November 2023 dairy market review

Thursday, 14 December 2023

Milk production

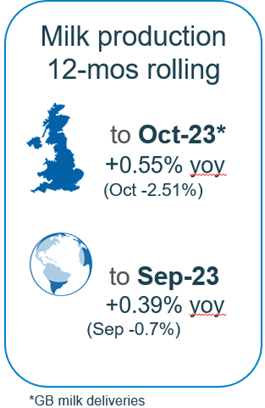

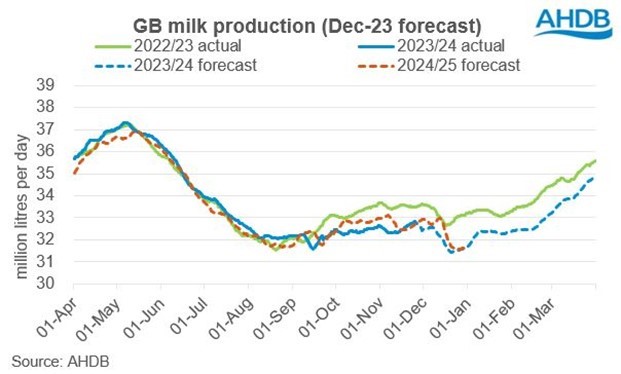

GB milk deliveries continued their downwards trajectory in November with estimated volumes for the month down by 2.8% year-on-year, or the equivalent of 29m litres. Production for the milk season to date is 8, 254 million litres, down by a modest 38m litres compared to last year. Very wet weather in the Autumn has meant that many cattle had to be housed early, further exposing farmers to market increases in inputs such as straw.

In our revised forecast GB milk production for the 2023/24 season is expected to reach 12.22 billion litres which is a reduction of 1.3%. this represents a more pessimistic outlook about the speed of decline than we estimated previously. This is due to the acceleration of production declines seen this Autumn.

Changes are being driven by yield reduction due to continuing high input costs and low prices, rather than a loss in cattle numbers. Latest analysis of BCMS data showed that over the previous year as a whole (the 12 months ending September 2023) dairy calf registrations were flat on the previous 12 month period, indicating a fairly stable herd size. Regardless of this we did see some fluctuation in calf registrations over the year, with fewer registrations seen in Q3 (down by 0.9%) compared to last year. The gap between registrations in Q2 and Q3 is growing showing that more farms are moving towards block calving systems.

Agricultural inflation levels have eased a lot since earlier in the year but many input costs remain at high levels and the continued declines in milk prices are impacting on farmers decision making with little appetite to push yields. Farmgate milk prices reported by Defra have stabilised for August, settling at 37.0ppl, which is significantly lower than last year. It is important to note that prices are not uniform across the country and farmers in N.I. in particular have been feeling the pinch.

Pressures on margins have been difficult to cope with for many farmers and our latest survey of GB producers showed there has been a significant loss in farms over the past year. Year-on-year, we have lost 420 producers, down to 7,500 dairy farms. The bulk of farm losses came earlier in the year, losing 350 producers with a further 70 going between April and October this year.

Global milk production in September fell into slight decline of -0.7% year on year. This still meant that the 12-month picture was up by 0.39% year-on-year but signals that as prices cool globally, the production tap is beginning to be turned down.

Wholesale markets

Overall price movements on UK wholesale markets made some substantial moves upwards in November. All product categories recorded positive movements, although SMP was more subdued. An uptick in demand ahead of the festive period is reported to be supporting markets, alongside falling milk supply. In November, butter rose by £510/t, cream prices improved by £186/t, SMP rose by £60/t, butter up by £30/t with mild cheddar up by £110/t.

Early in the month the GDT saw and end to the run of positive uplifts with a modest 0.7% decline. Since then we have seen a flat auction and a return to 1.5% growth in the latest period, with cheddar cheese in particular seeing some sharp uplifts (9.7%). The trajectory indicates some positivity but the direction of travel could, as yet, see some bumps in the road.

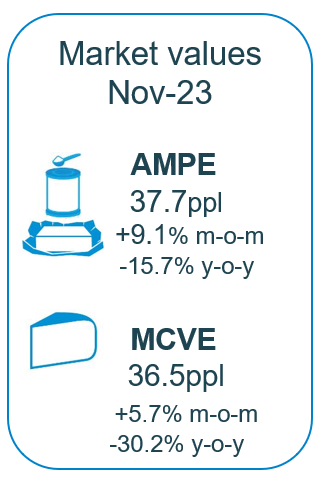

As of November, milk market values (which is a general estimate on market returns and the current market value of milk based on UK wholesale price movements) are moving in a more positive direction. AMPE rose by 9.1%, to 37.7pplMCVE rose by 5.7% to 36.5ppl. Both indicators in the UK remain much lower than a year earlier, with AMPE and MCVE down by 16% and 30% respectively.

Farmgate milk prices

The latest published farmgate price was for October with a UK average of 37.0ppl. Latest announced farmgate prices have been fairly steady for December with the exception of retailer aligned liquid milk contracts which have continued to fall (apart from Tesco and M&S which held). All non-aligned liquid contracts held, with most manufacturing contracts following suit. Arla UK made the only price increase of the month, up 0.89ppl.

Demand

Domestic demand may be beginning to creep back, in spite of continued inflation. Latest Nielsen figures indicate volume growth in butter (-1.0%), cheese (1.8%) and milk (0.2%), yogurt (5.2%), cream (0.7%). More data is available on the retail dairy dashboards. (source: Nielsen Homescan, 12 we 4 Nov 23).

Export volumes of dairy products from the UK have increased in the third quarter of 2023 year-on-year by 4%. Total export volume for Q2 2023 was 336,000 t, an increase of 22,300 t from Q2 2022.

This was driven by a stable level of exports to the EU, our biggest trading partner by far, up by only 1% year on year. This figure belies a fair bit of switching with the Netherlands and Germany buying a lot less and Poland and Italy buying more.

Some of the biggest wins in the latest quarter have been to Africa and the Middle East – exports to Egypt up by 1,438t, Libya 1,543, Nigeria 1,431t, Morocco 689t, Bahrain 725t, UAE 623t. It was not all positive with 1,588 less tonnes headed for Algeria.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.