Latest BCMS data indicates short term cattle supply pipeline

Friday, 20 September 2024

The latest BCMS data gives us a view of the number of cattle on holdings in GB. By breaking this down by age and type, we are able to examine trends and look forward at future cattle supply.

Key points:

- As at 1 July 2024, the number of cattle on holdings in GB stood at 7.79 million head, down 1.8% year on year.

- The number of cattle for beef production aged under 18 months was down year on year, driven by a reduction in the breeding herd.

- Lower numbers of cattle for beef production points to tightness in GB cattle supplies in Q4 of 2024 and lower slaughter numbers into 2025.

- Dairy beef calves were the only group that saw growth in registrations, however that growth does appear to be slowing.

As of 1 July 2024, the number of cattle on holdings in GB stood at 7.79 million head. This is down 1.8% (384,000 head) from the same point of 2023.

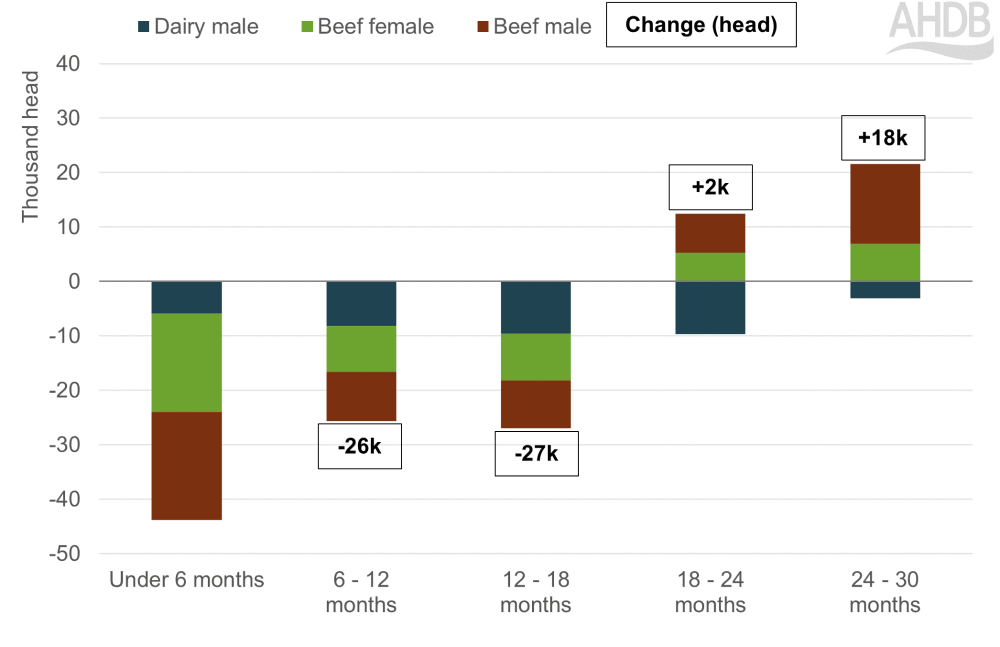

We can use this data as an indicator of short-term beef supply, by looking at animals available for beef production. This includes all dairy males and non-dairy animals under thirty months of age, which totalled 3.9 million head as of 1 July 2024, down 1.9% on last year.

GB cattle for beef (dairy M + beef M + beef F) population by age

Source: BCMS, AHDB calculations

Analysis by age group

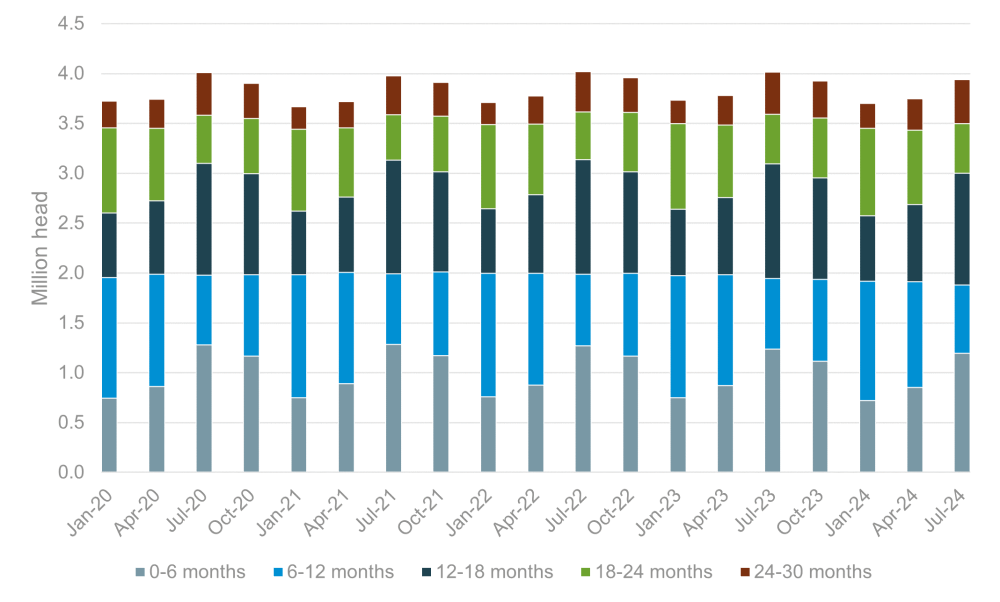

Significant year on year declines were recorded in the number animals for beef aged under 6 months, driven by declines in beef males and females of 20,000 and 18,000 head respectively. We also saw a lower number of animals for beef aged 6-12 months, down 26,000 head compared to last year.

This reduction in calf numbers can be linked to declines in the suckler breeding herd, as was reflected in the June population figures. We have seen a long term trend of decline in the suckler breeding herd, with factors such as robust beef prices, the reduction of farm support payments and challenging weather conditions all contributing to this decline. With a smaller breeding herd, it follows that we will see fewer calvings, and therefore a reduced beef pipeline, as demonstrated by these figures.

Looking the 12-18 months age group, cattle for beef were down 27,000 head compared to the same point of last year. This reduction means that we might expect some tightness in supply later in 2024 and into 2025, as these cattle come forward. AHDB’s beef outlook gives greater detail on prime cattle slaughter forecasts for the coming year.

On the flipside, there was year on year growth in the number of cattle for beef production in age categories 18-24 months and 24-30 months. This growth was driven by beef animals, which outweighed the declines in dairy males across both age groups. This increased number of older animals, versus the same point last year could point to increased finishing times, with cattle being kept on farm longer.

Change in GB cattle population by age and type, 1 July 2024 vs 1 July 2023

Source: BCMS, AHDB calculations

Registrations

BCMS registrations for the first half of 2024 have shown year on year declines across both dairy and beef, with total registrations down 49,000 head on the same period of 2023. The majority of this decline can be attributed to the suckler herd, with 45,000 head fewer calves registered to suckler dams in H1 2024 versus 2023, continuing the long-term trend of decline in the suckler herd and suggesting that this reduction in beef numbers will continue.

Dairy beef calves were the only group that saw growth in registrations, however that growth does appear to be slowing. Registrations grew by 7,700 head for the first six months of 2024 versus the same period of 2023. For comparison, in 2023 we saw year on year growth of 24,500 head of dairy beef calves in the same period. Could this suggest we are nearing the peak of dairy beef production? However, recent data showed that for the 12 months to April 2024 sales of beef semen made up 52% of all semen sold to dairy farms, the highest proportion recorded. This indicates there may be further growth yet and registrations data over the next year will be a good indicator of the direction of travel.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.