UK pork outlook 2025: May production update

Tuesday, 20 May 2025

Key points:

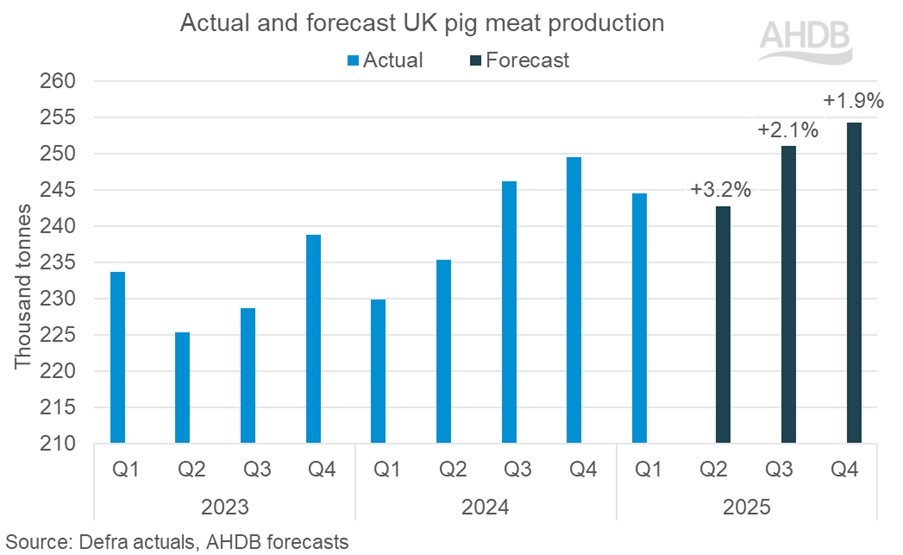

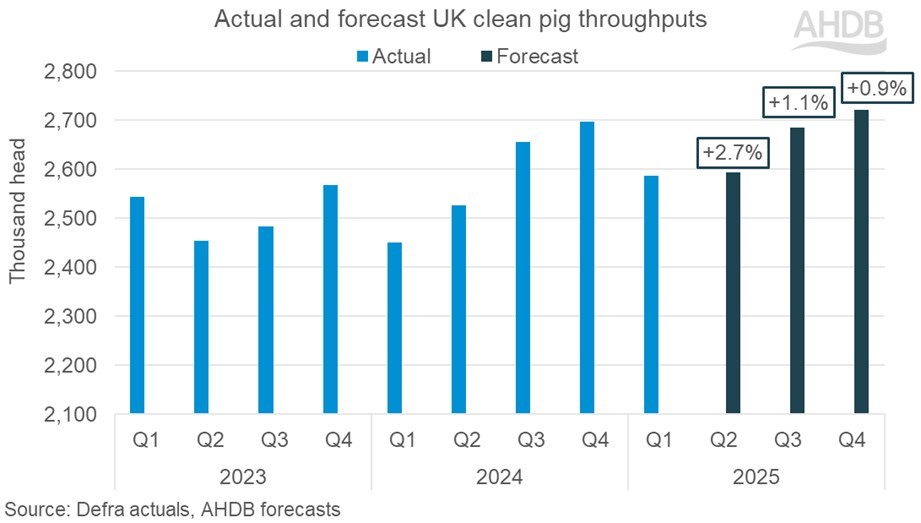

- UK pig meat production in 2025 is forecast to increase 3.3% year on year, driven by higher clean pig slaughter numbers and heavier carcase weights

