Dairy June forecast update: GB milk production set to record new highs

Wednesday, 18 June 2025

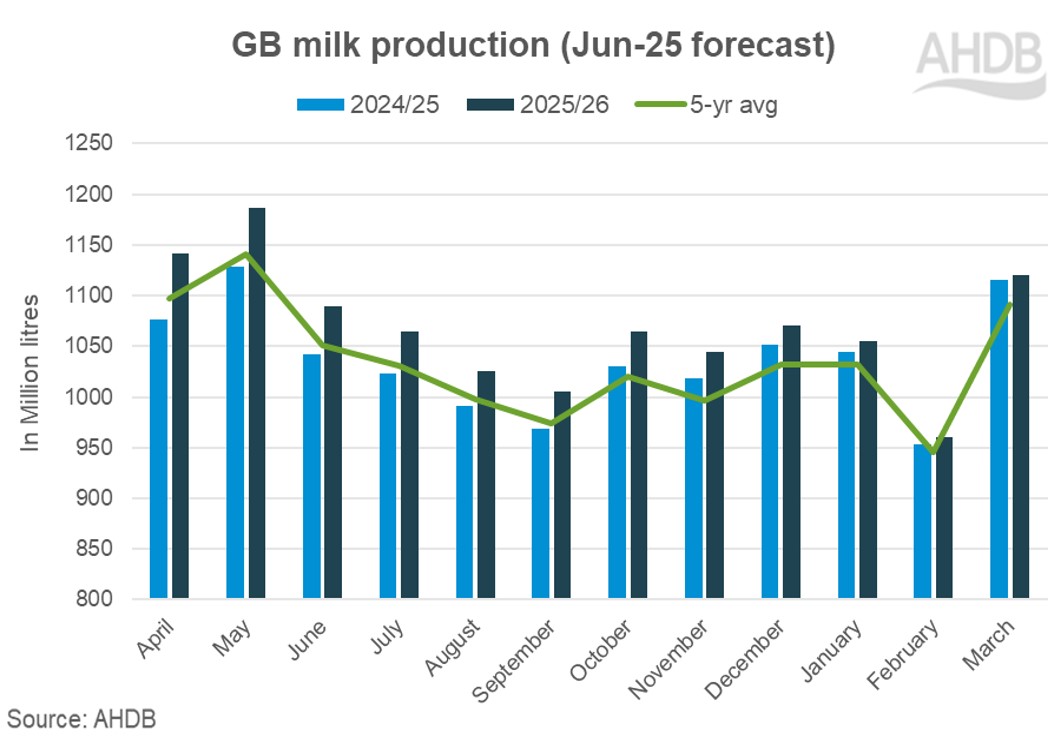

GB milk production for the 2025/26 season is forecast to record a new high at 12.83bn litres, 3.1% more than the previous milk year, according to our June forecast update. This is a revision from the previous forecast of 1% due to economic and weather-related factors.

Milk production in GB is set to record new highs this milk year rising above the challenges in the recent past.

2025 began on a high note with the spring peak reaching record highs. The weather remained favourably good (although dry), supporting early turnout of the cows in spring.

So far this milk year, volumes have been buoyant with April and May registering a 6% and 5% increase year-on-year respectively.

Favourable dairy economics have incentivised farmers to push production. The growth in the first half of the year (2025/26) will outshine growth in the second half of the milk year.

We do have to keep in mind that we are annualising against a higher base in the second half of last year.

The forecast is built in finely balancing the bullish and bearish factors. The latter could come into play later in the year.

Favourable factors for record production

Commodity prices have eased a little, but butter and cream remain at high levels amid tight stocks on the continent and good demand.

Milk deliveries on the continent have been constrained by outbreaks of bluetongue virus and environmental policy not conducive to growing production.

Tight stocks of fats and good demand are likely to keep the market supported in the coming months. Although, we will probably see prices easing to some extent in response to record production.

Milk price announcements in June have been overall fairly stable.

The trend towards block calving systems is also boosting milk flows in the autumn and winter months, higher than historic trends.

Towards the back end of the year, production is likely to be more subdued compared to the record highs in the beginning of the year.

The milk-to-feed price ratio has tipped off slightly after entering the 20-year high zone. However, it remains high in the expansion zone, motivating farmers to push production further.

Following a wet year, the Met Office reported below average rainfall in the spring raising concerns for potential drought.

Rainfall in the second half of the month helped to boost grass growth and improve silage quality and winter forage supplies but a return to dry conditions and a heatwave in June will not help matters.

The easing of key input costs is likely to improve farmer’s confidence and support them in scaling up production. Feed costs are currently lower than year ago levels.

In March, the overall API for all agricultural inputs continued to fall, down around 2 index points year-on-year. This was mainly driven by energy and feed. The average concentrate prices have declined by 6% to £302/tonne in March year-on-year.

Uncertainties continue

Despite the positive factors, there are always uncertainties surrounding the sector. Record high milk volumes will pressurise processing capacity and this will be a factor for processors reducing milk prices.

Declining milking herd size is another negative factor. The size of the GB milking herd in April 2025 was 0.9% lower year-on-year.

Furthermore, the availability of replacement heifers is limited and expensive, potentially impacting the future herd size. Disease risk of bluetongue on the continent and here and also the prevalence of TB will discourage sourcing cattle from elsewhere.

Ongoing environmental and sustainability governmental and supply chain demands will also grow the requirements for long-term investment.

Though overall input costs have eased, the price of fertilisers have increased 14 index points over the last year.

Moreover, with the prices of straw inching up, bedding cost is likely to increase. Labour costs also remain a hindrance to the sector.

The outbreak of a likely war between Israel and Iran could also further destabilise the Middle east and pressure fuel and fertiliser prices. The ongoing geopolitical tensions in the global markets continue to cast shadow on the overall economy.

The Trump tariffs have implications for the UK dairy sector as well. This will displace products off the shelves from one country to another.

Disease outbreaks such as TB and BTV remain a potential threat to the sector. Bluetongue has affected milk deliveries on the continent (Germany and the Netherlands) although the issue is easing in those areas now.

The uptake and availability of vaccines will play an important role in modifying the danger associated with the disease.

We have a developed a vaccine calculator to calculate how much it will cost to vaccinate dairy cattle, and how much vaccination could save if cattle become infected.

Looking ahead

Dairy economics remain encouraging for greater milk production but there are underlying tensions which are likely to re-emerge if prices begin to fall.

Should feed costs go up due to war and disruption or prices fall due to damage to demand due to global economic headwinds, the picture could shift quickly.

Amid record milk volumes, the industry’s ability to adapt to external challenges and become more resilient will be important in shaping the trajectory for the rest of the year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.