat in a tender.

Prices came under pressure on Thursday as the USDA increased its forecasts of the US maize crop and end of season stocks by more than the market had expected. In its monthly World Agricultural Supply and Demand Estimates (WASDE) the USDA revised the US maize crop up 4.3 Mt from the October WASDE, to 387.0 Mt. The forecast for US maize stocks at the end of 2023/24 was revised up 1.1 Mt to 54.8 Mt.

While Thursday’s WASDE put a bearish sentiment onto the market, South American weather is continuing to limit any further pressure on global grain prices. Despite some welcome rain in Argentina, Brazil continues to experience hot and dry weather across the Mato Grosso region, building concern over the plantings of the second maize crop, due to start planting early in 2024.

Brazilian supply agency Conab pegs the 2023/24 maize crop at 119.0 Mt, 10.0 Mt lower than the USDA. South American maize crops are critical to the predicted global grain surplus in 2023/24, so any downgrades could tighten the global grain market.

Meanwhile, thoughts are starting to look ahead to harvest 2024. US wheat crops are in the best condition for the time of year since 2019. But French winter planting remains delayed. After tracking the five-year average pace until late-October, by 6 November soft wheat planting was well behind average (83%) at just 67% complete. Winter barley planting is also behind at 81 % complete by 6 November, vs 91% on average.

UK focus

Delivered cereals

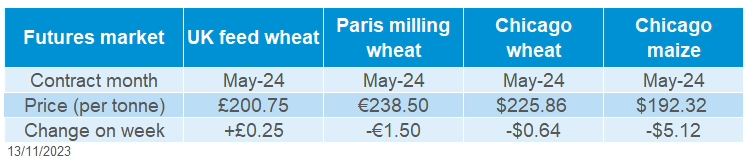

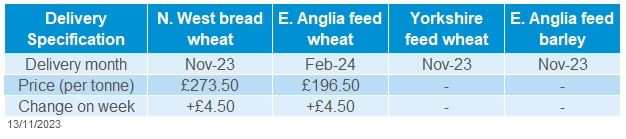

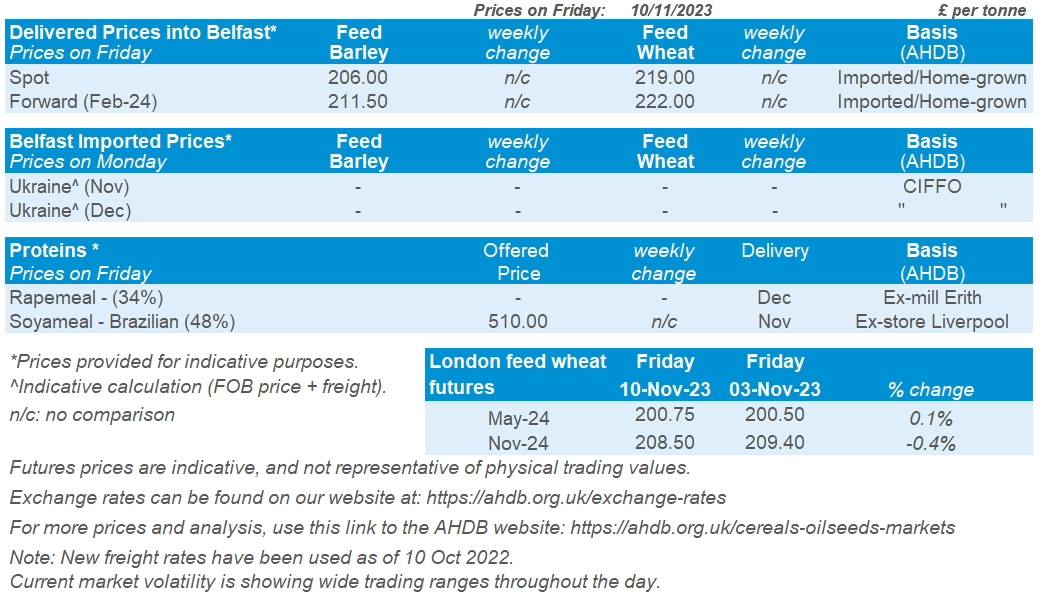

UK feed wheat futures (May-24) closed at £200.75/t on Friday, up £0.25/t from a week earlier. The Nov-24 contract fell by £0.90/t over the same period, closing at £208.50/t. Domestic wheat futures broadly followed global wheat market movements last week, though shifts in the sterling muted some changes.

