- Home

- News

- Red meat market update: Latest USDA forecasts global production to shift whilst volumes hold steady

Red meat market update: Latest USDA forecasts global production to shift whilst volumes hold steady

Friday, 9 May 2025

The US Department of Agriculture (USDA) has released its latest quarterly outlook for global red meat. This outlook features production and trade forecasts for beef and pork, summarised below.

Key points

- Beef production volumes continue to diverge, with losses in the US and EU offset by growth in Australia and Brazil

- Global beef trade faces an uncertain future as developing tariffs and fractious relationships may divert traditional trade flows between China and the US

- Global pork production is forecast to remain consistent with year earlier levels

- Brazil is anticipated to be best placed to take advantage of changes to international pork trade, growing its export volumes in 2025

Beef

Production

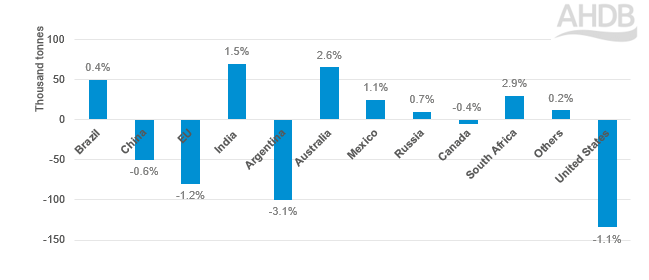

The USDA forecasts global beef and veal production to remain relatively flat year-on-year at 61.6 million tonnes (Mt), as production gains in Brazil and Australia offset herd contraction in the US, Argentina and the EU.

Indeed, beef production in both Brazil and Australia is anticipated to hit record levels in 2025 at 11.9 and 2.7 Mt respectively.

Forecast beef production, year-on-year change 2025 versus 2024

Source: USDA. Indian production includes Carabeef (Water Buffalo).

Trade

Unlike the continuity seen in production, the USDA predict a more unstable future for global beef trade in 2025. The trading relationship between the US and China is set to influence the global beef markets of 2025.

With Chinese demand set to increase by 2% in 2025, and limits on potential trade with the US, this will likely lead to greater opportunities for countries like Australia and Brazil that are at the peak of their cattle cycle. However, it will also mean that the US beef that would have been destined for China will be displaced on the global marketplace. This is especially significant as the USDA anticipates that the other primary destinations for US beef – Japan and South Korea – are experiencing reduced consumer demand amid economic uncertainty.

US imports are forecast to increase by 5% year-on-year with strong consumer demand, particularly for lean meat, holding against a reduced level domestic production. Both Brazil and Australia are well placed to serve this increased import demand.

Pork

Production

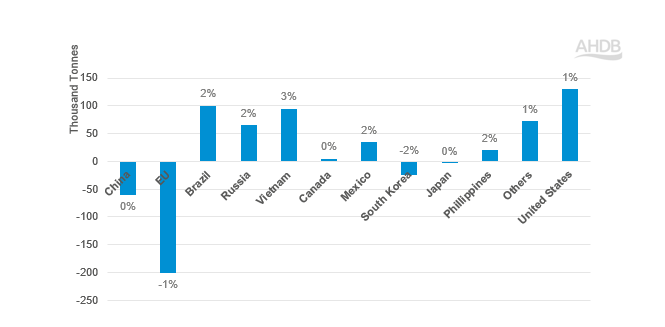

The USDA forecasts 2025 global pork production to be almost unchanged on the year at 116.7 Mt as increased Brazilian and US production (driven by lower feed costs) counterbalances losses in the EU and China.

The USDA attributes a 1% decrease in EU pig production to shifting consumer preferences, spread of animal disease, and regulations. Lower Chinese pig slaughter is driven by reduced sow numbers driven by lower pricing and continued industry contraction as well as improved pig performance with higher piglet numbers reducing the need for larger sow inventories.

Forecast pork production, year-on-year change 2025 versus 2024

Source: USDA

Trade

Global pork trade is anticipated to be slightly muted in 2025 compared to 2024. Reduced exports from major producers like the EU and Canada are expected, due to reduced exportable supply and reduced demand in key markets due to economic uncertainty – specifically in Asia. The US is also expected to see a decrease in pork exports throughout 2025, attributed by the USDA to market uncertainties. Meanwhile, pork exports from Brazil are primed for growth, as Brazil takes advantage of the unstable trade situation and its lower production costs to pivot towards new opportunities.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.