Understanding the lamb consumer and evolving eating habits

Monday, 29 March 2021

Lamb has faced long term volumes challenges linked to pressure from evolving consumer needs and tastes alongside the higher price point of lamb.

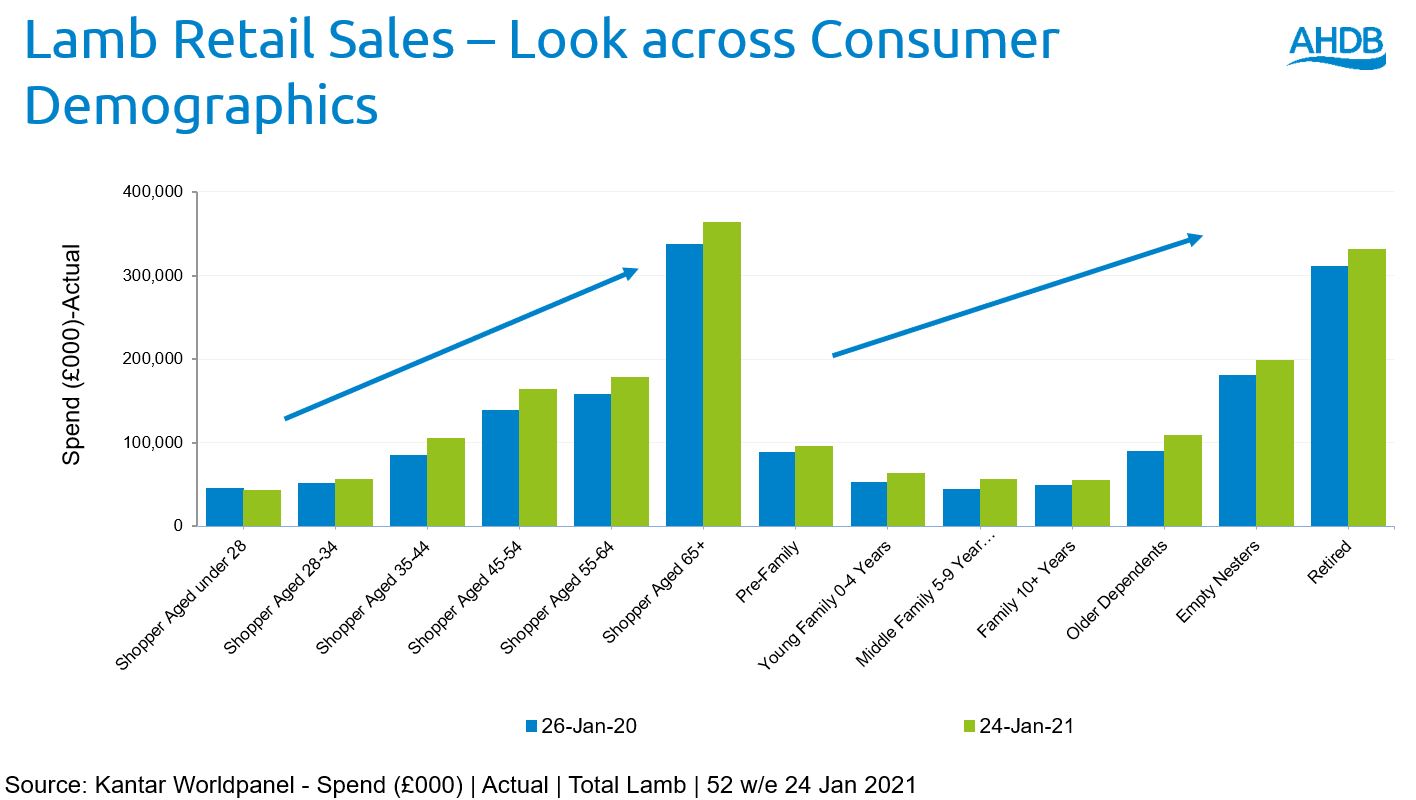

In particular, the last 10 years has seen the desire for quick, convenient and healthy meal options intensify. Understanding the shopper profile and how lamb is consumed provides crucial context. Lamb has a heavy proportion of older consumers, with 60% of retail sales from those aged 55+ (compared to 51% for all meat/fish/poultry). In terms of household type, the majority are either retired, older dependants or empty nesters (have children who are no longer living with them). The current consumer profile points to continued contraction of the domestic market. As such, widening appeal to young consumers is important in the longer term.

