Pork market update: domestic round up

Wednesday, 3 January 2024

Key points

- GB pig prices continue to fall but with a steady decline

- Production grew for November to 85,200 tonnes but remains below last year

- More pigs came forward ahead of Christmas, bringing slaughter to 910,500 head

- Imports grew for October, as EU product remains competitive due to lower prices

- Exports have fallen compared to last year, as our export capacity has been limited

Prices

GB pig prices continue to fall week-on-week, but this decline is steady. The SPP (EU spec) for the week ending 16 December sat at 214.65p/kg, down by 0.40p from the previous week. This is 14.5p above the price at the beginning of the year but represents a 11p drop from the highs in August. The APP (EU spec) is also falling steadily, sitting at 215.5p/kg for the week ending 9 December. However, this is 1.51p growth from the previous week but follows the overall trend of declining prices since the end of September.

The UK tracks closely with the EU prices which have seen similar declines, but with steeper falls. The EU reference price for the week ending 17 December sat at 181.86p/kg, with a drop of 0.63p from the previous week.

Production

Pig meat production remains below levels seen last year, with November production sat at 85,200 tonnes. Although this is a slight elevation of 2,500 tonnes (3%) from the previous month, driven by increased slaughter, it is a fall of 3,200 tonnes (3.6%) from November 2022 . Increased production may be a result of more shoppers choosing to eat gammon over Christmas.

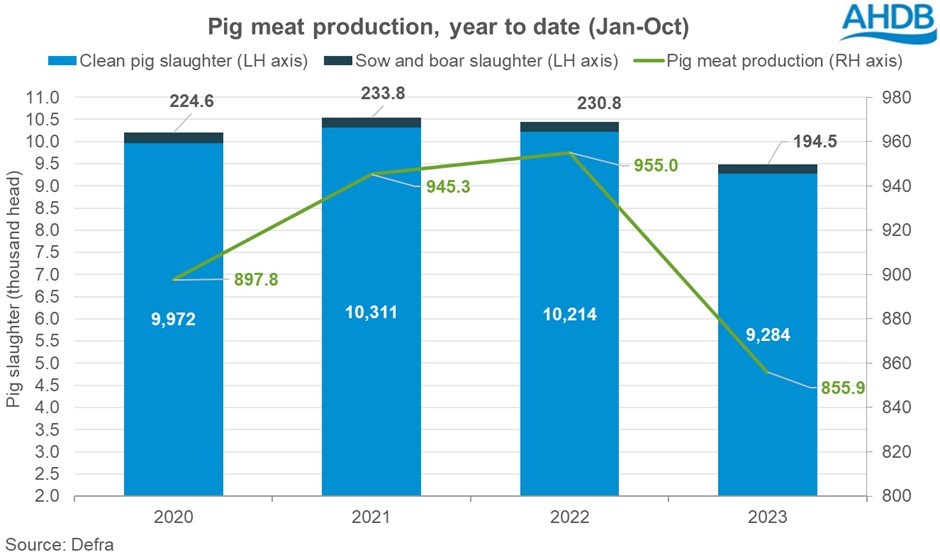

Clean pig slaughter numbers have grown to 910,500 head in November, an increase of 2.6% from October with reports of pigs being brought forward ahead of Christmas. However, numbers are down 45,900 head (4.8%) from the same time last year and 36,100 head (3.8%) behind the five-year average, as the population of fattening pigs continues to decline. Clean pig slaughter year to date (Jan – Nov) sits at 9.28m head, a drop of 9% (930,000 head) from the same period in 2022.

Pig meat production, year to date (Jan-Oct)

Source: Defra

Trade

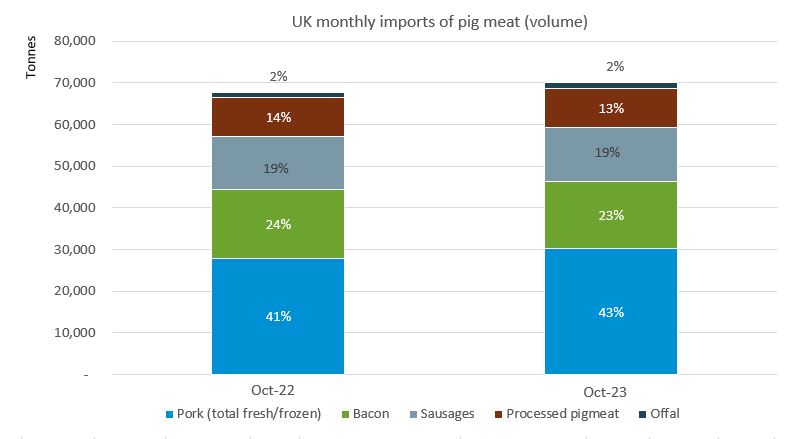

Pig meat imports for October sat at just above 70,000 tonnes, as increases came from imports of bacon, sausages, and fresh/frozen pork. Total fresh/frozen pork imports grew by 1,865 tonnes, as bacon imports grew by nearly 1,200 tonnes, and sausages were up 1,100 tonnes from the previous month. Imports from the EU continue to be competitive as prices remain lower. On the year, volumes grew in all categories except bacon which saw a 255 tonne decline, fresh/frozen pork saw an increase of 2,180 tonnes as our domestic production has declined and imports are needed to keep up with demand.

UK monthly imports of pig meat (Volume)

Source: HMRC via Trade Data Monitor LLC

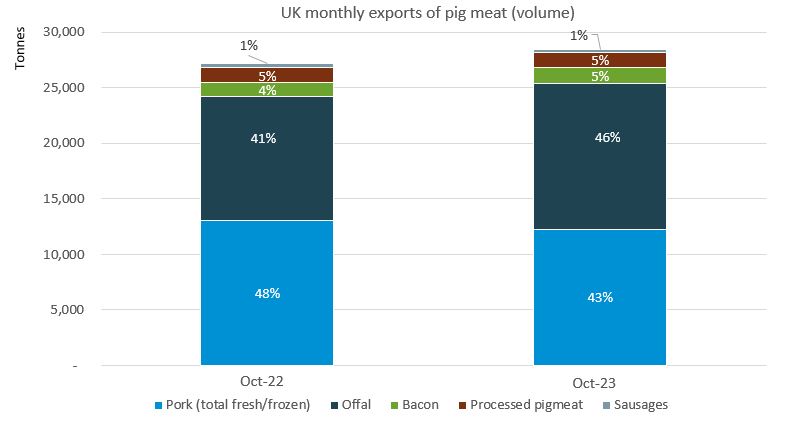

On the exports side, as our domestic production has fallen year on year, our export capacity has been limited. Exports totalled 27,140 tonnes for October. This is a fall of 1,320 tonnes from 2022, with a near 1,900 tonne fall in offal exports. The fall in export volumes from last October mainly came from China, as volumes fell by 590 tonnes. Volumes also fell in key EU trading partners such as Germany, France and Belgium as demand has been easing on the continent. However, export volumes increased from September, up almost 3,500 tonnes (15%), as volumes grew to China by over 2,000 tonnes.

UK monthly exports of pig meat (Volume)

Source: HMRC via Trade Data Monitor LLC

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.