Q1 pig meat production follows forecasted trend

Wednesday, 19 April 2023

The latest monthly production figures released by Defra show that the UK produced 83,000 tonnes of pig meat in March, an 18% (-18,600 tonnes) decline compared to the record high production in March 2022. It is the lowest recorded production for the month of March since 2019 when both reduced slaughter numbers and lower carcase weights impacted volumes.

Clean pig slaughter stood at 898,700 head for the month, a 15% (-160,200 head) decline from the record high kill in in March last year and 8% below the 5-year average. Reduced slaughter numbers are driving the declines in production as carcase weights have remained steady at 89kg.

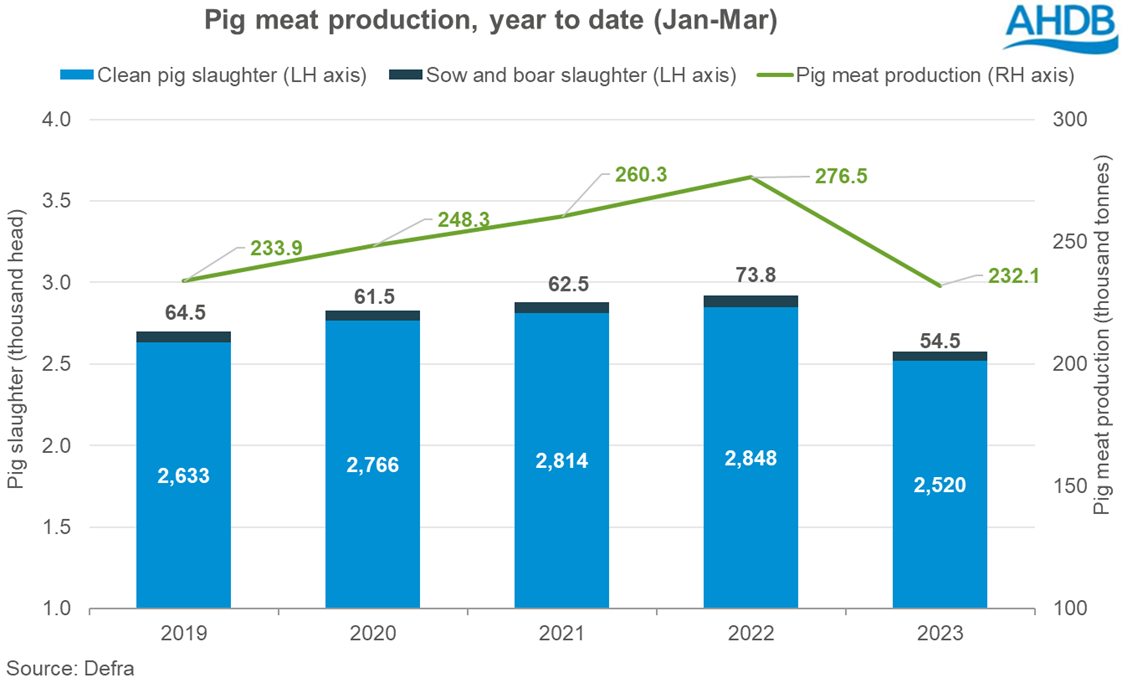

So how does this compare to our Agri-market outlook? Production for the year to date (Jan – Mar) totals 232,100 tonnes, 16% (-44,400 tonnes) behind the same time last year. This is in line with our January forecast of 230,000 tonnes in Q1 2023. Clean pig kill has totalled 2.52 million head in the first 3 months of 2023, a 12% (-328,300 head) decline year on year. In January we forecasted Q1 kill to total 2.53 million head. Production for Q2 is forecasted to decline further with some industry commentators stating that the height of the shortage of pigs may likely be felt in May.

These tight supplies will likely keep prices supported for the foreseeable, with the EU also expecting further production declines this year. However, demand is also a crucial factor with the cost of living crisis impacting on consumer purchases. In the 12 weeks ending 19 March, sales volumes of pork in the retail market have fallen 3.5% year on year, while inflation driven price rises resulted in prices paid increasing 12.5% during the period. This is a little above our projected demand decline of 3%, however with the approaching BBQ season there is opportunity for pork volumes to grow. Most product categories saw volumes decline, driving the overall trend, but sausages, mince, burgers and grills, and pork ribs recorded growth in the 12-week period.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.