Meaty meals increasing popularity out of home

Tuesday, 7 October 2025

The out-of-home (OOH) market is struggling in the backdrop of inflationary living, making it more important than ever for foodservice establishments to stand out in terms of offerings, whether that be on price or experience. When dining OOH, 80% of consumers like trying out new things*, opening exciting opportunities for operators to experiment with menu offerings. So how are different cuisines and dishes currently faring and what are the opportunities for red meat going forward?

Market performance

In the last year, food spend in the OOH market has reached £49.9 billion (Worldpanel by Numerator UK, 52 w/e 7 September 2025). A 5.8% increase in average price paid is driving this as the market has struggled in terms of transactions (packs -3.7% year-on-year).

Inflation has hit a point many consumers are unwilling, or unable, to pay, resulting in some shoppers leaving the category and the remaining shoppers eating out less frequently.

This is reflected in 73% of consumers currently being concerned about the cost of living (Sparkminds Sentiment Tracker, September 2025), and according to the AHDB/You Gov Consumer Tracker, among those whose finances have worsened in recent months, 57% are planning on reducing spend on eating out – the top combative measure (August 2025).

Consumers appear to be dropping everyday OOH occasions and prioritising occasion-led dining experiences instead.

Cuisine/meal performance OOH

According to Worldpanel by Numerator, meat-centred meals, which are typically British or American in nature (such as fried chicken, roast dinners, steak and sausages), contribute the biggest value to the market.

In the last year, 64% of GB adults have consumed a meat-centred meal OOH, with sales hitting £7.9 billion (52 w/e 15 June 2025).

Contributing less value to the market (£4 billion), because of the lower price point, but hitting the highest penetration are burgers, with 66% of GB adults consuming them in the last year. The third biggest meal is pizza at £3.1 billion with 49% penetration.

