Opposing price trends for prime cattle and cull cows

Thursday, 3 November 2022

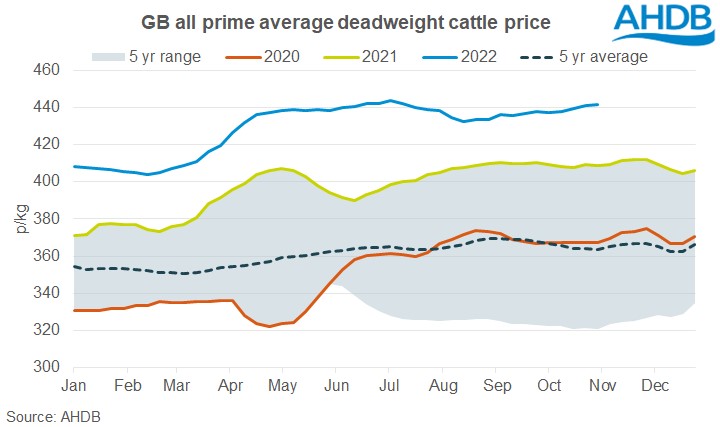

GB deadweight cattle prices continued the steady upward trend seen through September, following an easing of prices during July and August. In the 4 weeks ending 29 October, the all-prime cattle price averaged 440.2p/kg, up 3.3p (0.7%) on the previous 4-week period.

Prices rose each week, peaking at 441.7p/kg in the week of 29 October. This was almost 33p above the same week last year, and more than 78p above the five-year average for the week. Within the all-prime cattle average, young bulls saw a softening of price, averaging 426.4p/kg for the period, back 0.8p on the previous four weeks. However, prices for heifers and steers strengthened, up 3.2p (0.7%) and 3.5p (0.8%) respectively from the previous four-week average. This put the average price for the period to 439.4p/kg for heifers and 442.3p/kg for steers, regaining some of the ground lost during July and August.

