Winter warmers and treats for Halloween this year

Wednesday, 30 November 2022

Traditionally, Halloween and Bonfire Night ignite a spike in sales of red meat and dairy with revellers sinking their fangs into bangers and burgers. But with this year marking the first Halloween since the pandemic started without high levels of Covid infections, we have taken a look to see which categories bewitched consumers and which failed to cast a spell. According to IGD, a third of shoppers claimed to have done more to celebrate Halloween this year than previously, with one in ten households buying a pumpkin (Kantar).

In October, the need for treats and rewards is always higher when compared to the rest of the year for both kids and adults alike (Kantar Usage, 4 w/e 31 October 2021). This year, sweet treats proved a hit, with chocolate sales up 9.7% and sweets and candy up 14.9%, showing people were excited to celebrate (Kantar 2 weeks ending 30 October 2022). New HFSS regulations meant the usual end aisle displays have to move in-aisle and a scale back in promotions doesn’t seem to have impacted sales of confectionary.

Meat, fish and poultry

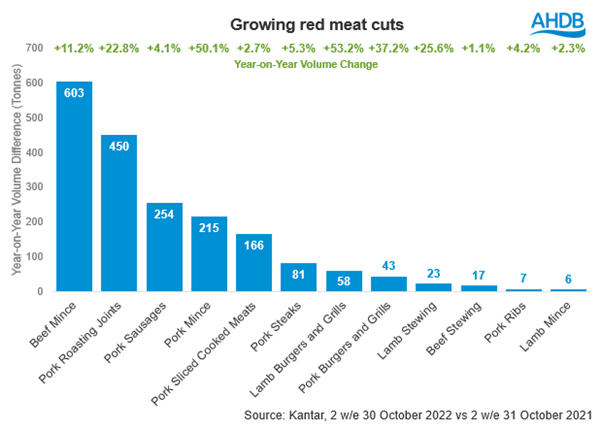

Despite being unseasonably warm, Halloween still signals a change in seasons and people move from summer food to more wintery dishes. This is playing out in the types of cuts people bought.

Mince was the only cut to see growth across all three proteins, which is unsurprising given the versatility and value of mince at a time when consumers are struggling with the cost-of-living. It also plays into the sharing dishes we expect to see at Halloween.

Stew and casserole meals also proved popular, with beef stewing seeing the biggest uplift verses the rest of the year. Shoppers are 59% more likely to buy this cut in the two weeks to Halloween than the average two weeks (Kantar, 2 we 30 Oct 22 vs 42 we 16 Oct 22).

Sales of pork joints also increased, with shoulder cuts driving most of this growth – a cut often used in pulled pork, which is a Halloween and bonfire favourite.

As well as making more comforting meals, consumers also opted for party and finger foods. This Halloween, lamb (+53%) and pork (+37%) burgers were among the fastest growing cuts, however it was from a small base. There was also growth in meat-based party foods such as cocktail sausages, up 16%, pastries, up 14% and sausage rolls, up 8.5%. We also saw people starting on the Christmas treats early with pigs in blankets up 15%.

Whilst we saw growth in these categories, total grocery sales were down on 2021. As the cost-of-living crisis impacted peoples spending power, total meat, fish and poultry volume sales were down 2.0% in the two weeks to the 30 October 2022 (Kantar). Shoppers restricted their purchases by shopping online and fewer impulsive purchases than previous years, according to IGD. We also saw switching towards cheaper proteins such as pork and chicken.

Dairy

Halloween is a key time for baking. In October last year, sweet baking was 46% higher than the rest of the year, with scones, crumble and banana cakes being the most popular creations (Kantar Usage, 4 w/e 31 October 2021).

And whilst sales of butter and spreads experienced a 2% uplift this Halloween, it was still lower than previous years, with volumes down 6.7% (Kantar, 2 w/e 30 October 2022). There was growth for cream, with volumes up 2.2% year-on-year, led by an increase in aerosol (+9.2%), single (+5.3%) and double cream (+2.8%). However, it was not just sweet treats which led to growth in cream – sour cream saw the biggest increase in volumes, up 21.8%.

Cream is also least reliant on promotions of all dairy categories. As retailers scale back on promotions, this is impacting sales of dairy.

Recommendations

Retailers which had in store displays as well as targeted promotions saw the best performances. As we turn towards more comforting foods at Halloween, marketing and messaging for meat and dairy should focus on winter warmer meals – which was the focus of AHDB’s most recent pork campaign, ahdb.org.uk/feedthefamilyforless

While beef is the only protein to over-index at Halloween, it hasn’t seen as strong a performance as we might have expected. And while mince did well, this may cause issues for carcase balance as mince is typically not very profitable. Positioning beef brisket in a similar way to pulled pork, which is performing well, could boost the roasting category. Beef burgers may also need some new product development behind them if they are to compete with pork and lamb which has been growing in popularity.

For dairy, shoppers should be encouraged to bake at home with plenty of butter, milk and cream. Shoppers are also looking for tasty savoury options so highlighting snacking cheese and cheese boards as well as chips with dips such as sour cream, would be beneficial.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: