EU short term outlook predicts red meat production declines

Friday, 8 August 2025

The European Commission has recently released its summer 2025 short-term outlook. This article looks at the key stats and forecasts for the beef, lamb and pork sectors.

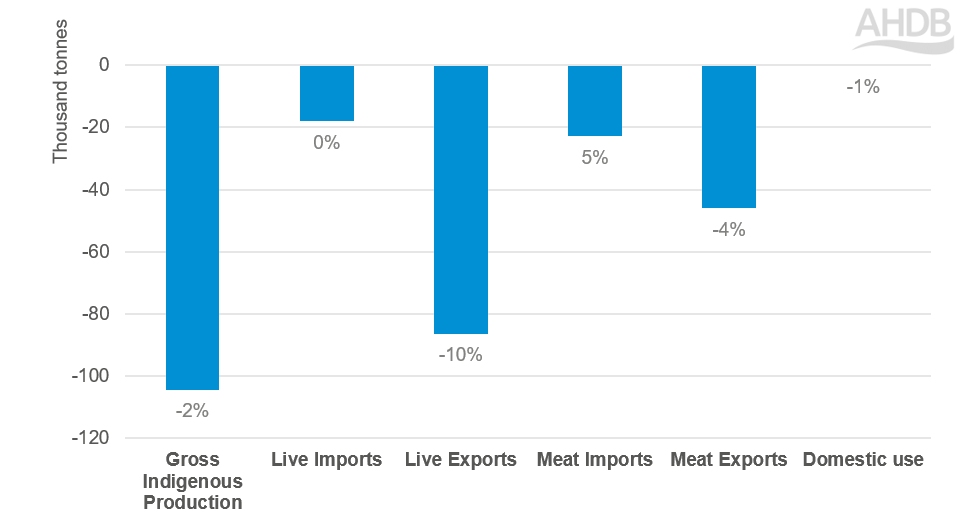

Beef

EU 2025 beef outlook: year-on-year market change

Source: European Commission, AHDB calculations

- Elevated cattle prices have encouraged EU beef carcase weights up in Q1 2025, leading to a 2% annual increase in carcase weight for this period.

- However, early year production declines in major beef producing states (France, Spain and Germany) have offset slight increases in Ireland, Italy and Poland. Total 2025 EU net beef production (from total cattle slaughter in the EU excluding the balance of trade) is forecast 1.3% lower than 2024 levels at 6.73 million tonnes, driven primarily by the shrinking breeding herd.

- Beef consumption in Europe is expected to remain steady despite higher prices with per capita consumption estimated at 9.9kg (-0.9% year-on-year).

- Total EU beef exports for 2025 are forecast to decline by 4%, due to high prices making EU product un-competitive in comparison to South American product from Brazil and Argentina.

- It is estimated that EU beef imports could increase by up to 5% year-on-year to 370 thousand tonnes as shipments from Mercosur countries increase.

- Meanwhile imports into the EU from the UK were down by -11% from January to April this year – reflecting the UK’s elevated beef price.