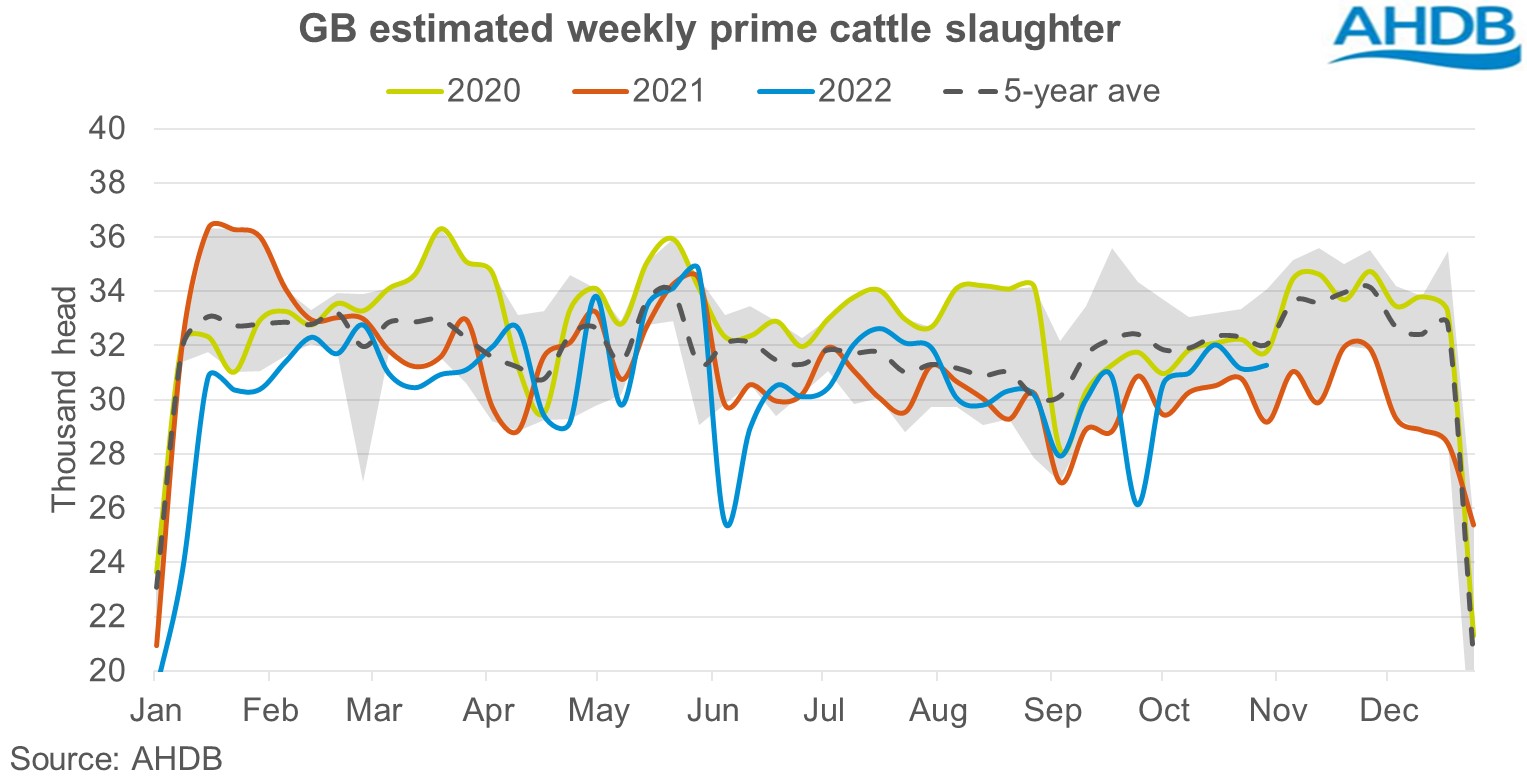

Estimated GB prime cattle kill rose in the 4 weeks ending 29 October to a total of 125,400 head, 3.8% (4,600 head) above the same period last year. Whilst higher than last year, throughputs are below the 5-year average, a trend that has been present since the beginning of August. Throughputs were relatively stable week on week through the period. The week ending 15 October recorded the highest slaughtering at 32,000 head, while the remaining three weeks saw around 31,000 head processed per week.

