Economic pressure on consumers provides opportunities for discount and bargain stores

Tuesday, 28 September 2021

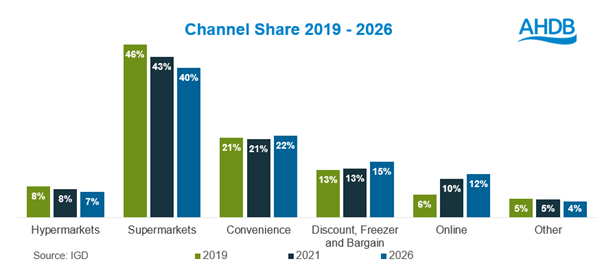

Discount, freezer and bargain stores* are predicted to be worth an additional £6.6bn per year by 2026 with much of this value switching from supermarkets according to The Institute of Grocery Distribution (IGD).

After a relatively slow rate of growth during the peak of the pandemic, discount, freezer & bargain stores are expected to see the biggest share growth of all channels between now and 2026. The grocery multiples will need continue to keep a close eye on these stores if they are hoping to compete with them in the future and meat and dairy suppliers should take this growth rate in to account when planning for the future, as supplying existing and new entrants in the discount market could be a big opportunity for growth.

Nearly half of shoppers say they are more price conscious than they were at the start of the pandemic (AHDB/YouGov, Aug 2021). Economic crises can have long and lasting impacts on how much we spend on food and drink. Our weekly expenditure on food and drink (excl. alcohol) in 2020 is still down 3% compared to 15 years ago before the 2008 financial crash according to the ONS (although up 8% versus five years ago showing there is some recovery). Discount and bargain stores are likely to benefit in the upcoming years as some households look to cut back spending as the economic outlook continues to look uncertain.

The discount channel currently has 13.1% share of the total grocery market according to IGD and it is predicted to reach 15.0% by 2026.

Encouraging shoppers back who may have switched to other retailers during the pandemic will be key in the short term but long-term growth for existing discount players (such as Aldi and Lidl) will likely come from continued physical expansion. They could be especially boosted as they plan to expand their Southeast and London presence. Internationally, we have seen hard discounters diversifying in to more corner and local store formats to cater to urban environments, a trend which they are likely to roll out in the UK. Freezer stores (such as Iceland and Farm Foods) should look to mirror this expansion if they wish to keep their market share.

As bargain stores (such as B&M and Home Bargains) become increasingly credible destinations for grocery shoppers, they could look to evolve their propositions and grow their grocery ranges. Bargain stores which are out of town are doing particularly well over those on the high street.

Hard discounters, freezer and bargain stores are starting to take advantage of shoppers move online but it is still in its infancy, and they could do more to enhance their offering in this space. For example, Aldi have linked up with Deliveroo to offer home delivery and Lidl have launched their loyalty app to give shoppers exclusive rewards and discounts.

Despite the predicted growth for hard discounters, they still face many challenges. Increasing their offering in this space and not just relying on low prices will be key as they face increasing price pressure from supermarkets.

There are new players entering the market such as Russian discounter Mere which plans to open 300 UK stores within 10 years and promises prices 30% less than Aldi and Lidl and also One Below which opened 60 stores in 2020. These are likely to compete strongly on price with existing discount and bargain stores, so finding a point of difference for their shoppers by highlighting range, quality and sustainability credentials could be essential.

Category performance

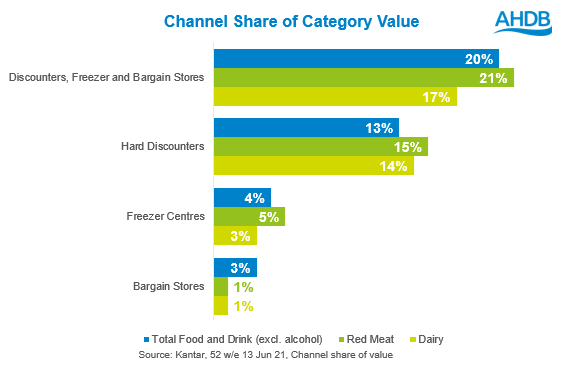

Red meat over indexes at discount, freezer and bargain stores, whereas dairy tends to under trade. Hard discounters have a higher share in both red meat and dairy than total food and drink (excl. alcohol), as shoppers do both main and top up shops in these stores, which red meat and dairy are reliant on. Bargain stores under trade in both areas as it is not a main destination for these products and are more angled towards ambient food. However, bargain stores were seeing strong growth in chilled food prior to the pandemic, so could prove an opportunity for suppliers in the future.

