Coronavirus: Scenarios for exiting lockdown

Tuesday, 30 June 2020

Forecasting what will happen in the future is always a challenge. Some factors, such as consumer behaviour, are broadly stable and follow recognisable patterns. Others, such as the weather, are much harder to predict and have a big impact on market volatility.

This year’s Agri Market Outlook has the added uncertainty of the COVID-19 pandemic. Expectation of how the pandemic will develop, the impact it has on the economy and consumer demand vary significantly. Most forecasts agree that we are facing the worst recession since the 1940s, but there is little consensus on how quickly recovery will come. This is perhaps the biggest uncertainty and risk to our projections of sector supply and demand.

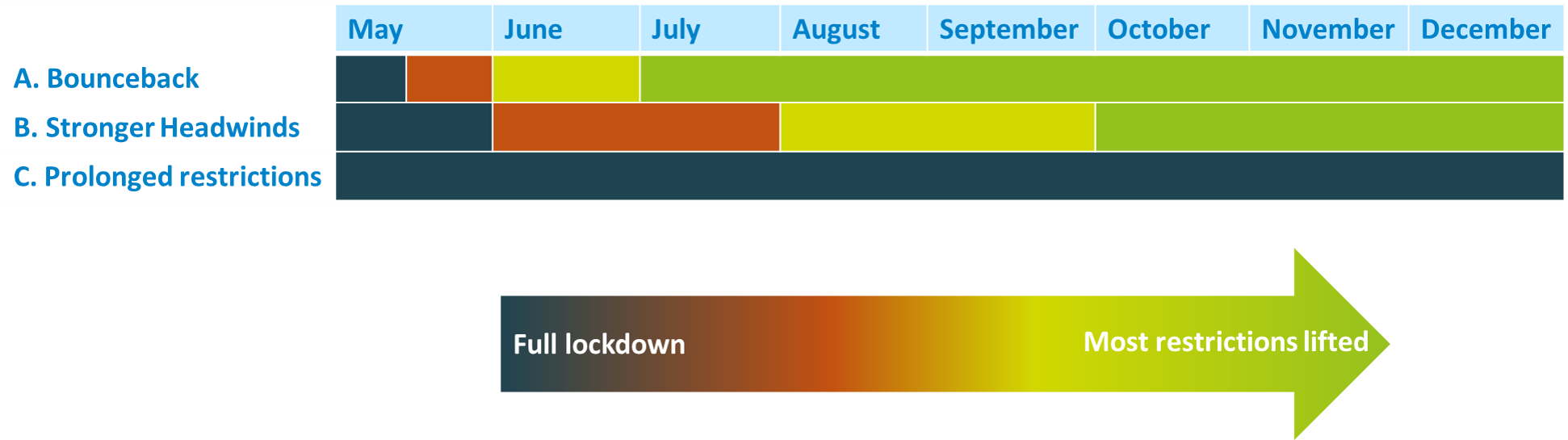

To deal with this uncertainty AHDB has developed three scenarios for recovery, covering a range of possible routes out of lockdown. We have looked at how these scenarios will impact demand for food in retail, restaurants, takeaways and in public sector catering, to estimate what the impact on total demand will be.

Scenario A – Bounceback

Our most optimistic scenario assumes that restrictions will be eased in line with the government’s stated plans for England. Lockdown began to be eased in May, with a return to work for those unable to work from home. The middle of June saw the phased re-opening of non-essential retail and schools opening their doors to more pupils.

Pubs and restaurants will reopen on 4 July, although we assume they will be operating at a reduced capacity (50%) to enable social distancing between customers and staff. Hotels and domestic tourism will also resume and international travel, we assume they will operate at 25% of its previous level. Around a quarter of office workers will return to their office environment, the majority will continue to work from home. Schools will gradually allow more children back, returning to full capacity in September.

This scenario has the least impact on the economy – overall GDP for 2020 falls by 8% and the government’s Job Retention Scheme helps to keep unemployment at less than 5%.

Scenario B – Stronger Headwinds

Under this scenario, we assume that restrictions continue to apply for longer than currently planned, possibly as a result of further infections. Restrictions begin to ease in June. In August, some leisure venues and domestic travel hubs reopen; restaurants and pubs reopen for open-air custom only. From October, indoor dining will be allowed, but at a much reduced capacity (40%) to ensure social distancing. Around 15% of office workers return to their workplaces.

The economic impact of this scenario is more intense, driving unemployment up to 14%. The young and those with low incomes are worst affected. Overall, GDP falls by 15% over 2020.

Scenario C – Prolonged Restrictions

This is our most pessimistic scenario and it assumes that restrictions remain in place indefinitely or any relaxations to lockdown are short-lived. The foodservice sector remains closed for the rest of 2020, except for takeaways.

Prolonged shutdown of the economy has a long-lasting and deep impact. GDP for 2020 drops by 30% in this scenario and unemployment rises to 21% with a big spike in October as support for furloughed workers is withdrawn.