Whilst markets remain quiet, feed wheat delivered into East Anglia for February was quoted at £196.50/t on Thursday, up £4.50/t over the week. Bread wheat delivered into the North West in November was quoted at £273.50/t on Thursday, up £4.50/t from the previous week.

UK trade data shows wheat exports for July-September 2023 fell by 67.9% year-on-year to 79.4 Kt, while imports have increased by 13.6% over the same period to 404.2 Kt. For barley, exports have decreased by 24.4% for July-September year-on-year to 218.0 Kt. Oat exports have fallen substantially year-on-year by 51.4% for July-September totalling 24.0 Kt, while imports have increased by 18.1% over the same period.

GB fertiliser prices were broadly stable in October. For imported AN (34.5%), the quoted price fell £1/t from September to October 2023 to £361/t. Although fertiliser prices remain higher than before the energy crisis in Europe, prices changes have been relatively stable over the past few months.

AHDB’s Early Bird Survey takes place each autumn to assess national cropping intentions – the provisional results for harvest 2024 will be out tomorrow. Results will be published on our website, with highlights in Grain Market Daily.

Oilseeds

Rapeseed

Soyabeans

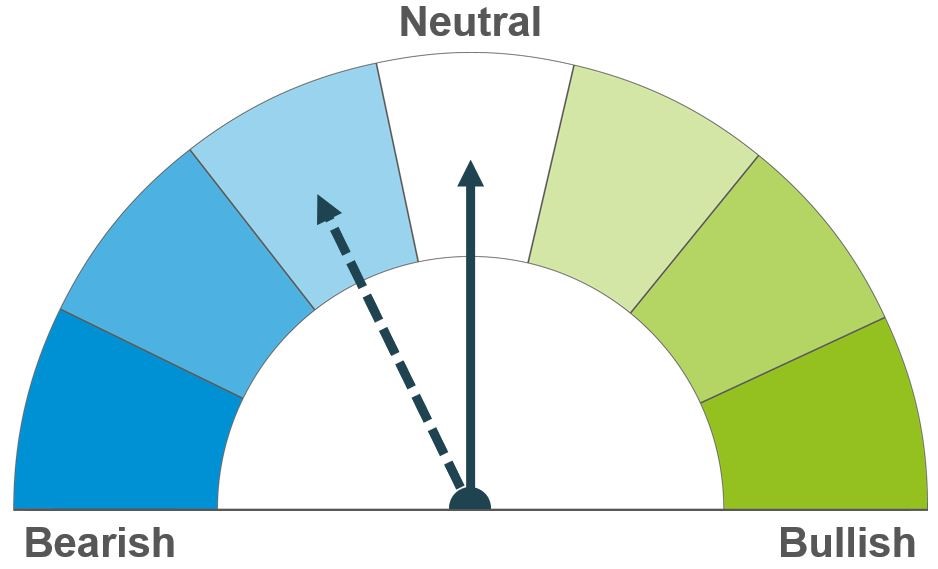

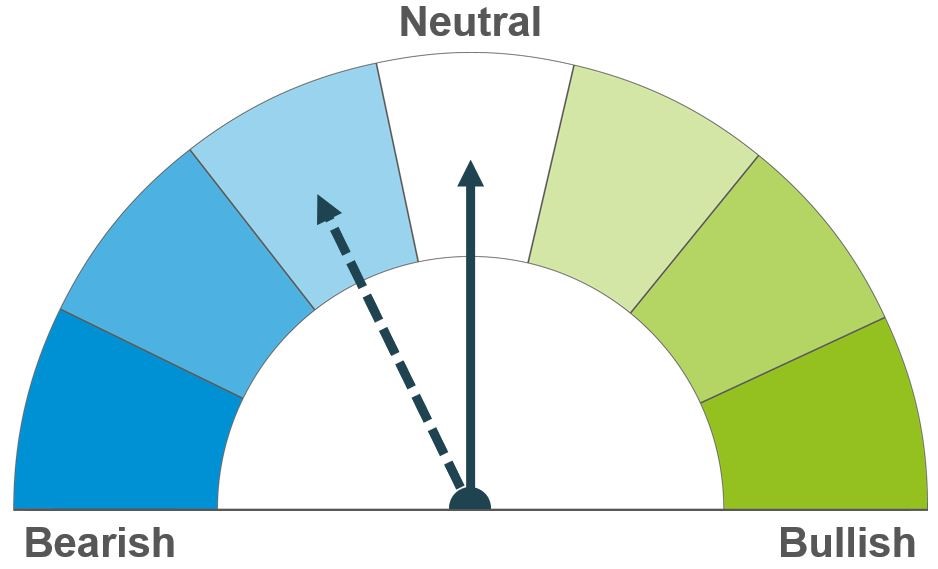

Global rapeseed markets continue to follow the general sentiment of soyabeans. Longer-term, a heavy supply of soyabeans from South America is still expected, though focus will begin to turn to new crop EU rapeseed supply.

Short-term, South American weather remains the key watchpoint, with hot and dry weather over coming days likely to keep prices supported. Longer term, there is still the expectation of heavy supplies this season (2023/24) likely weighing on prices, though US new crop plantings will be a watchpoint.

Global oilseed markets

Global oilseed futures

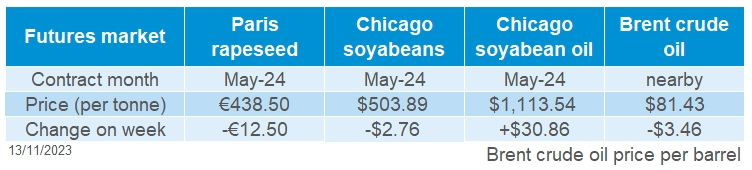

Chicago soyabean futures (May-24) were overall pressured last week, down 0.5% Friday to Friday. The key factors driving oilseed markets last week were adjustments to the USDA’s World Agricultural Supply and Demand Estimates (WASDE), South American weather, firm Chinese demand for US soyabeans and a weaker US dollar at the beginning of the week.

