The dairy shopper journey

Monday, 13 January 2020

In 2019, the UK dairy market* was worth £9.7 billion – with 99.8% of households buying dairy. But what drives our purchasing behaviour and which products are we most likely to want? Understanding consumer needs and behaviours is vital to ensure the right on-pack and in-store messaging, encourage innovation and ultimately boost sales. The decision-making process differs across each category – what resonates with consumers buying milk may not be the same for cheese purchases. Therefore, the purpose of this article is to highlight the purchase drivers for key dairy categories to provide further opportunities for industry.

Overview

Despite the high numbers of 2019, the dairy market had a challenging year, according to Kantar, with volumes down -1.2% as some shoppers bought less per trip (52 w/e 1 Dec 19). While milk saw the biggest decline in volume sales, more indulgent categories like cheese experienced growth of +3.0%. How people shop the various dairy categories highlights some similarities, with quality messaging being important across all, but also some differences, and therefore opportunities, to tailor communication by product.

Key opportunities

- Milk – The shopping experience must be quick and easy. To reignite growth, reputational messaging on production and health will land in this category

- Butter/margarine/spreads – Trade people up through premiumised packaging and quality-oriented messaging. A health claim is important here

- Cheese – Brand heritage and quality credentials are key to brand loyalty. Encourage new shoppers through innovation and tactical support

- Yogurt – Appealing packaging and innovation will help products stand out. Health claims are extremely important here, along with tactical support

The following findings come from in-store, real-time research performed by IGD ShopperVista, whereby consumers were asked what was important when choosing various products. The research covered 35 food and drink categories to allow for comparison across grocery sectors (Category Benchmark Reports, 2019).

Milk

Milk is a staple product, featuring in 99% of UK households (Kantar, 52 w/e 1 Dec 19). It is more likely to be a planned purchase, with a third of shoppers prepared to shop at another store to get their preferred choice.

Due to its routine nature – featuring daily in drinks, cereals and in cooking – practical elements such as ease of use and pack size are just as important as clear quality credentials – the top purchase driver. As a result, price and special offers are less important for milk than other categories.

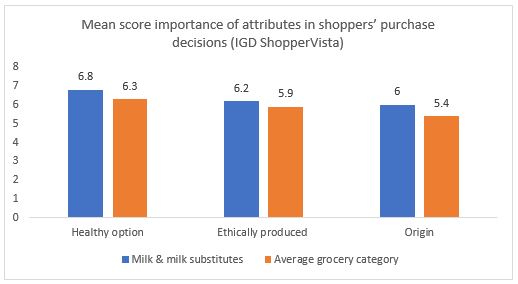

Healthy, ethically produced and origin feature lower down the ranks but are of more importance than other grocery categories, highlighting the importance of reputational messaging on dairy production, as well as clear signposting to fat content levels.

Butter/margarine/spreads (BMS)

As with milk, price and promotions are less of a driver for BMS sales than other categories. However, consumers are willing to pay more for improved quality, taste or ingredients – highlighting an opportunity to premiumise packaging and improve messaging on pack.

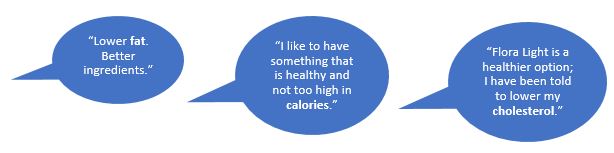

Unlike milk, origin and being ethically produced are less important for BMS, with health being more important. Health can mean different things to different people, which is reflected in the consumer quotes collected by IGD. Therefore, claims around health credentials will encourage brand loyalty and increase sales.

Cheese

The majority of cheese shoppers make their final purchase decision in store, so there is the opportunity to encourage brand switching and trade-up at point of purchase. While quality is still the most important purchase driver for cheese, price and special offers are next in terms of importance, showing it is a category that will benefit from tactical support. Due to its indulgent nature, health claims are less important.

More important is origin. Therefore, highlighting brand heritage along with quality credentials will help maintain shopper loyalty. To entice new consumers, innovation with new flavours and formats is key, as cheese has a higher than average propensity towards new and different products.

Yogurt

Similarly, quality, price and special offers are the most important purchasing drivers for yogurt and, like cheese, shoppers are more open to trying new products. What makes yogurt different is that nearly all criteria are more important compared with the average grocery category, including pack size, healthy option, packaging and brand. Of significantly more importance is health, with yogurt being the second-highest-ranked category in this aspect, behind fruit and veg. This highlights that a clear health claim gives a reason for purchase and trade-up. In a fragmented category, standout packaging is the way to get noticed.

*Total dairy is defined as cows’ milk only, so excluding other animals and plant-based alternatives.