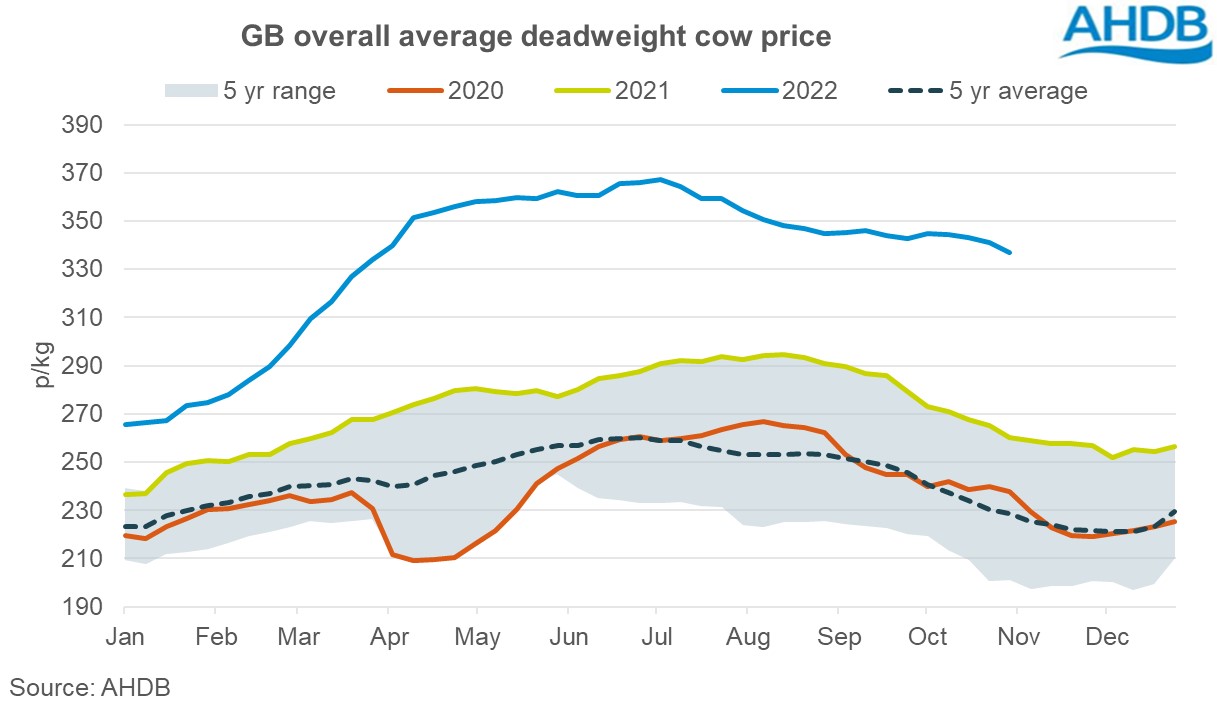

Cull cow prices, whilst still well above the 5-year average, have continued the steady decline first seen in July. In the 4 weeks ending 29 October, overall cull cow prices averaged 341.4p/kg, back 3p (0.9%) on the average from the previous 4 weeks. With prices easing each week, the price in the final week was back 7.4p (2.1%) from where it started the period.

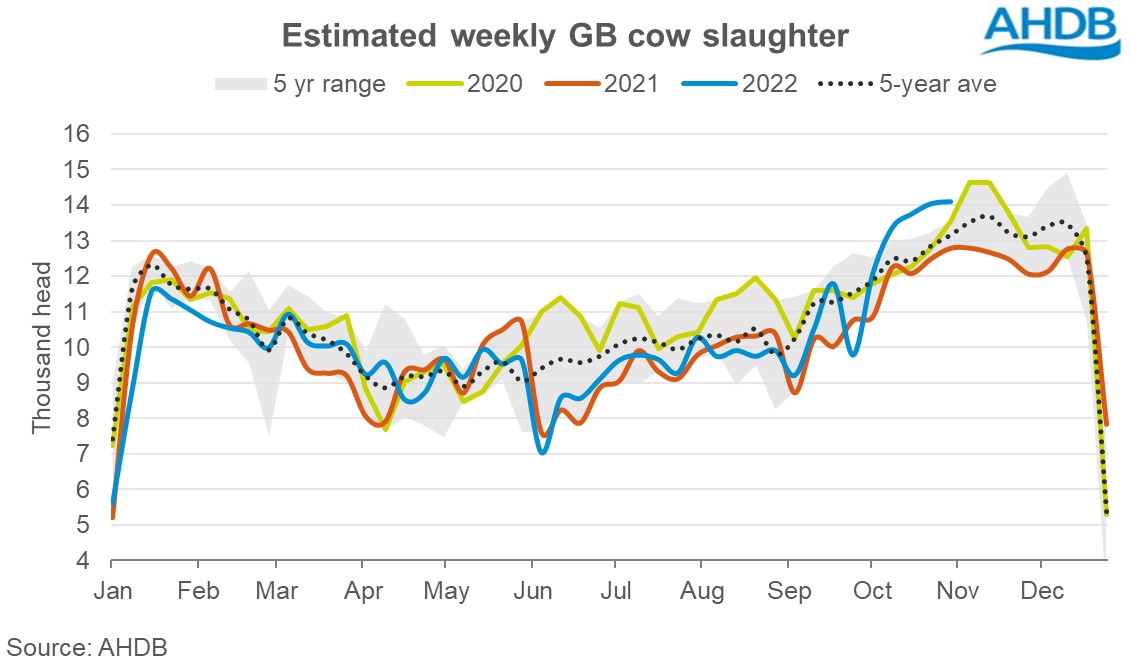

Cull cow slaughter was estimated to total 55,300 head for the 4-week period ending 29 October, up 5,600 head (11.3%) on the same period last year. Throughputs increased week on week, peaking at 14,100 head in the fourth week, the highest level seen so far this year. Year to date, throughput is estimated to total 445,400 head, 5,200 head (1.2%) up on last year, although remaining 13,200 head (2.9%) below the 5-year average.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.