GB pig prices: easing amidst higher production and weaker demand

Thursday, 21 September 2023

Key trends

- GB pig price has recorded four consecutive weeks of decline

- August monthly production and kill figures are the highest so far this year

- Demand remains negative year-on-year, with retail purchase volumes down 2.7%

- Monthly import volumes in growth year-on-year, but year-to-date volumes remain behind 2022

Market overview

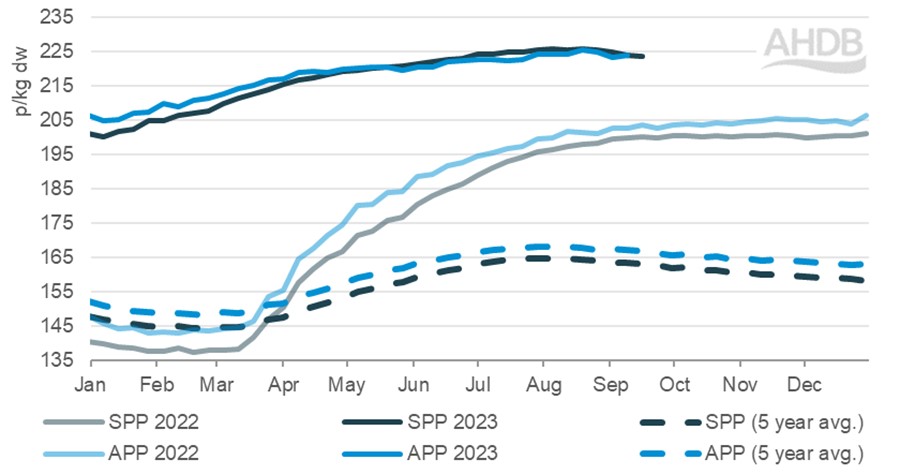

GB pig prices have been under pressure in recent weeks with the EU spec SPP losing 1.91p over the last four weeks to now stand at 223.74p/kg (w/e 16 September). Although this is historically quite a small change, it is the first consistent set of negative movements we have seen this year with the SPP previously having moved from strength to strength, peaking at 225.65p/kg for the week ending 19 August.

The EU spec APP has also recorded a decline in recent weeks, losing 1.60p in the two weeks ending 26 August and 2 September, but regained 0.91p in the most recent weeks data (w/e 9 September) to stand at 224.04p/kg.

GB finished pig prices (EU spec)

Source: AHDB

Some of the pressure behind these price declines is likely driven by falling pig prices in the EU marketplace. The EU average reference price has recorded downwards movements for seven consecutive weeks since peaking at 215.46p/kg for the week ending 23 July. Not only has the decline in the EU been present for longer than seen in the UK, the price change has been significantly larger, falling by nearly 20p over the period, an average of almost 3p/kg a week. Demand appears to be the key driver of this market change.

However, the principles of supply and demand closer to home are not to be dismissed as production gains and lower demand will have also played an important part in the shift of the domestic marketplace. Defra figures show that the UK produced 80,800 t of pig meat in August, the highest monthly volume seen in 2023 so far, with 876,300 head of clean pigs slaughtered, the largest monthly kill since December, when peak Christmas demand was in play. This higher throughput will have reduced pressure on some parts of the supply chain by increasing product availability.

Meanwhile, demand remains in a challenging position year-on-year as consumers continue to be price conscious. In our latest retail data release, in the 12 weeks ending 6 August, purchased volumes of pork were down 2.7% with volume losses in the more expensive products such as steaks, roasting joints and sliced cooked meats outweighing growth seen in more affordable products such as ribs, sausages and mince.