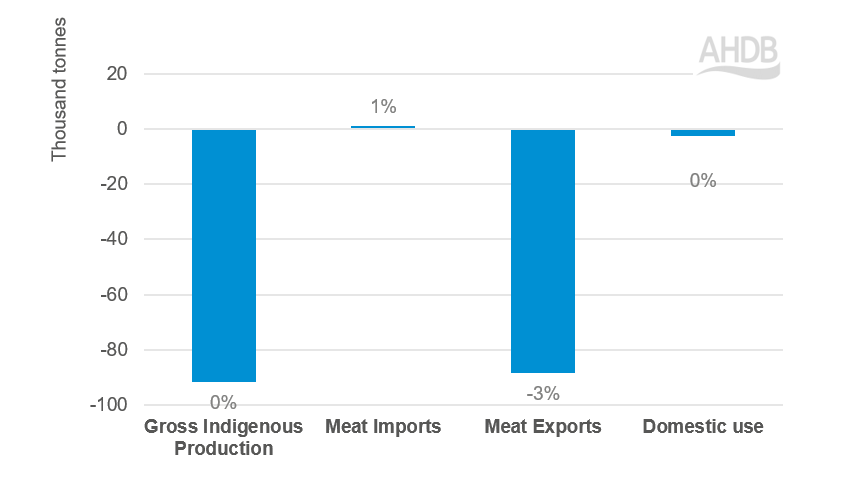

Pig meat

EU 2025 pig meat outlook: year-on-year market change

Source: European Commission, AHDB calculations

Source: European Commission, AHDB calculations

- Despite more pigs coming forward and higher carcase weights leading to increased production in Q1, overall 2025 pig meat production estimates are set at the stable level of 21.2 million tonnes (-0.4% on the year). The smaller breeding sow herd is expected to lead to lower production in the second half of the year.

- ASF remains a major risk factor for European pig producers.

- Pig meat consumption is currently stable year on year following the consumption increases observed in 2024 – this has been attributed to its competitive price point.

- Internationally European pig meat has been less competitive in comparison to similar products from Brazil, the United States, and Canada. This combined with the increased production forecasts coming from the UK and China (and the extension of the Chinese-EU anti-dumping investigation until December 2025) has led to a reduced European export forecast for the remainder of 2025 – down by 3% year-on-year to 2.86 million tonnes.

- European pig meat import forecasts are set to be 1% higher than 2024 levels, totalling 100 thousand tonnes, driven by the continuation of increased UK exports to the bloc. However, these levels are expected to decline come 2026.

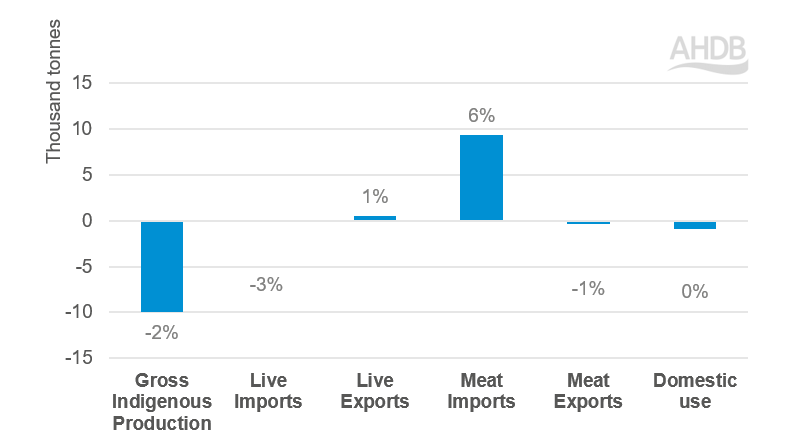

Sheep meat

EU 2025 sheep meat outlook: year-on-year market change

Source: European Commission, AHDB calculations

- The Commission predicts a decline for net European sheep meat production of 2% year-on-year to 518 thousand tonnes, despite a 10% reduction in production volumes in Q1 this year.

- It is expected that higher carcase weights from 2024 carryover lambs will help offset reduced slaughter numbers in 2025 caused by the gradual structural decline of the European sheep and goat flock, meaning we could see potentially greater production declines in 2026.

- European sheep meat prices are currently elevated (+47 cents from the same week last year for the week beginning 21 July). However, this has not led to a reduction in consumption. This stability is attributed to the significance of lamb at cultural events.

- European sheep meat imports are forecast to rise in 2025 by 6% as high prices in the bloc attract in elevated product volumes from the UK, New Zealand, Australia, Argentina and Uruguay.

- Exports from Europe present a mixed picture. The European Union saw elevated export volumes to Algeria and Morocco at the start of this year, and live exports of sheep and goats to North Africa from Spain rose by 5% from January to April this year. Meanwhile, European sheep meat exports to the UK fell by 38%.

- As high, uncompetitive prices and low production persist, total EU exports for 2025 are forecast at 32.6 thousand tonnes (-1% year-on-year).

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.