Pig prices at record high while slaughter numbers at record low

Thursday, 13 April 2023

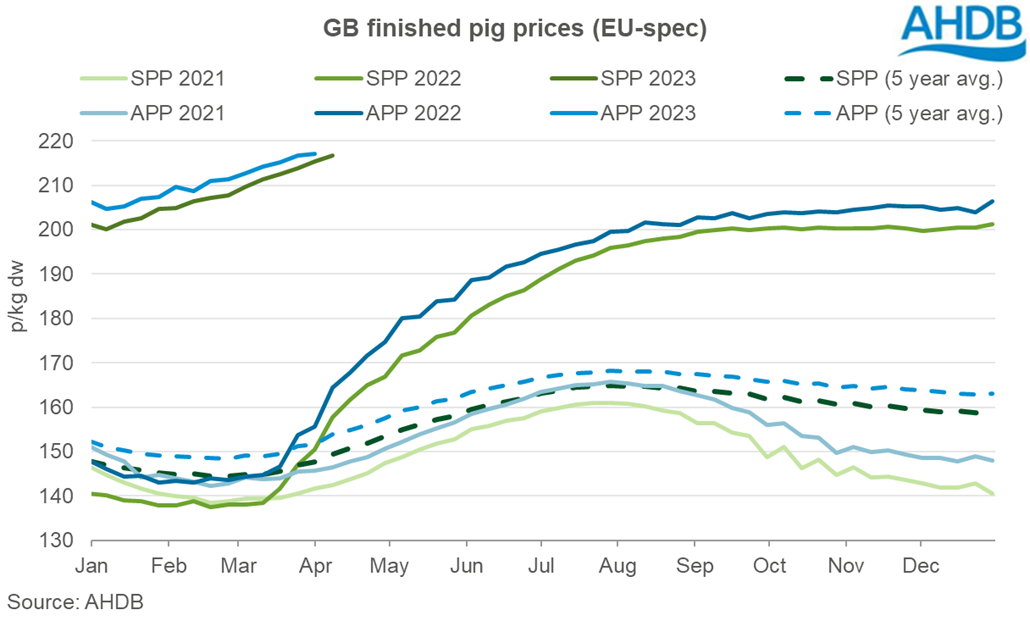

GB deadweight pig prices have continued climbing to new highs in March (w/e 04 Mar - 01 Apr) bringing the average price for the EU spec SPP to 213p/kg. Weekly increases between 1-2p have resulted in the EU spec SPP standing at 216.74p/kg for the week ending 08 Apr, an increase of over 16p/kg in the 14 weeks since the start of the year.

The EU spec APP averaged 215p/kg in March (we/ 04 Mar- 01 Apr). Like the SPP, the APP has also seen weekly increases, although a little more subdued, ranging between 0.5-1.5p, with the EU spec APP standing at 217.13p/kg in the final week of the month. This has meant the gap between the APP and SPP has been narrowing, now standing at only 1.6p.