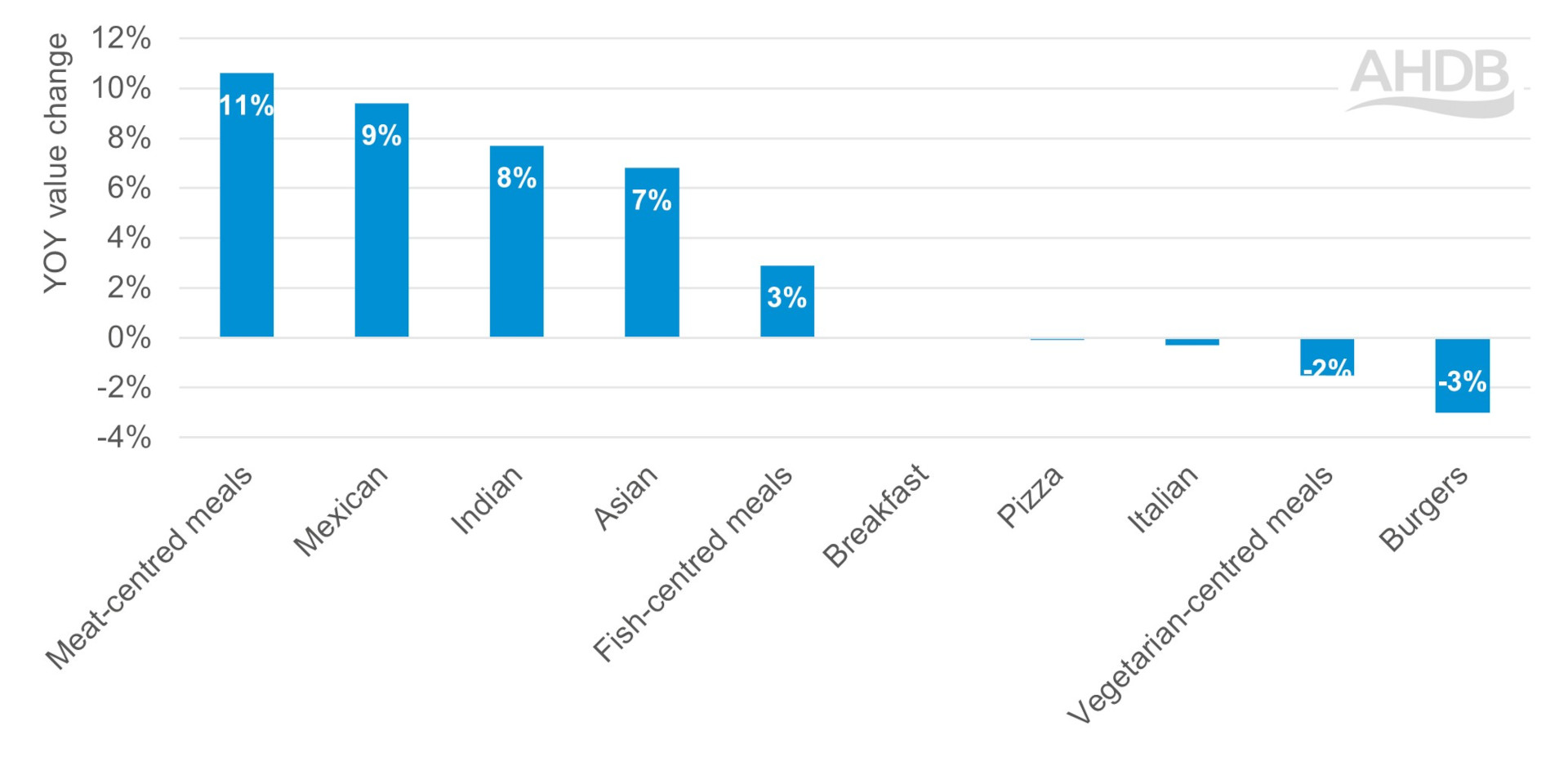

However, these top three meal choices have performed very differently in the last year, with two out of the three declining in value, showing that shoppers are trying something different.

Meat-centred meals have bucked the market trend and grown 10.6% in value, not only through price, but also purchase frequency.

Burgers and pizza have lost share of the market through shoppers dropping the meals from their repertoire and loyal shoppers eating them less often.

Other cuisines gaining share of the market are Asian and Indian. But also seeing significant growth, although smaller, is Mexican, which has been the only category to recruit new shoppers.

Figure 1. Year-on-year value change by cuisine/meal

Source: Worldpanel by Numerator UK, 52 w/e 15 June 2025

Chicken takes the largest serving share of protein in meat-centred meals (62.4%) due to the dominance of fried chicken.

However, chicken is losing share of meat-centred meals due to lamb and beef seeing faster growth rates at 6.4% and 2.7% respectively (Worldpanel by Numerator UK, 52 w/e 15 June 2025).

In terms of what is driving this, roast lamb and beef have seen double-digit volume growth in the last year, stealing share from chicken roasts. This shows that when going out for a Sunday dinner, consumers are willing to trade up to elevate their experience, despite the cost of living.

Also performing well in the last year are mixed grills and hot dogs.

Learning from these top-performing dishes, we can see how sharing options, through roast and meat boards, and hot dog customisation options are elevating the experience.

Communicating quality credentials, such as the sourcing or butchery of the meat, also resonates with the three in four consumers who are quality-led when choosing a meal OOH (Lumina Intelligence, UK Menu & Food Trends Report, 2024).

Other traditional meat-centred dishes that are losing share, such as steak, shepherd’s pie and ribs, should capitalise on these trends and innovate to stand out on the menu.

Burgers compete across a price spectrum, with growth over the last few years on pub, bar and restaurant menus resulting in these channels stealing share from quick-service retail, providing consumers with a more premium and indulgent experience.

Beef burgers dominate the category, accounting for 58% of burgers sold in the last year (Worldpanel by Numerator UK, 52 w/e 15 June 2025), followed by chicken at 31%. Both proteins have declined in the last year, while more niche lamb burgers have grown, providing more opportunity for the lamb category.