In Brazil, limited rainfall and high temperatures in the Mato Grosso region continue to delay soyabean plantings. Brazilian farmers have said that plantings are being delayed up to 30 days, and that some areas will need to be re-planted (Refinitiv). However, on Thursday, Brazilian crop agency Conab increased its production estimate 0.4 Mt from October, to 162.4 Mt and up from 154.6 Mt last season. Over the next seven days, the Mato Grosso region is forecast limited rain, with temperatures remaining elevated.

Argentina on the other hand has received some much-needed rain over the past couple of weeks, improving soil moisture and enabling planting progression. Data to the 8 November shows that soyabeans plantings are currently 6.1% complete, slightly ahead of last year, but 13 percentage points (pp) behind the 5-year average.

On Thursday, the US soyabean market was pressured following the release of the latest WASDE. The US soyabean production figure was pegged at 112.4 Mt, above the average analyst estimate of 111.7 Mt. US soyabean ending stocks were also unexpectedly revised to 6.7 Mt, up from the previous estimate and analysts’ expectation of 6.0 Mt. However, limiting any major pressure was firm Chinese demand. The USDA reported flash sales of more than 3 Mt of US soyabeans last week and today to China and unknown destinations. Any further sales this week will remain a watchpoint.

Rapeseed focus

UK delivered oilseed prices

May-24 Paris rapeseed futures closed at €438.50/t on Friday, down €12.50/t Friday to Friday. The Nov-24 contract also saw pressure, falling by €10.00/t over the same period closing at €446.00/t. Movements in rapeseed futures tracked pressure in the wider oilseed complex last week, largely driven by the US soyabean market as well as pressure on nearby brent crude oil earlier in the week.

Recent UK trade data shows that rapeseed exports are up 139.4% from last year for July-September totalling at 7.3 Kt, though down 45.6% from the 5-year average for the same quarter. For imports, rapeseed has increased year-on-year for July-September by 10.7% reaching 217 Kt, 27.5% greater than the 5-year average.

AHDB’s Early Bird Survey takes place each autumn to assess national cropping intentions – the provisional results for harvest 2024 will be out tomorrow. Results will be published on our website, with highlights in grain market daily.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.