Ready meal growth driven by need for convenience

Friday, 1 April 2022

Consumers choosing convenient meals is now at a five year high. Over the last year, spend on red meat preprepared meals* was worth more than a billion pounds to retailers, with 260 million convenience meals eaten in January alone (Kantar).

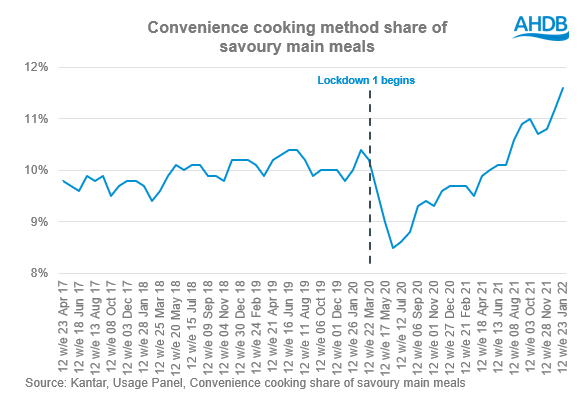

During the pandemic, we saw a rise in home-made meals cooked from scratch but as the busyness of everyday life returns, shoppers are turning back to quick and easy meals.

After seeing a huge drop at the start of the pandemic, convenience has been on a strong upward trend and now 11.5% of meals have little to no preparation time. Convenience meals are defined as pizzas and ready meals.

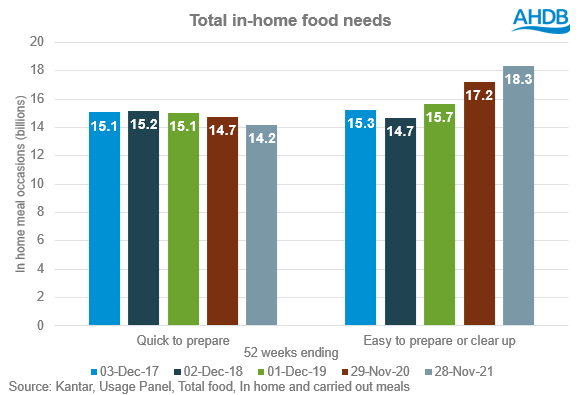

Convenience meals are much lower effort, taking only 27 minutes to prepare and cook compared to 41 minutes for meals cooked from scratch. However, this comes at a cost with convenience meals costing £2.18 per person, which is 68 pence per person more than scratch cooked meals (Kantar Usage, 52 w/e Nov 21). Easy-to-make dishes have become more important than quick meals, which means some shoppers may not be put off by longer cooking times, as long as the meal is easy to prepare.

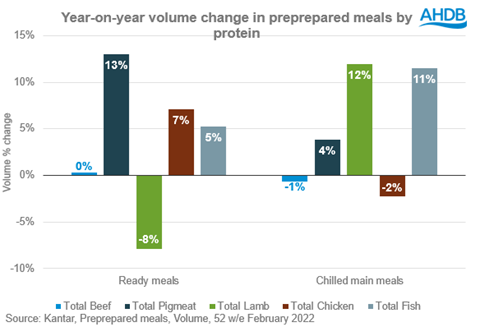

This change in consumer needs has had an impact on the types of foods shoppers buy from the supermarket. Some of the easiest and quickest meals to cook are preprepared meals*. While total volumes of meat, fish and poultry (MFP) in retail have declined by 6.3%, preprepared MFP meals were up 3.2% (Kantar, 52 w/e 20 Feb 22). MFP ready meals* drove most of this growth, up 4.3% while chilled MFP main meal accompaniments (e.g. the lamb and sauce part of a lamb curry where the rice is sold separately) * grew by only 0.3% year-on-year.

All age groups increased their purchase of MFP preprepared meals, but shoppers aged under 28 increased volumes by more than half (+50.5%) but from a small base. However, it is not just younger shoppers driving growth with empty nesters contributing the biggest volume increase when we look at different life stages.

However, the growing popularity of convenience meals does not necessarily benefit convenience stores, which have seen sales of preprepared meals fall by 6.6%. Whereas hard discounters have seen MFP preprepared meal volumes increase by 7.2% and premium retailers have seen growth of 6.5%. The big 4 retailers saw volume growth of 2.5% over the last year and despite slower growth were still the biggest contributor to category volume increases (Kantar, 52 w/e 20 Feb 22).

Meat ready meals

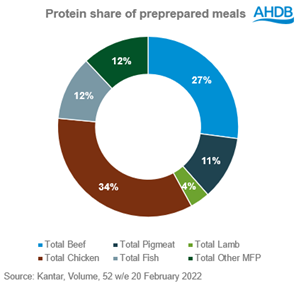

Pork was the fastest growing protein in ready meals, up 13.0% but chicken contributed the most to overall growth as it has a much larger share of the category.

Growth in pork is from chilled ready meals, rather than frozen, with Italian being the most popular cuisine, representing 66% share of pork chilled ready meals and still growing. British dishes, which make up 28% of pork ready meals, are in decline with shoppers moving away from the more traditional sausage and mash ready meals. Other cuisines have only a 6% share, showing there is opportunity to expand world cuisines such as Mexican and Asian pork ready meals, which currently are limited. This may be due to these cuisines being more prevalent in takeaways, so when looking for convenience in these areas, consumers opt for takeaways and delivery.

While pork is growing quickly, within red meat, beef still has the largest proportion of preprepared meals. Again, Italian cuisines dominate the market with 65% share of chilled beef ready meals – up 5% on 52 w/e Feb 2021However, all other cuisines, including British, Asian, Mexican and European (excluding Italian) dishes, were in decline. Italian also dominated beef NPD with 74% of new products being pasta based.

As shopper budgets get squeezed over the next year, prepared meals may have to justify their higher price point to consumers. However, if shoppers choose to scale back on eating out and takeaways, we could see shoppers move into the category as a cheaper alternative. Therefore, preprepared meals which emulate a takeaway could prove popular.

*Preprepared meals include chilled main meals (chilled meat part of a main meal but which does not include a side or carbohydrate e.g. the lamb and sauce part of a lamb curry where the rice is sold separately), chilled ready meals (a chilled whole meal with sides) and frozen ready meals (a frozen whole meal with sides).

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.