Inflation and a decline in shopper numbers poses a risk to butchers

Monday, 26 September 2022

Inflation and a decline in shopper numbers poses a risk to butchers. Although meat and poultry from butchers tends to be more expensive than other retailers, average market prices have gone up faster than butchers’ prices year-on-year. With consumer confidence levels at their lowest, people are looking for transparency and trust, which is something butchers can provide. Therefore, opportunities exist in attracting shoppers back by leveraging their competitive advantage of being able to recommend cheaper cuts and demonstrating their full range.

Shopper numbers decline

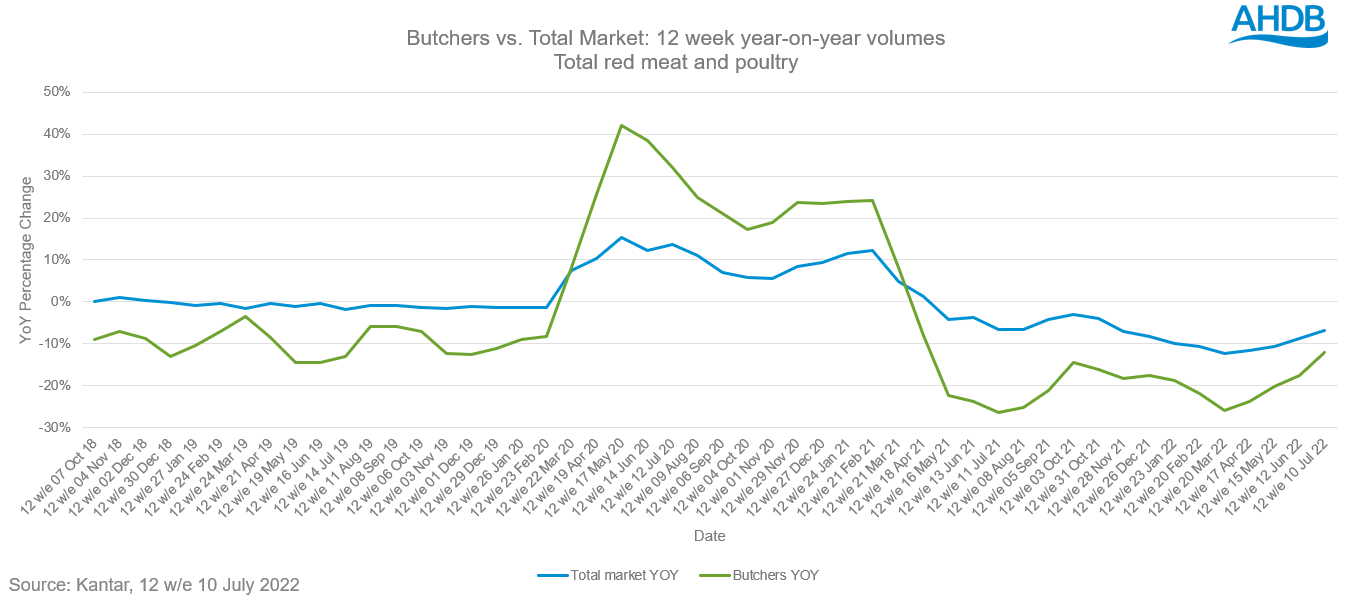

In 2021 we saw butchers’ sales performance slow as shoppers dropped out of the category when Covid restrictions eased. This was a significant shift in shopping behaviour from the previous year when butchers overperformed in the market during the pandemic. The sharp drop in butchers’ meat and poultry sales saw volume levels at their lowest, down by 26% year-on-year in the 12 w/e 11 July 2021.

Butchers’ volume sales have seen some recovery but are still below pre-pandemic levels. Current volume sale levels are down 12% year-on-year for the 12 w/e 10 July 2022. However, this compares to a total market decline of 7%.

