EU outlook forecasts tight supplies for dairy, beef, pork and lamb

Tuesday, 12 April 2022

The Spring 2022 edition of the EU short term outlook for agriculture has been released. Unsurprisingly a key theme was the impact of the Russian invasion of Ukraine. However, the outlook takes an optimistic view over the impact of the conflict on the EU agri-food sector, suggesting that food, feed, and fertiliser availability are not a primary concern, although affordability may be. The EU is largely self sufficient in many agricultural output commodities, but imports many inputs.

Key points from the report:

- Rising input costs a key theme for all sectors with many raw commodity prices increasing

- Many EU livestock producers are already looking at adjusting rations.

- Fewer pigs on the ground also reducing demand for animal feed

- Cereals prices are forecast to remain high through to 2023 harvest

- Total EU cereals production forecast to be +1.5% year on year

- EU fuel demand forecast to decline, reducing demand for biofuels

- The EU has also put measures in place to try and increase crop production areas for the coming harvest by increasing area

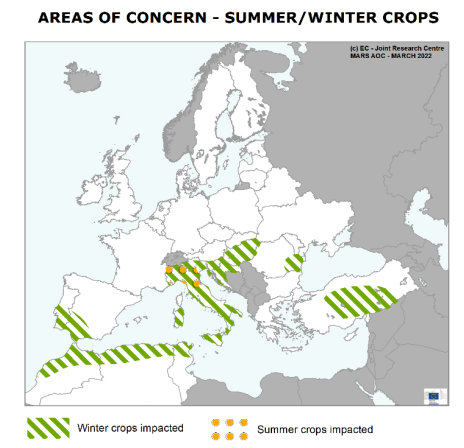

- Some concern over crop conditions in Southern Europe

Dairy

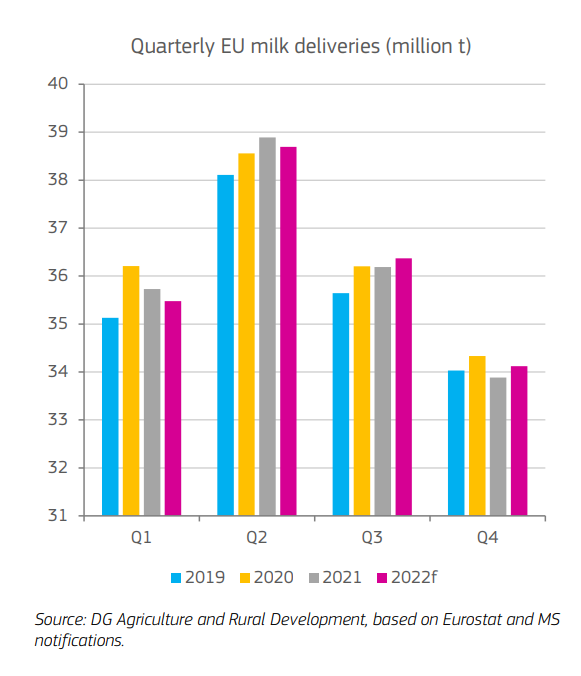

- In 2021 EU milk deliveries declined (-0.4% yoy)

- Driven by the continued reduction in herd size

- High input prices limit growth in milk yields

- In 2022 milk deliveries forecast to be stable on 2021 levels

- Volumes decline year on year in H1

- In H2 volumes to be above year earlier levels

- Feed affordability key to production trends

- Production of cheese to rise, driven by a rise in export demand

- Whey demand could benefit from the price rises in other proteins

- There could be increased usage in animal feed

- SMP and WMP production declined last year

- With export demand easing due high prices

- SMP production could slightly grow this year (+1.5% yoy)