Trade Update

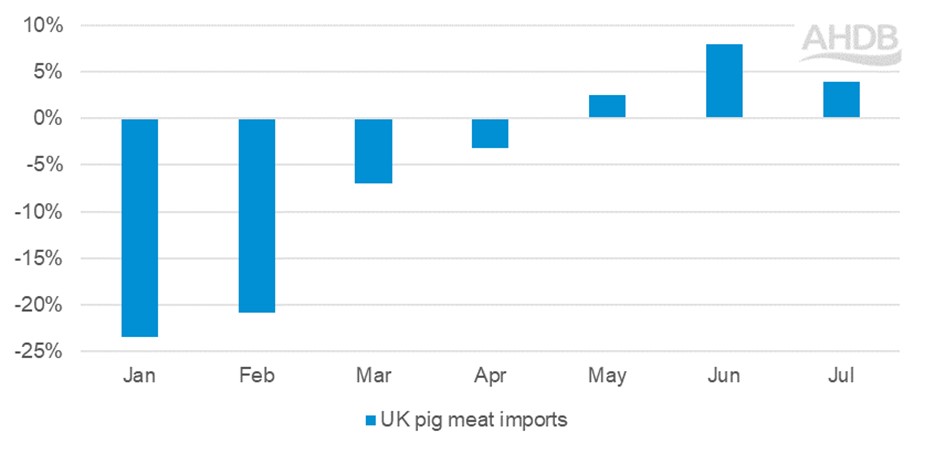

Although year-to-date (January–July) pig meat imports are down 6.6% compared with last year, July was the third consecutive month to see UK imports increase year-on-year. It is worth noting that due to domestic consumer preference in cuts, the UK will always see reasonable volumes of imported product to balance supply and demand.

A total of 65,300 t of pig meat was imported into the UK in July, a month-on-month decline of nearly 3,000 t but an increase of 2,500 t compared with July 2022. The growth is driven by volume increases in the fresh and frozen and sausages categories. This added volume of product indicates that consumer demand remains, despite lower retail volume purchases, with some of this product likely destined for foodservice, where pork volumes have been in year-on-year growth.

However, it does make an interesting watchpoint with the current market dynamics. With EU prices establishing a more typical discount to the UK, product from the continent could appear more attractive to buyers, especially in the current cost-conscious climate that both businesses and consumers are in. This could add some pressure to UK pig prices in a bid to maintain competitiveness.

Year on year change in UK pig meat import volume

Source: HMRC, compiled by Trade Data Monitor LLC

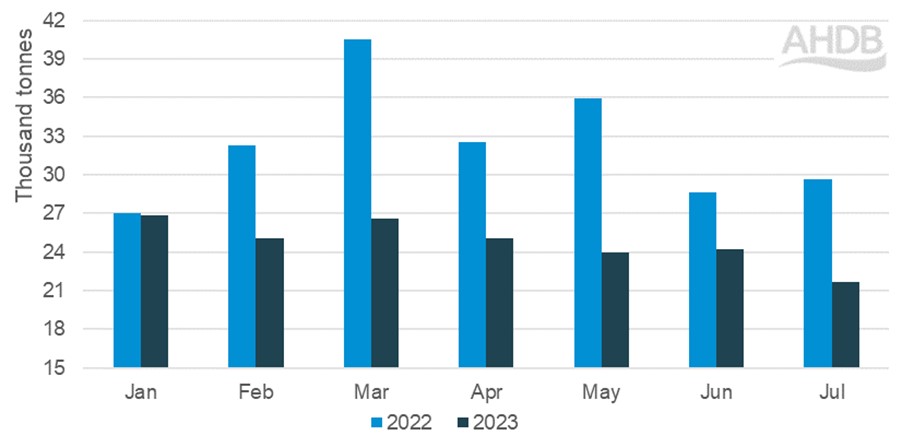

As expected, due to lower production, exports continue to sit well below the volumes seen last year.

In July, the UK exported a total of 21,700 t of pig meat, a month-on-month decline of 2,500 t and a year-on-year decline of almost 8,000 t. Sausages were the only category to record growth with the largest declines seen in the fresh and frozen and offal categories.

As UK pig prices remain historically high, product is less competitive on the global market for importers, who continue to look for the most affordable cuts at the lowest prices. If UK pig meat production volumes grow, this will likely result in pressure being applied to pig prices as the domestic market adjusts.

Monthly UK pig meat export volume

Source: HMRC, compiled by Trade Data Monitor LLC

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.