Butchers’ share of total market volume was 2.3% for the 12 w/e 10 July 2022, which is a 0.2%pt (percentage point) reduction from the 12 w/e 11 July 2021. Pre-pandemic levels for the same period in 2018 and 2019 were 3.1% and 2.7% respectively. Trip volume levels and frequency of purchase at butchers are in line with previous years and the main driver for this decline is a drop in shopper numbers. Shoppers gained during the pandemic haven’t continued to shop at local stores, and the increasing pressure of inflation has accelerated this decline.

Whilst prices increase for butchers, opportunities still exist

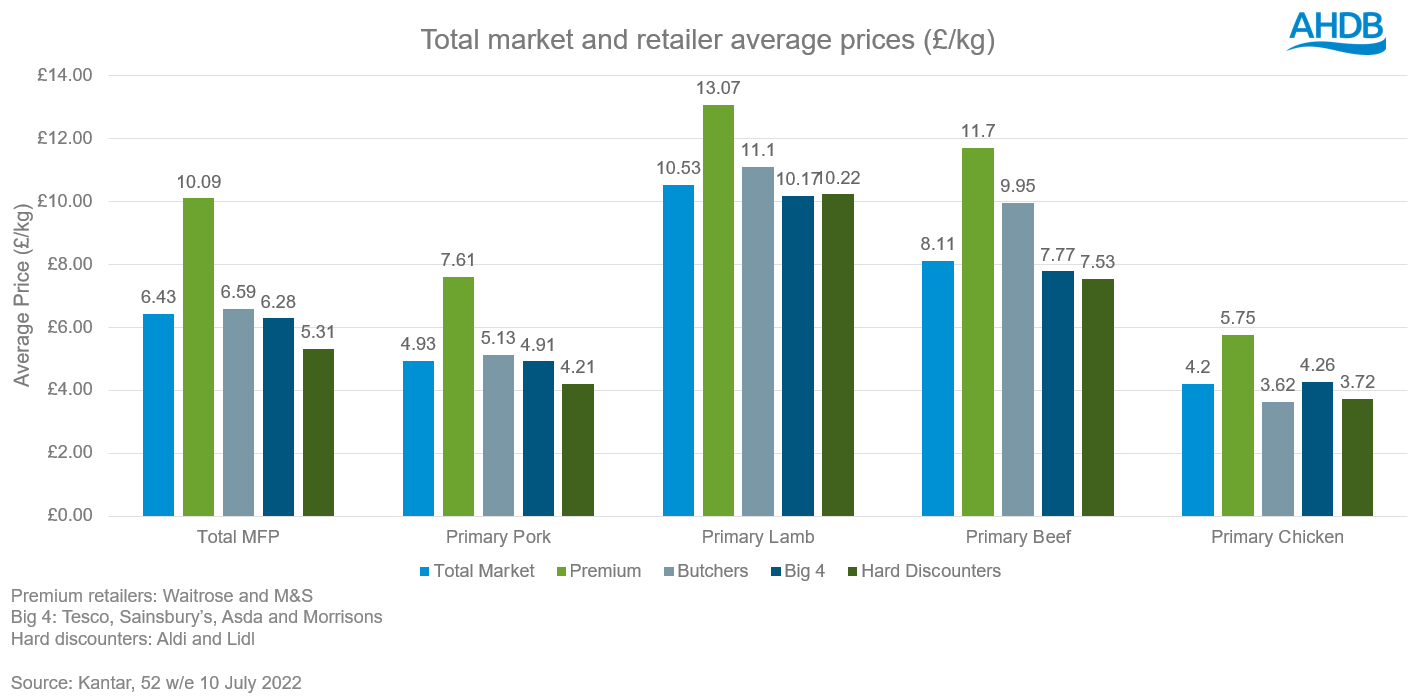

The red meat market still faces a period of unprecedented change, albeit this time the pressure comes in the form of inflation. Prices have been increasing across all product categories, and that is no different for butchers. Butchers are slightly more expensive overall than the top retailers, however, average total market prices have gone up faster than butchers’ prices (2.5% increase for butchers and 4.4% for total market) year-on-year (Kantar, 52 w/e 10 July 22).

