Dairy exports: better Q3 but flat year to date

Thursday, 23 November 2023

With falling domestic commodity prices and a challenging retail environment, export has become an even more important channel for UK dairy producers. The government committed in May to a new £1 million programme of support to aid British dairy exporters. Ahead of this support coming online, how have UK exports fared in the year to date?

Quarter 3

Q3 2023 exports are marginally up on a year ago, by 4%. This was driven by a stable level of exports to the EU, our biggest trading partner by far, up by only 1% year on year. This figure belies a fair bit of switching with the Netherlands and Germany buying a lot less and Poland and Italy buying more

Some of the biggest wins in the latest quarter have been to Africa and the Middle East – exports to Egypt up by 1,438t, Libya 1,543, Nigeria 1,431t, Morocco 689t, Bahrain 725t, UAE 623t. It was not all positive with 1,588 less tonnes headed for Algeria.

Year to date

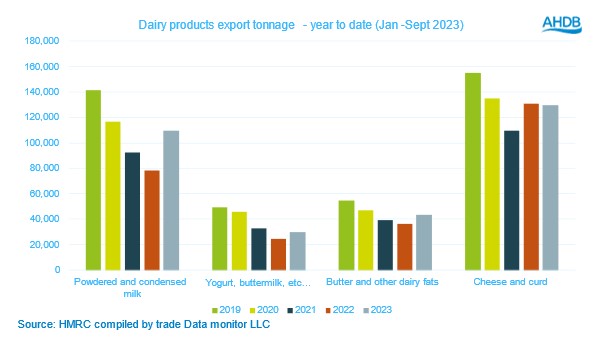

A similar picture year to date with exports being fairly flat, up by only 1%. The EU overall down by -1%. Exports to China have continued to dwindle but losing only 380t this year (-6%) compared to much deeper losses the preceding year. Chinese demand is hugely influential in driving world trade, and securing a decent-sized UK slice of the Chinese pie is important and should be on ongoing focus.

In addition to the markets mentioned above, there have been some big wins in 2023 year to date to markets such as Bangladesh (up 5,278t), Peru (up 1,962t), and more surprisingly, New Zealand up by 824t.

Focus on cheese and curd

Most of the more emerging markets have focussed their imports of UK product on powders, which tend to be a less profitable commodity overall. It is the more added value dairy products such as cheese, which have particularly been in need of the export channel to support domestic prices in recent months.

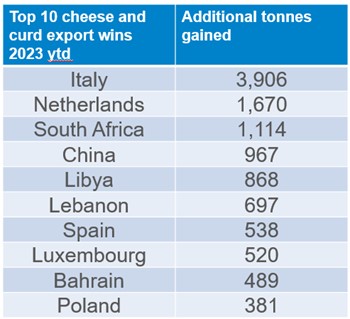

Cheese overall has been fairly steady, with exports down by -0.9% in the year-to-date versus the same period in 2022. Exports to the EU27 have dwindled a little, and although we are not at the immediate post-Brexit lows of 2021 cheese exports to the EU lost a further -4.8% on last year. Key losses were Ireland, France, Belgium (typically our biggest three destinations for British cheese), and Germany, and which some good wins in Italy (up 3,906t),the Netherlands (up 1,670t) and Luxembourg (up 520t) could not make up for.

Globally, the biggest increases in tonnage have come from South Africa (up 1,114t), China (up 967t after a poor year last year), Libya (up 868t) and Lebanon (up 697t).

These latest figures indicate that in order to meet the stated goal of increasing British dairy exports, further investment and focus in this area is needed and much welcomed.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.