COVID-19 to push global meat production down in 2020

Thursday, 18 June 2020

By Rebecca Wright

The FAO has recently published its latest global Food Outlook for 2020.

Overall the disruption and uncertainty related to the COVID-19 pandemic is likely to continue for many more months. The global agri-food sector is likely to be more resilient to the crisis than some other sectors.

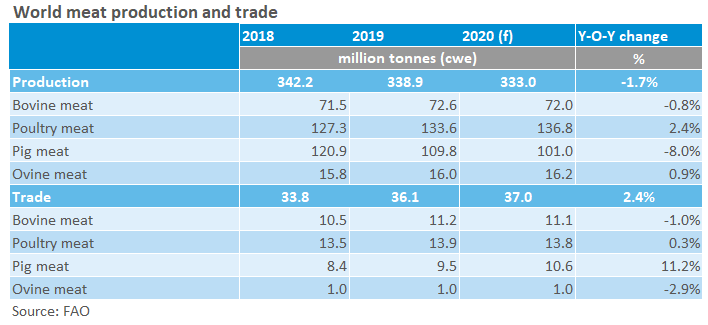

For a second consecutive year, global meat production is expected to contract. Much of this decline is likely to be in pig meat, driven by the on-going African Swine Fever (ASF) situation in Asia. Beef production is forecast to contract too, driven by US and Australia. In contrast, global trade is likely to increase, largely due to increased imports of pig meat by China.

Global processing capacity has been reduced, due to social distancing measures putting farmgate prices under pressure. The downwards movements are weighted towards countries with more intensive production systems, opposed to areas with good pasture conditions.

COVID-19 lockdowns around the world have reduced foodservice demand, with the uplift in retail only partially offsetting this. Economic uncertainty and potential job losses is likely to put meat demand under pressure moving forwards.

Beef

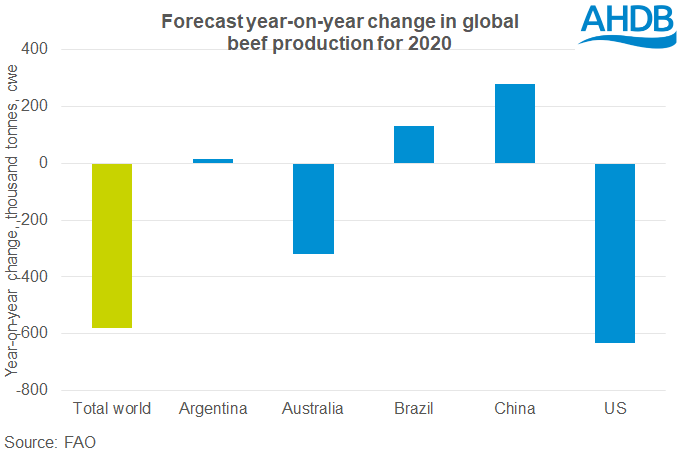

Global beef production is forecast to drop 1%, to 72 million tonnes this year. It is expected that there will be contraction in production from many of the largest beef producing nations. Some of the contraction will be driven by COVID-19 disruptions (US) whereas elsewhere this would be due to herd re-building following a sustained drought period (Australia).

China and Japan are both expected to increase the volume of beef they import, with consumption also rising. In China this will largely be driven by the protein shortage caused by ASF. However, the US, Mexico, Philippines and South Korea are all forecast to record declines in imports, driven by an economic downturn. The EU-27 + UK is forecast to record a decline in consumption, met by a decline in exports.

Sheep meat

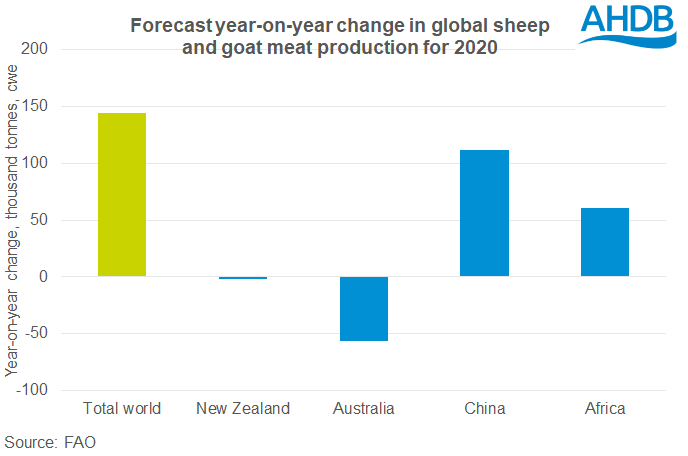

Global production is likely to record a modest expansion of 1%, to 16 million tonnes, this year. Most of the increase is anticipated to be in China, with some potential modest growth in Africa. In contrast, production down under, which dominates global trade, is forecast to drop driven by limited supplies and also the breaking of the drought leading to restocking demand. With New Zealand and Australia dominating global trade and production there expected to contract, global trade volumes are forecast to decline. Import demand from China is likely to remain strong but not increase moving forwards, high volumes are still in storage which will limit growth, and China is also expected to expand its own production.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: