How much red meat is traded by Ukraine and Russia?

Tuesday, 1 March 2022

Neither Russia or Ukraine trade red meat directly with the UK, but they do have mutual trade partners for beef and pork. Any impacts from the conflict are therefore likely to be indirect and probably only minimal. Let’s look at the trade figures in more detail.

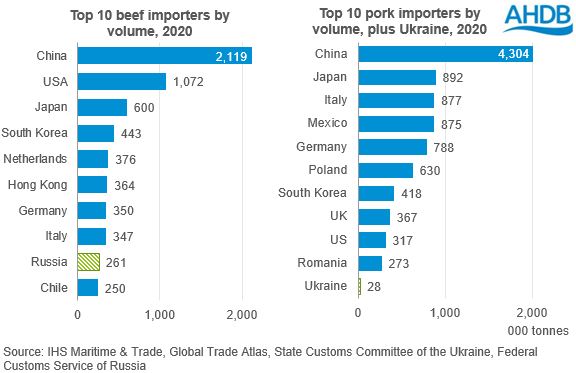

While Russia is a large producer of red meat, its trade volumes are moderate in comparison to other nations. Russia mostly imports beef and exports pork, with virtually no trade done with European countries.

According to trade figures from IHS Maritime & Trade, in 2021 Russia imported 214,000 tonnes (product weight) of beef, mostly from Belarus, Paraguay and Brazil. For context, this is slightly less than the quantity imported by the UK (241,300 tonnes in 2021). Russia also imports a significant amount of beef offal (72,000 tonnes in 2021), again mostly from South America.

Russia’s pork has historically been exported mostly to Ukraine and Belarus, but more recently, Vietnam has become a major market for Russian pork. Smaller quantities are sent to other Asian countries. In 2021, Russia exported 129,200 tonnes of fresh and frozen pork. For context, the UK imported 320,100 tonnes in 2021.

Ukraine also mostly trades in beef and pork, but in relatively small volumes in comparison to Russia. In 2021, Ukraine imported 40,600 tonnes of pork, which mostly came from the EU (Denmark, Poland, and the Netherlands made up over 80% of total imports).

Beef is mainly exported from Ukraine, with 27,200 tonnes shipped in 2021. Historically this has been sent largely to Belarus, however in recent years China has taken the top spot. Other Asian countries including Kazakhstan and Uzbekistan also receive Ukrainian beef.

So what does this mean in the current context?

It is nigh on impossible to say what impact the rapidly changing situation between Russia and Ukraine could have on domestic red meat markets going forward. Any impacts are likely to be indirect, as the UK does not trade directly with Ukraine or Russia, but does trade with the EU and South America.

If beef exports to Russia from South America are disrupted, this could increase supplies of price-competitive beef looking for a home. The EU is not a major importer of beef, although over 50% of the quantity it does import comes from South America. However, these imports are subject to quotas and tariffs which will limit extra volumes.

If Ukrainian pork imports are disrupted, this product would then need to find a new home. However, the volume in question is only about 1% of total EU pork exports, and so would be unlikely to have much of an impact.

Another pertinent concern for beef and lamb producers will be any repercussions on the cost of inputs, including feed, fertiliser and fuel. Head to the Cereals & Oilseeds market page for more analysis and insight on this.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.