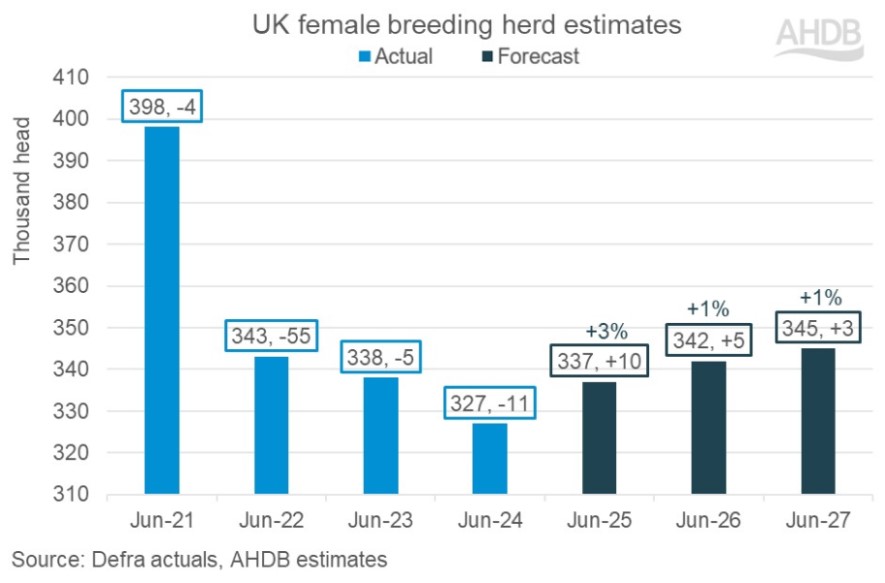

- The English female breeding herd grew 2.6% between June and December 2024, leading to a larger projected UK herd size of 337,000 head for June 2025

- Uncertainties around government policy may limit future growth

Overview

2025 has certainly been eventful so far. The first quarter saw pig meat production surpass our original expectations, foot and mouth disease was declared in Europe, and Donald Trump announced sweeping changes to US trade policy and import tariffs, to name a few key highlights.

Despite this turbulence on the global stage, the UK pig industry has held firm. GB pig prices saw some weakening at the very start of the year, continuing the trend seen in the latter part of 2024. But prices have since bounced back alongside positive demand, with the EU spec SPP sitting just over 205p/kg for the week ending 10 May.

Although estimated quarterly cost of production figures also held relatively steady through 2024 - resulting in some welcomed positive net margins and on-farm investments - there is likely to be pressure on these cost and margin bases in 2025. Government policy will result in key input costs increasing such as labour, and market uncertainty may lead to more volatile pig pricing.

Supply

Whilst April pig meat production data from Defra showed stability year on year (YoY) it should be noted that there were less working days due to how Easter fell in 2024 versus 2025. We anticipate that production trends seen in Q1 will continue through the rest of Q2. Overall, strong growth is expected for the whole of 2025, almost mirroring the overall trend recorded in 2024.

For the full year, we are forecasting pig meat production to increase 3.3% YoY, to around 990,000 tonnes. The strongest growth will be seen through the first half of the year, with Q1 already recording annual growth of 6.4% and Q2 forecast up 3.2%. While we forecast smaller YoY change (+2%) in Q3 and Q4, this period is annualising against very strong performance in 2024.

This increase in production will be driven by an anticipated 2.5% increase in clean pig kill, reaching near 10.6 million head. As with production, growth in clean pig kill is weighted to the first half of the year. Alongside this, a further 1kg gain to carcase weights is expected to carry through 2025, averaging at 91kg.

The change in clean pig numbers between our original forecast and this update has been heavily influenced by the England livestock survey data for December 2024 (the UK December survey stopped producing data for pigs in 2021). This data indicated that the female breeding herd in England grew by 2.6% between June and December 2024. Historically, the English pig population has made up over 75% of the UK total.

Carrying this assumption into our forecast has led to a larger projected herd size for June 2025, with the female breeding herd now forecast to stand around 337,000 head. We continue to forecast only a small change in annual numbers in the medium term, with the herd size in 2027 similar to 2022 records.

Longer term, numbers may stabilise as supply finds a balance with processing capacity. The number of pig abattoirs in England has fallen to 81, a loss of 13 premises in the last 5 years (2020-2024), including 4 specialist facilities. Industry sentiment has taken a knock over the last six months following the autumn budget, poor government communications and concerns over new trade deals. This has led us to believe that further on-farm investment may ease as businesses become cautious of larger tax burdens, and the uncertainly of potentially new welfare and environmental policy.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.