Rising straw costs and the impact on livestock farms

Wednesday, 8 October 2025

At the beginning of the year we published the straw market outlook which looked at key points that may impact straw supply and pricing over 2025. At that point market conditions seemed uncertain due to ongoing cost pressures and dependency on weather influencing both production and price.

The picture during 2025 has mirrored this outlook. With a very dry spring and summer, straw yields have been highly variable across the country and there have been concerns about supply going into winter 2025. With these concerns and a tighter supply of straw, straw prices have started climbing.

Background

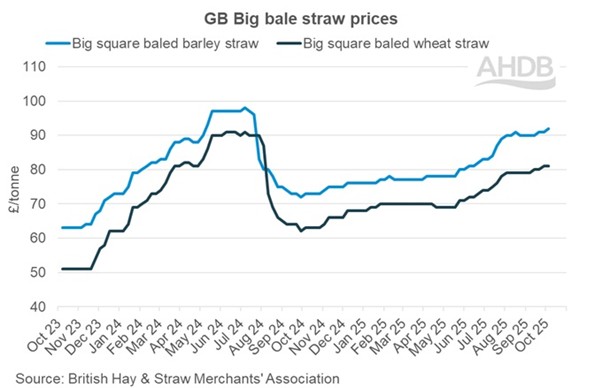

AHDB publish weekly straw prices. These show average buying prices for hay, barley straw and wheat straw in Great Britain.

As of the end of September 2025, the price for straw had increased by 19% for barley straw, and 18% for wheat straw compared to September 2024. As straw supply tightens over the winter it is likely these prices will continue to rise.

Figure 1. GB Big bale straw prices (£/tonne)

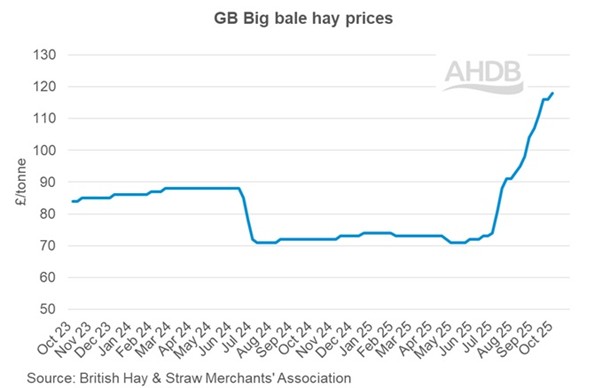

It is also important to consider the cost of hay. Big bale hay prices have increased 46% compared to this time last year due to poor harvest and dry weather. With limited hay stock and increasing prices it might prompt businesses to look at feeding straw as a bulking ingredient instead of hay which will increase demand for straw in an already tight year.

Figure 2. GB big bale hay prices (£/tonne)

2025 straw harvest

The AHDB Harvest Progress report shows that straw yields this season had been highly variable, as with the cereal grain yields. This had led to localised challenges for straw availability, which is already being identified going into the winter. This following a dry summer where livestock farmers have seen limited forage growth may contribute to challenges for winter. AHDB’s Forage for Knowledge has resources and information on grass growth and to support decision making.

Impacts on cost of production

The dry weather over 2025 has impacted straw yields, but also other forage as hay and silage. In addition, the dry weather over summer has meant that some farmers may have had to start using forage stores early. This combination of impacts means there is a smaller supply and greater demand which has led to straw prices climbing. Straw costs are an important part of a farms cost of production and will have an impact on overall costs and ultimately net margins.

We publish cost of production figures for pork, beef and lamb production. As part of these calculations, we look at the cost of straw as a variable cost within production.

For pig production, straw costs make up almost 2% of all costs. Around two thirds of pig cost of production is made up of the cost of feeding, so straw costs for bedding are an important consideration within those remaining costs.

This sensitivity analysis in table 1 looked at the impact on cost of production if straw prices were to increase by 20%, 30% or 40%. This baseline is an annual average from July 2024 to June 2025 whilst straw prices were relatively stable. This analysis shows how overall production costs may be impacted by straw costs increasing.

Table 1. Sensitivity analysis of straw price increase on pig cost of production (p/kg deadweight)

| Baseline | 20% increase in straw costs | 30% increase in straw costs | 40% increase in straw costs | |

|---|---|---|---|---|

|

Feed |

121.6 |

121.6 |

121.6 |

121.6 |

|

Straw |

3.9 |

4.7 |

5.0 |

5.4 |

|

Other variable costs |

12.9 |

12.9 |

12.9 |

12.9 |

|

Labour |

15.7 |

15.7 |

15.7 |

15.7 |

|

Building, finance & Misc |

43.3 |

43.2 |

43.2 |

43.2 |

|

Total costs |

197.2 |

198 |

198.4 |

198.8 |

The impact on cost of production is minimal in percentage terms but could increase by 1.4p/kg deadweight if straw prices were to increase by 40%. Considering that straw prices are almost 20% higher than prices in September 2024, we expect to see this impact come through in the quarterly cost of production and net margin estimates that are published throughout the year.

When considering beef suckler herds, bedding costs make up 18% of variable costs and 5% of all costs. It is likely that beef production will see a greater impact of straw price increases than with pig production as bedding costs make up more of overall costs. The beef suckler herd costs are shown in £/cow put to the bull for the middle 50% of businesses in 2024. Similarly to above if straw costs per cow put to the bull were to increase by 20%, 30% or 40% there would be a 4%, 5% and 7% increase to totals costs respectively for businesses with suckler herds.

Table 2. Sensitivity analysis of straw price increase on beef suckler herd cost of production (£/cow put to the bull)

| Baseline | 20% increase in straw costs | 30% increase in straw costs | 40% increase in straw costs | |

|---|---|---|---|---|

|

Vet and medicine |

42.84 |

42.84 |

42.84 |

42.84 |

|

Bedding |

50.98 |

61.18 |

66.27 |

71.37 |

|

Purchased feed |

45.43 |

45.43 |

45.43 |

45.43 |

|

Purchased forage |

10.72 |

10.72 |

10.72 |

10.72 |

|

Homegrown forage |

59.28 |

59.28 |

59.28 |

59.28 |

|

Total variable costs |

283.74 |

293.94 |

299.03 |

304.13 |

Conclusions

Straw prices are likely to continue increasing over the winter due to supply conditions and ongoing cost challenges. Livestock farmers will be looking at maximising straw use and navigating a landscape of high prices and continued tight supplies.

With any price increase this will be reflected in total cost of production for livestock and will ultimately effect a businesses net margins and bottom lines. As we go through the next few months AHDB will continue to look at the impact of increasing straw prices and what this could look like for farm businesses profits across all the sectors.