Lamb retail sales by consumer demographics

Just under a third (28%) of lamb meal occasions occur on a Sunday – this rises to around half if you looked just at lamb roasting joints (Kantar Usage 52 week end 29 Nov 2020). This highlights the importance of Sunday roasts to overall category performance. The longer-term decline of the traditional Sunday roast is making it increasingly important to evolve lambs offering into other dishes. Lamb consumption peaks at Easter and Christmas, highlighting a wider opportunity to make lamb more appealing beyond these two key seasonal periods.

Lamb is often seen as a treat and fits well within special occasions in the mind set of consumers. Pre- COVID, lamb was more likely to be chosen over other meat, fish, and poultry where there were five or more people present, the reason being the meal was a social occasion. Obviously, this was heavily impacted during 2020 due to household restrictions but in the longer term there is an opportunity as restrictions ease and consumers look to recreate these occasions.

Price challenge

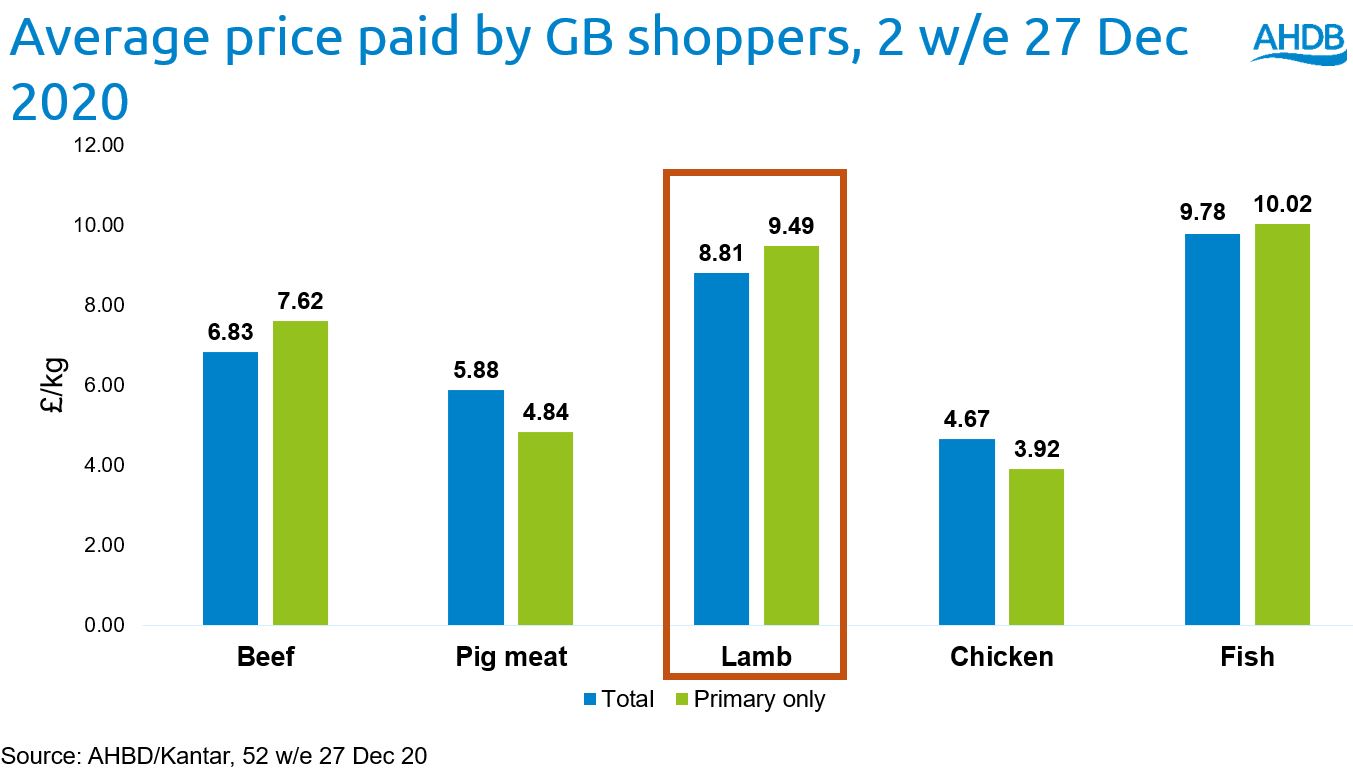

The most notable consumer consideration for lamb is its price and consumers’ reaction to that, with AHDB research indicating that 64% of consumer agree that lamb is too expensive to eat on a regular basis (AHDB/YouGov Consumer Tracker Feb 2020). With price already acting as a barrier, the economic fallout from COVID could see increased challenges for lamb, pushing it further into the treat/special occasion bracket. Signals are that consumers are increasingly seeking value for money, with 43% of consumers stating they have become more price conscious in the last month (AHDB/YouGov Consumer Tracker Nov 2020).

Lamb’s price point is a challenge when compared to chicken, beef, and pig meat, placing it at the higher end of the scale across meat options. In addition, lamb’s price point has also grown the most over the past five years, with the retail average price per kilogram 19% higher than five years ago (Kantar 52 w/e 27 Dec 20). This rate of growth is much higher than beef (+5%), pig meat (+10%) and Chicken (-1%). The price differential is evident when it comes to meat centrepieces, as well as versatile, cheaper products such as mince. This makes it vital that lamb justifies the price point by clearly communicating taste and quality attributes to consumers.

Consumer perceptions

Evidence around consumers’ perception of lamb highlights a number of strengths and weaknesses. Notable attractions of lamb for consumers are it is ‘tasty’ (58%) and a ‘good source of protein’ (50%). However, only 27% of consumers perceive lamb as being ‘good for you’ with many thinking that lamb can be ‘fatty’ (57%) (AHDB/YouGov Consumer Tracker Nov 2020). Given the growing importance of health to many consumers, on which AHDB has published insight previously, this presents a challenge to the lamb market.