Butchers are price competitive to the premium retailers (Waitrose and M&S) across primary meat and poultry, by a considerable margin. There are some similarities with those who shop at premium retailers and those who shop at butchers. This presents an opportunity for butchers to win shoppers back through comparable pricing and sourcing.

With consumer confidence levels at their lowest, people are looking for transparency and trust, from retailers. Highlighting farm links in-store can help humanise the farm to fork journey and boost the butchers’ brand image, as farmers are the most trusted group in the supply chain.

Consumers seek value for money

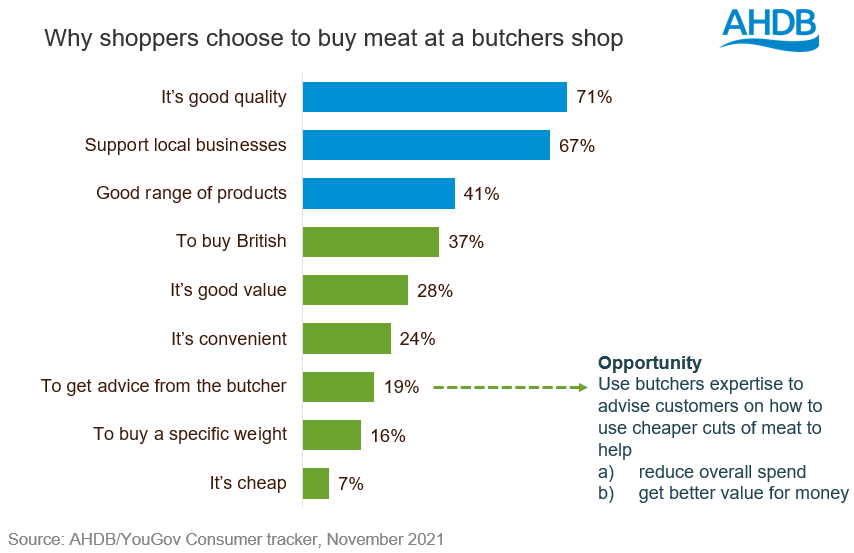

Inflation reached 8.8% in July 2022 (ONS, 2022) and this has driven a reduction in meat sales as shoppers buy less as a coping strategy. Price has come to the forefront of many consumers minds when shopping with 42% of shoppers sticking to a budget (IGD, ShopperVista, July 2022). The fastest growing driver of red meat reduction is now cost, with 35% of consumers stating this as their reason for cutting back (AHDB/YouGov Consumer Tracker, May 2022). Even so, consumers still value what butchers can offer. The main reason shoppers say they choose to buy meat from a butcher is the quality (71%), followed by supporting local businesses (67%) (AHDB/YouGov Consumer Tracker, Dec 2021), these are key areas for butchers to communicate to shoppers. In addition, butchers have the expertise to help shoppers stretch their budgets further by recommending cheaper cuts (and crucially, how to cook them) and should communicate this to customers.

More than half of consumers (52%) are planning to spend less than usual on visiting pubs and restaurants over the next three months (Two Ears One Mouth, Aug 2022). This provides a significant opportunity for butchers to capture meal occasions lost from out-of-home. Cooking from scratch is claimed to be the preferred choice at-home, so meal deals and recipe inspiration that helps households deliver this would be welcomed (IGD ShopperVista, Aug 2022).

Taking full advantage of the season ahead

Seasonal events are a key time for butchers to demonstrate their full range and demonstrate to consumers value for money for good quality, locally sourced meat. Despite the expectation of a “normal” Christmas last year, consumers were still disrupted by the new variant, with 32% of people stating that the news of Omicron affected their celebrations and a further 27% avoiding making plans altogether due to the uncertainty of restrictions (IGD ShopperVista, Jan 2022). As this is the first Christmas without restrictions, many will be looking for more normality than recent years, potentially benefitting butchers (and retail overall), particularly if they can help shoppers spread the cost. Butchers can also take the opportunity to offer incentives to return throughout the following year such as discounts or loyalty cards.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.