Burgers have had a strong few years; however, they appear to be unable to maintain these levels.

So what is next for innovation in the burger category? Diverse, culturally inspired flavours and mash-ups (think curry or banh mi-inspired burgers, according to Tastewise), bold toppings, customisable options and clear meat quality cues can help ensure they stand out on the menu.

The third most popular meal in Britain, pizza has seen heavier losses in shoppers than other meals over the last six months.

In the longer term, quick-service retail has been losing share of pizzas as cheaper individual slices, via bakery and sandwich shops, have gained ground (Worldpanel by Numerator UK, 52 w/e 15 June 2025).

Looking specifically at the last year, it is pork really suffering here as ham and pepperoni toppings have declined in transactions. Continuing to offer value, alongside more premium red meat offerings, would boost the category going forward.

According to Lumina Intelligence, hot honey has become mainstream on pizzas and features on new pizzas in Zizzi, Ask Italian and Pizza Hut.

New launches in the market have been more premium and featured ingredients including prawns, venison pepperoni and roquito pearl slices. And according to trend predictions, NYC, Chicago and Detroit-style pizzas are becoming increasingly popular (UK Menu & Food Trends Report, 2024).

So, what about the other cuisines and meals across the market which make up 45% of market value?

Focusing in on areas of growth, we see Asian, Indian and particularly Mexican doing well.

Both Asian and Indian overtrade in chicken. However, for both cuisines, shoppers appear to be expanding their taste, with both beef and lamb growing share of Indian meals in the last year and all red meats growing faster than chicken in Asian meals. While Indian is an established cuisine, OOH Asian provides opportunities through emerging regions such as Korea and Malaysia.

But for both flavoursome cuisines they need to continue to tap into the 35% of OOH users who are seeking unique flavour combinations (Mintel’s Menu Trends Autumn/Winter – UK, 2025 Report) by communicating taste cues on menu.

Mexican remains the cuisine that uses the widest range of proteins and is winning as a result. Pork is the biggest gainer in Mexican, while beef has struggled in the last year so needs to maintain its relevance.

Shoppers are looking beyond burritos, with tacos, nachos and authentic Mexican rice dishes driving the category so continue to feature red meat Mexican options on the menu.

Cuisines to watch out for

It is important for foodservice establishments to be aware of up-and-coming cuisines to aid business innovation through understanding evolving consumer needs and gain a competitive edge by identifying growth opportunities early.

According to Lumina Intelligence, hyperlocal and authentic global cuisines continue to see an uptick in popularity, providing red meat with an opportunity to utilise these trends to gain space and stand out on menu.

Figure 2. Trending cuisines

| Warm | Hot | Emerging |

| Venezuelan | Cuban | British fusion |

| Afghan | Sri Lankan | Greek |

| Irish | Authentic Caribbean | West African |

| Basque | Malaysian | Filipino |

| Burmese | Peruvian | German street food |

| Ethiopian | - | Authentic Mexican |

| - | - | Authentic Eastern European |

Source: Lumina Intelligence, UK Menu & Food Trends Report, 2024

Cuisine opportunities for red meat

- The ‘occasion’ remains the largest pull to the OOH market for shoppers, therefore ensure red meat meals elevate the experience for diners

- Meat-centred meals bring the highest value OOH, so ensure red meat retains its relevance and stands out on menu through exploring innovative recipes and presentation styles

- Continue to innovate red meat offerings for important meals, including burgers and pizza, tapping into a variety of price points to meet differing consumer needs

- Capitalise on creative world cuisines and communicate the flavour experience via menu descriptions

- Use and communicate British red meat’s high quality and sourcing credentials on menu to tap into quality-led consumers (read more on this topic)

*Lumina Intelligence, UK Menu & Food Trends Report, 2024

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.