Lamb prices ease but remain historically firm

Friday, 4 August 2023

Spring lamb prices continue their seasonal declines as lamb supplies grow but are holding up historically. We examine the key market drivers behind prices now and going forward.

Key market trends

- Supplies of lamb have uplifted through June.

- Domestic demand remains pressured by the cost-of-living.

- Exports to the continent have fallen from March peak.

- Imports grew from New Zealand in May but remain below 2022.

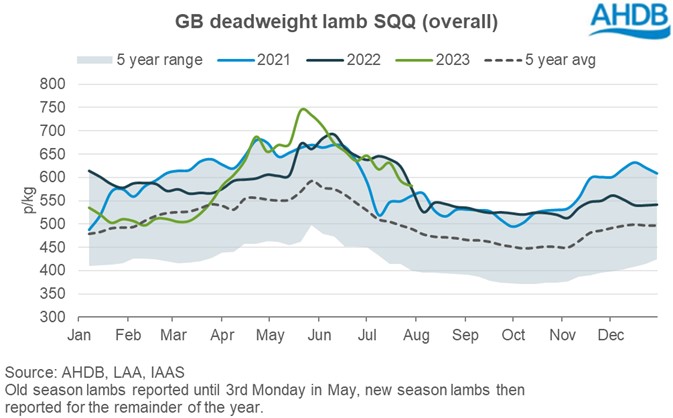

The GB deadweight new season lamb (NSL) SQQ averaged 651p/kg for the month of June, a fall of 55p from May and almost 9p on the year, as it ended the month (1 July) at 646p/kg. The equivalent liveweight measure averaged 307/kg for the month of June, as it ended the month (1 July) at 292p/kg. This represented a drop of 19p from May and almost 5p on the year.

Spring lamb slaughter rebounded in June, following several months of lower kill compared to a year ago. The latest Defra statistics showed 1.06m lambs slaughtered in June. This was an increase of 140,000 head from May, and up 184,000 head (21%) from June 2022. Slaughter levels were also up 157,000 head on the 5-year average for June. NSLs had been slower to come to market through April and May, likely reflecting the impact of last year’s challenging feed and forage conditions on ewes, combined with a wet/cold spring.

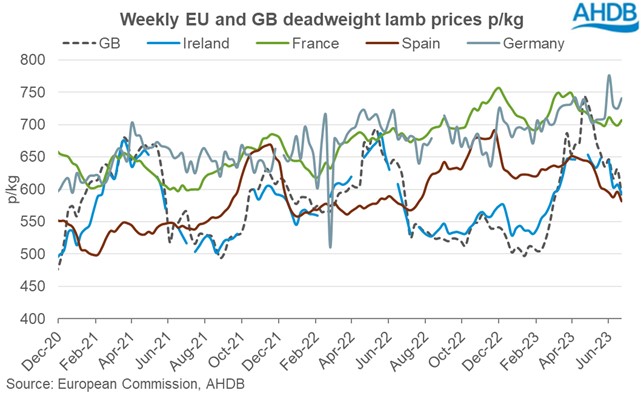

In terms of trade, exports for May totalled 5,550 tonnes (fresh and frozen sheep meat). Exports were down 1,620 tonnes from April but remained largely stable year-on-year. Exports to the EU have been relatively strong through the first four months of the year, supported by competitive GB pricing and lower production on the continent. However, GB prices rallied through the spring and by May were closer to equivalent prices in France, potentially reflecting changes in trade volumes at the time. GB prices have since eased back, as have prices in Ireland and Spain. Meanwhile, Southern Hemisphere product continues to be very competitive, partly due to a combination of higher Australian production and subdued export demand.

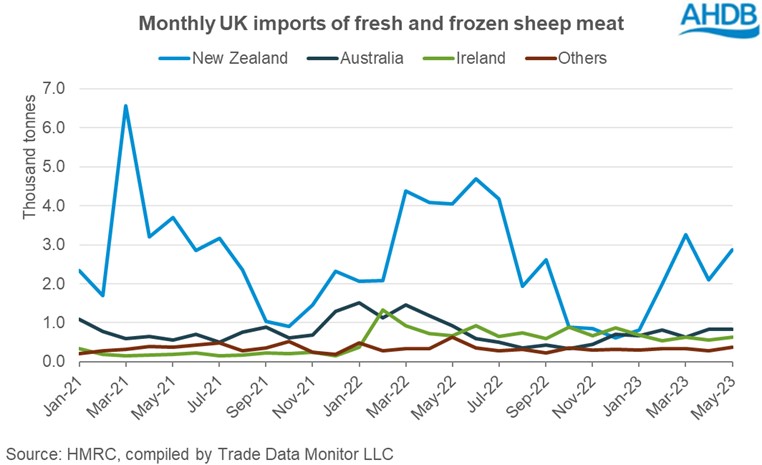

UK sheep meat imports increased in May from the previous month to 4,700 tonnes (mostly driven by New Zealand), but this was still down notably from last year, as has been the case since January. Demand is lower in the domestic market compared to a year ago, as consumers wallets are squeezed from the increased cost-of-living.

Looking further afield, China continues to play a key role in the global sheep meat market, with Australia and New Zealand making up 93% of China’s sheep meat imports in May. Exports from Australia have grown to China, up 2,200t from April to May, and up 6,600t from May 22, as they continue to increase their production. Increased supplies have been weighing on domestic prices, making Australian exports more competitive. Whilst exports from New Zealand to China have grown slightly (555t) from April to May, there has been growth of over 8,200t from May 2022.

However, there are uncertainties over the sustainability of Chinese sheep meat demand. Reports suggest that fragile economic conditions in China are not incentivising consumption growth, but recent announcements of government support for businesses may improve consumer confidence.

What’s the outlook for GB sheep prices?

As our latest outlook shows, production is expected to grow throughout the remainder of 2023, as GB lamb kill is forecast higher on-the-year through the second half. Domestic lamb consumption is expected to remain lower than 2022, as consumers face the cost-of-living crises. By themselves, this could point to potential downward pressure on prices. However, tighter supply forecast in the EU and favourable pricing is expected to support trade with the continent, while EU demand is expected to stay firm thanks to lambs cultural and religious significance. This could soften potential price declines vs 2022.

A key watch point for lamb prices more widely comes from the Southern Hemisphere, as Australian and New Zealand product remains more competitive on the international stage, amid greater Australian supply. Any significant weakness in demand from China could lead to more Oceania product looking for a home elsewhere on the global market.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.