Red meat

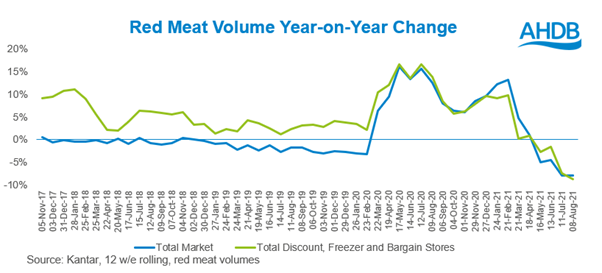

Before the pandemic, discount, freezer and bargain stores were consistently seeing red meat growth, whereas total red meat volumes had fallen in to decline. During the pandemic, we have seen this gap shrink as the channel tracks close to the total market growth.

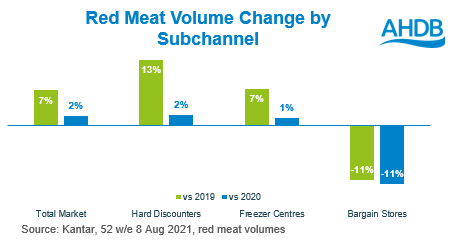

The main driver of this has been the hard discounters. These stores over-index on red meat value compared to their share of total food and drink (excl. alcohol) sales (13%), making up 15% of red meat value sales and 18% of volumes over the last year (Kantar, 52 w/e 8 Aug 21). As discount stores now track in line with the market, establishing a differentiation and unique selling point is essential to return to gaining market share. Discount store shoppers are more likely to have families, so catering to their needs with larger packs for a cheaper per kg price could be an opportunity.

While bargain stores are a tiny channel for red meat, accounting for less than 1% of total volumes, they were seeing considerable growth before the pandemic. However, they were not boosted by the pandemic in the same way as many other grocery stores. Bargain stores have seen penetration fall, as have many channels but the red meat volume per buyer has also dropped, leading to an overall volume decline. Encouraging these grocery shoppers back is important for bargain stores as they increase basket sizes and shop more frequently.

Perhaps unsurprisingly, bargain stores under trade in primary red meat, with much of the focus on processed pig meat. To appeal to shoppers for their big or top up shops, increasing the range of products on offer is essential to retain these shoppers in the future.

Within red meat however, all subchannels under trade in lamb, if the category was to achieve its fair share, this could be worth approximately £48 million per year to the category. Hard discounter suppliers should consider different ways they could appeal to these shoppers with lamb.

Dairy from cow’s milk

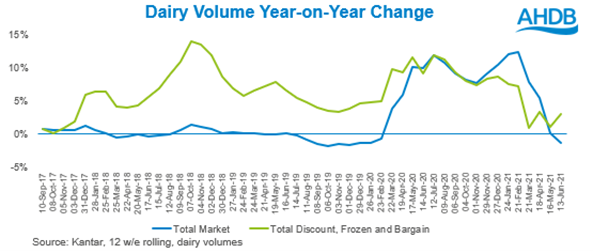

Prior to the pandemic, dairy volumes in discount, freezer and bargain stores were growing much faster than the total market.

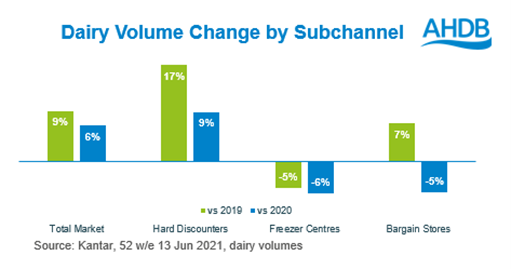

Hard discounters accounted for 83% of dairy value growth in discount, freezer and bargain stores over the last year (Kantar 52 w/e 13 Jun 2021), and are the only subchannel to see dairy volume growth.

Milk makes up the majority of dairy volume sales at hard discounters accounting for 69% of volumes but only 27% of value. Cheese is the largest category for dairy value at hard discounters at 37% of sales. At bargain stores, again milk makes up the majority of dairy volumes sales at 66%, with bargain store shoppers more likely than average to buy butter and margarine, cheese and cream (Kantar, 52 w/e 13 Jun 21).

Overall however, dairy under trades at discount, freezer and bargain stores. Milk is the main area of under trade as at a total market level milk accounts for 76% of total dairy volumes. Milk is a staple product; 98% of households purchase cow’s milk every year and most shoppers buy it 67 times per year, meaning that buying milk is more than a weekly occurrence (Kantar, 52 w/e 13 Jun 2021). Therefore, capitalising on these frequent shopping trips in critical for discount, freezer and bargain stores to increase footfall in stores post pandemic. Dairy suppliers in to these stores should encourage marketing towards top up and quick trips as it would benefit their categories.

Hard discounters are the subchannel to see growth in dairy year on year. Shoppers are still worried about doing multiple trips to grocery stores and freezer centres and bargain stores have been hit hard by this. Shopper numbers have fallen across retail, however, loyal hard discount shoppers, have increased their frequency of visits to store and are buying more dairy per shop which is driving the growth. Maintaining this momentum and keeping those shoppers loyal is key once consumers feel more confident shopping again. This has been done successfully at other stores through loyalty schemes or tailored promotions, which they could look to emulate.