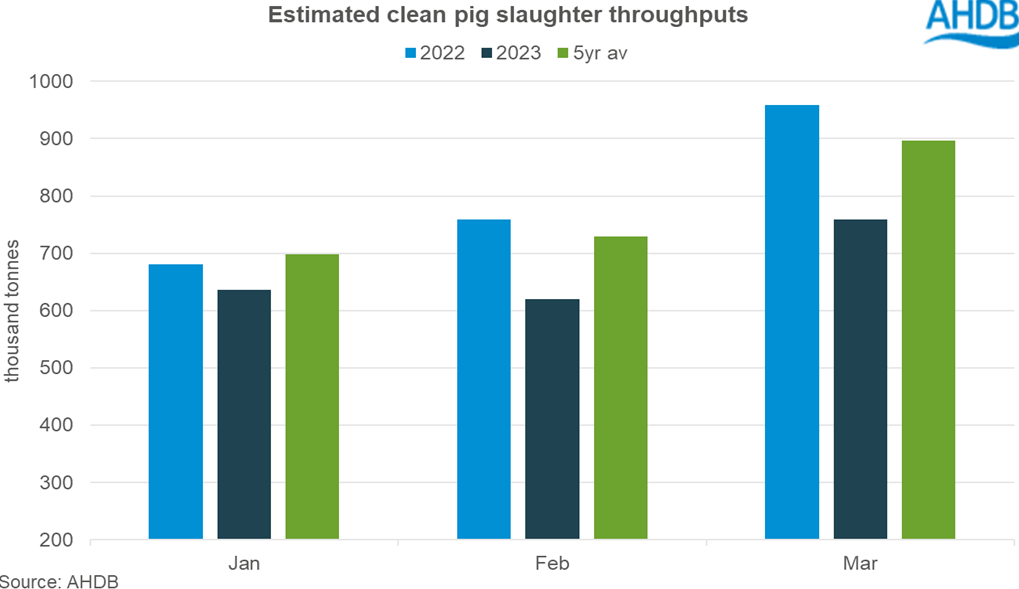

Estimated GB slaughter was the lowest total for the month of March since records began in 2014. For the 5 weeks (w/e 04 Mar – 01 Apr) numbers stood at 758,700 head. This is 200,000 head below the record high throughputs of March last year and nearly 140,000 head below the 5-year average. Estimated slaughter numbers for the year to date stand at 2.02 million head, a significant decline of 16% year on year and 13% compared to the 5-year average.

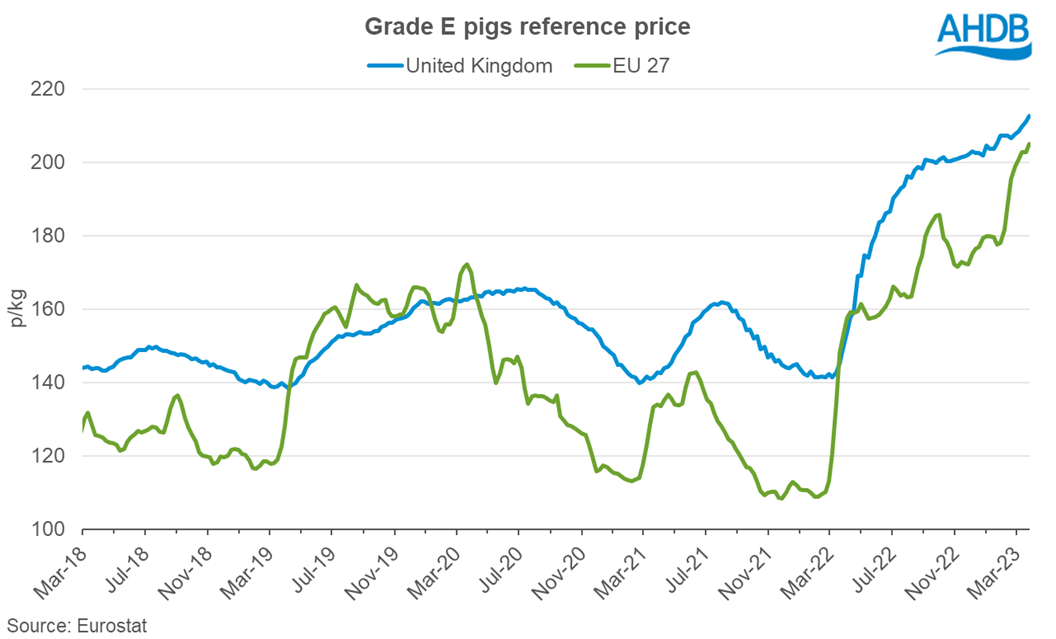

In Europe, markets are recording similar trends. The latest EU reference prices show that in the 4 weeks ending 26 Mar the EU-27 gained over 4p/kg to sit at 204.95p/kg. This is a substantial increase of over 25p since the beginning of the year. The difference between the EU and UK reference price is now just under 8p.

All key producing nations have recorded significant growth in pig prices compared to the start of 2023, with the exception of Denmark, where price declines in January are equal to the price increases recorded through February and March. France and Spain have seen the strongest growth, with price increases in the region of 40p/kg in the 12 weeks that have passed. The Netherlands, Germany and Belgium have recorded growth of almost 30p/kg while Poland is up 23p/kg.

The latest EU production data shows that in January a total of 19.74 million pigs were slaughtered, a year on year decline of almost 1 million head. 2022 saw the lowest slaughter throughputs in almost a decade in the EU with production forecast to decline a further 5% in 2023 which may keep prices supported if demand is steady.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.