Butchers’ sales performance slows as shoppers drop out

Thursday, 21 October 2021

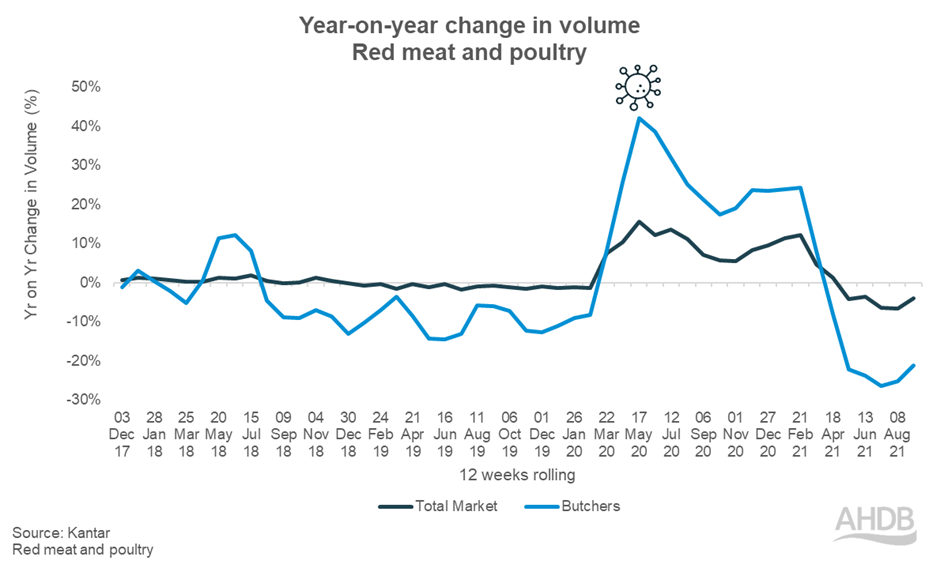

Butchers enjoyed a strong 2020, with meat and poultry volumes up 22% on the previous year (Kantar, 52 w/e 27 Dec 20). However, pre-pandemic shopping habits have crept back in recent months, with latest Kantar data showing the amount of meat and poultry sold at butchers in the 12 w/e 5 Sept 21 fell 21.1% year-on-year. This compares to an average decline of 4.1% across all retailers.

During the peak of the pandemic, many shoppers were avoiding the big stores, instead opting for their high streets – leading to a better than average sales performance for butchers. However, in the past few months, butchers’ meat and poultry volumes have slipped back to below average and are down 4.4% compared to two years ago, in contrast to the market average increase of 2.7% over the same time.

Shoppers dropping out of butchers

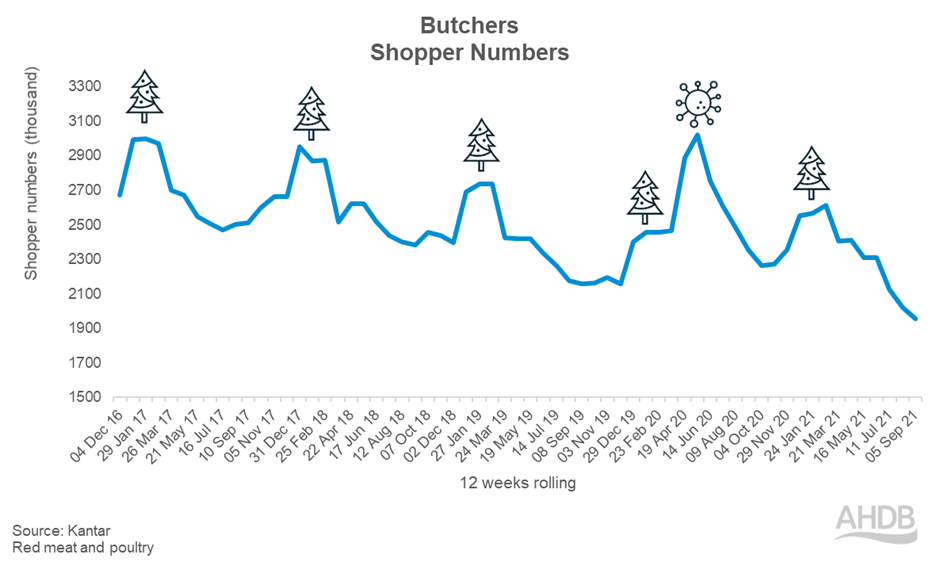

The main driver of the recent decline in volumes is a reduction in shopper numbers, with nearly 400,000 fewer shoppers than the same period in 2020, and around 200,000 fewer than 2019 (Kantar, 12 w/e 5 Sep 21). Many of those gained during the pandemic haven’t continued to shop with these local stores and in the latest 12 weeks, just 7% of households bought meat and poultry from a butcher.

Opportunities exist to attract shoppers back to their local butchers and increase sales, such as maximising on the seasonal peaks, including the Christmas trading period, by offering incentives to return throughout the following year.

There is an also an opportunity to encourage existing light shoppers to add a bit more to their basket. In the last 12 weeks, light shoppers bought an average of 0.7kg of red meat per trip, whereas medium shoppers bought 1.2kg and heavy shoppers 1.6kg. Encouraging those light shoppers to increase their red meat purchases to around 1kg would equate to an extra £5.6m worth of sales for butchers, in that 12-week period.

Dialling up quality and local

The main reason shoppers say they choose to buy meat from a butcher is the quality (73%), followed by supporting local businesses (65%) (AHDB/YouGov Tracker, Nov 20), and therefore these are key areas for butchers to communicate to shoppers.

This element of supporting local is also seen for doorstep milk deliveries however, in contrast, milk sales via milkmen are much higher than 2019, and shopper numbers have also maintained well above pre-pandemic levels. The subscription model for doorstep milk deliveries could be emulated for popular meat product purchases from the butcher in order to reward shopper loyalty and avoid further losses in shopper numbers in future.