- Some countries looking to build stocks as part of food security programs

Beef

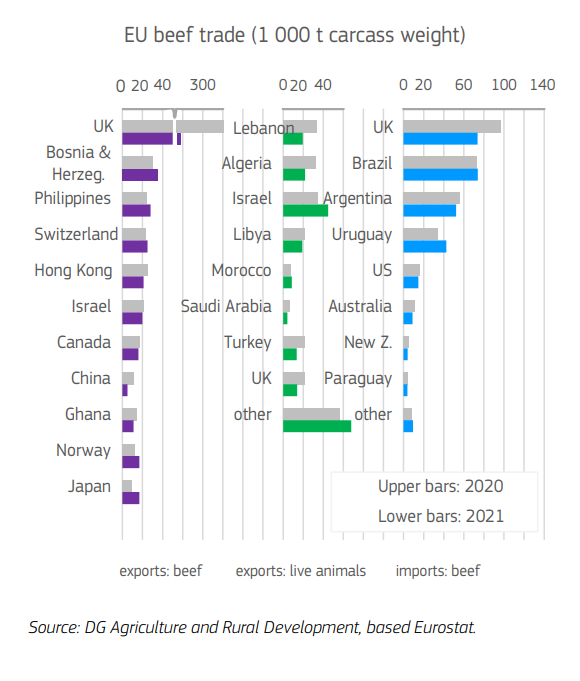

- During 2021 EU beef production marginally declined (-0.3% yoy)

- In 2022 EU beef production is forecast to decline again (-0.9% yoy)

- High input prices could lead to lower carcase weights and earlier slaughtering

- EU beef exports fell last year (-4.4% yoy)

- Exports to rise in 2022 (+1% yoy)

- Growth constrained by domestic production

- Tight global market to continue to support prices

- Imports lower last year (-7.3% yoy)

- Driven by foodservice closures

- In 2022 imports to rise (+5% yoy)

- Reopening of foodservice increasing demand

Pig meat

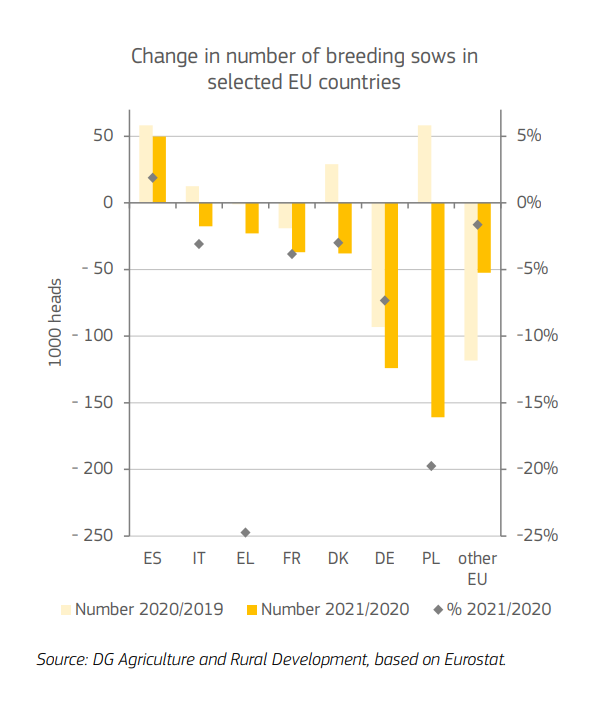

- High input costs have pushed already negative margins even further into the red

- Recent output price rises (32% mom) have not been sufficient to offset the rise in input prices

- In 2022 production forecast to decline (-3% yoy)

- Driven by high input costs

- Last year sow numbers declined (-3.6% yoy)

- ASF limiting production in affected countries

- Could see lighter carcase weights

- Exports suffered in 2021 due to lower demand from China with the trend expected to continue through 2022 (-2.2% yoy)

- Imports expected to increase (+9.1% yoy)

- Driven by improved trade with the UK

Sheep meat

- Production in 2021 recovered to 2019 levels (+3%)

- In 2022 production forecast to fall back (-2%)

- Flock size has been reduced

- High feed will impact production in some countries

- Lower production to support prices

- Trade volumes forecast to remain at low levels with potential to reduce further

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.