Another key area the industry must address is just 34% of consumers agree that lamb is ‘versatile’ (AHDB/YouGov Consumer Tracker Nov 2020). This is significantly lower than agreement towards other meat choices, such as chicken (78%), beef (64%), and pork (47%). With the increased popularity of ‘dish-based’ cuisines such as Italian, Indian, Chinese and Mexican, finding ways to align Lamb to more world cuisines may increase relevance for a wider group of consumers. For instance, traditional cuts such as leg, shoulder and chops can be used in a variety of Mediterranean, Middle Eastern and North African-inspired dishes, such as tagine and Kleftiko.

Environment perceptions

The environment is another area of growing consumer interest. Here, most consumers believe farmers care about the planet, with 64 per cent in agreement (AHDB/Blue Marble Trust Research 2020). Indeed, many aspects of UK sheep meat production, such as grass-based and extensive, may lend themselves to a good news story on the environment.

In recent years, concerns about the environment, together with health, have become the key reasons why those consumers who limit the amount of meat in their diets choose to do so. For sheep meat the message is clear, it is important that the supply chain introduces new products which appeal to consumers and addresses concerns around the environment. Demonstrating and communicating environment credentials to consumers is a must for our industry.

Looking ahead, it is key that lamb is communicated as a tasty and nutritious product – these were key pillars of AHDB’s domestic marketing campaigns such as ‘Lamb hits you in the chops’ in 2019 and the ‘Make it Lamb’ in 2020, alongside statements about the health benefits of eating red meat in AHDB’s recent ‘Eat balanced’ 2021 campaign.

Important consumer considerations for AHDB and the supply chain

- Utilise evidence around changing consumer needs to inform planning and protect plate share.

- Connect with the next generation of lamb consumers, who are willing to pay more for the unique intrinsic qualities of lamb, so that we extract the most value from every animal, as well as redefining the ‘lamb brand’ with a younger audience.

- Focus on positioning lamb as a positive contributor to wellbeing so it benefits from the growing consumer interest in health. Leverage the sustainability and naturalness of lamb to appeal to a broader consumer base of ‘mindful eaters’.

The points raised here are covered in more depth in the domestic demand section of AHDB’s report Horizon: Opportunities for the sheep sector

Related Content

Topics:

Sectors: