Consumers trade down in dairy as costs continue to rise

Tuesday, 21 March 2023

Consumers are living through one of the most difficult economic periods in years, with high inflation, rising interest rates and wages failing to keep pace causing living standards to fall.

One of the ways of mitigating high prices in the shops is to “trade down” or buy cheaper versions of their regular products to keep their overall basket spend more stable. How is this impacting on the dairy sector?

62% of consumers are concerned by the rising prices of food (Source: AHDB/Blue Marble Sept 2022) and price has grown in importance when choosing a dairy product, with 57% saying it has recently become more important (Source: AHDB/You Gov Nov 2023). While people are trying to save money, dairy is such a staple product that not many are choosing to reduce their dairy consumption for cost reasons (claimed by only 27% of dairy reducers compared to 54% of meat reducers). Rather they are choosing to save money by buying cheaper versions of the same products.

Clearly brands may have a tougher time over the next year or two and processors will need to make investment decisions wisely, investing in parts of their portfolio that offer the biggest opportunities for growth or that are strategically important. Conversely, those supplying private label and retailers have a clear opportunity to capitalise on the trend towards trading down in replicating some of the more added value branded products in a more pared-back way. How will this play out by category?

Milk: a basic staple?

Within milk, this dynamic is particularly evident for organic. Overall cow’s milk volumes are declining by -3.1% year on year (Source: Kantar 12 we 25 Dec 22). However, organic cow’s milk volumes have declined by -14.7% in volume terms. Price for both conventional and organic have risen at a similar rate (35% and 32% respectively) but the more premium position of organic makes it less affordable for many consumers.

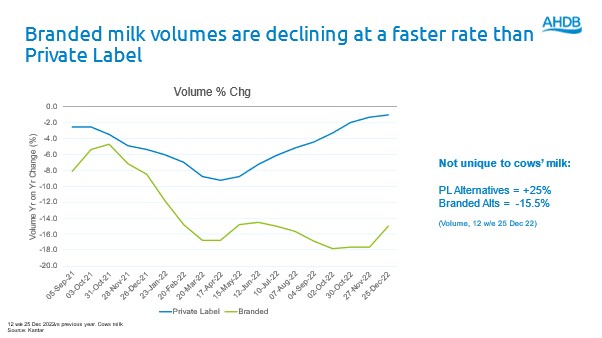

There is a similar pattern for branded milk. Private label milk is currently only losing a modest amount of volume but branded milk is in double digit decline as the graph below shows. This dynamic is not unique to cow’s milk, private label alternatives are capturing a higher share of the milk alternatives market currently as brands are declining by -15.5% year-on-year.

Butter: branded volumes are sliding away

Butter has always sat as a more price sensitive commodity with an obvious switch to margarine to be made when times are tight. In fact, all sub-categories are currently losing volume, but margarine has suffered the least, with only -1.7% of volume lost.

The switch from branded into private label is also very clear within the yellow fats markets. Total yellow fats have seen branded volumes reduce by -13% whilst private label has grown by 12.3% (Source: Kantar 12 we 25 Dec 22). In block butter this pattern is replicated with branded at -7.5% whilst private label is still down but by only -4.4%. In spreadable where we have seen so many headlines about the cost of certain brands of butter, branded is down by -18.3% while private label is up by 30.4% year-on-year.

Cheese: will shoppers make an exception

Cheese is a dairy product category that bucks trends – shoppers stay committed to buying cheese in spite of price rises. Also, when other dairy products experienced declines pre-pandemic, cheese was in a phase of growth. Does that mean that consumers are prepared to maintain their investment in cheese?

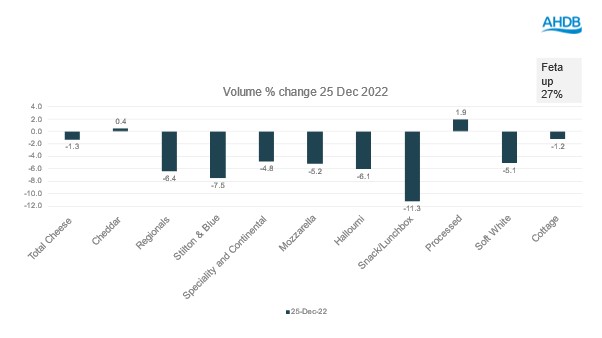

The signs are that whilst people retain their overall commitment to cheese (overall volumes only down by -1.3%) in the 12 we 25 Dec 22, repertoires seem to be reduced. Staples like cheddar are performing best, up by 0.4% year on year whilst more speciality regionals are declining. Processed also saw some volume growth. The stand-out performer was feta, up by 27%. This could be a result of people using the product as a substitute for more expensive meat. Feta has also been heavily promoted in viral TikTok trends that include baked feta with tomatoes used as a pasta sauce and a whipped feta dip.

Within cheddar (which makes up the lion’s share of the cheese market), private label is in growth by 5.3% whilst branded is down by -14.4%. Curiously, within the private label cheddar market there are signs of polarisation with standard cheddar in volume decline of -13.1% but budget private label up a huge 49% year-on-year and premium private label also in growth by 22.5%, picking up some of the losses from branded cheddar.

Yogurt

Yogurt has more branded product sold than any other dairy product, making up 55% of the market by volume in the past 12 weeks to 25 Dec 22. Similarly to other categories private label is in growth by 8.6% whilst branded is down by -12.1%. Split pots and standard private label are the biggest winners with 36% growth and 16% growth respectively. The only private label losers were private label luxury yogurt which declined by 3.1%, fat free (down by 7.5%) and kids handheld (down by 1.8%).

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.