Consumer awareness of regenerative agriculture

Tuesday, 13 July 2021

Since 2019, the term regenerative agriculture or regen-ag has started to gain traction, with google searches in the UK peaking in March 2021. Regenerative agriculture encompasses farming practices that work to actively improve the environment. But what is the general awareness and understanding of the term? And will it become the buzz word of agriculture?

Consumer awareness

A questionnaire conducted by AHDB and YouGov in May 2021, found that only 14% of British consumers have heard of regenerative agriculture. Although awareness is currently low, we predict it will grow as consumer concern for the environment increases, and brands and retailers begin to use the term more frequently.

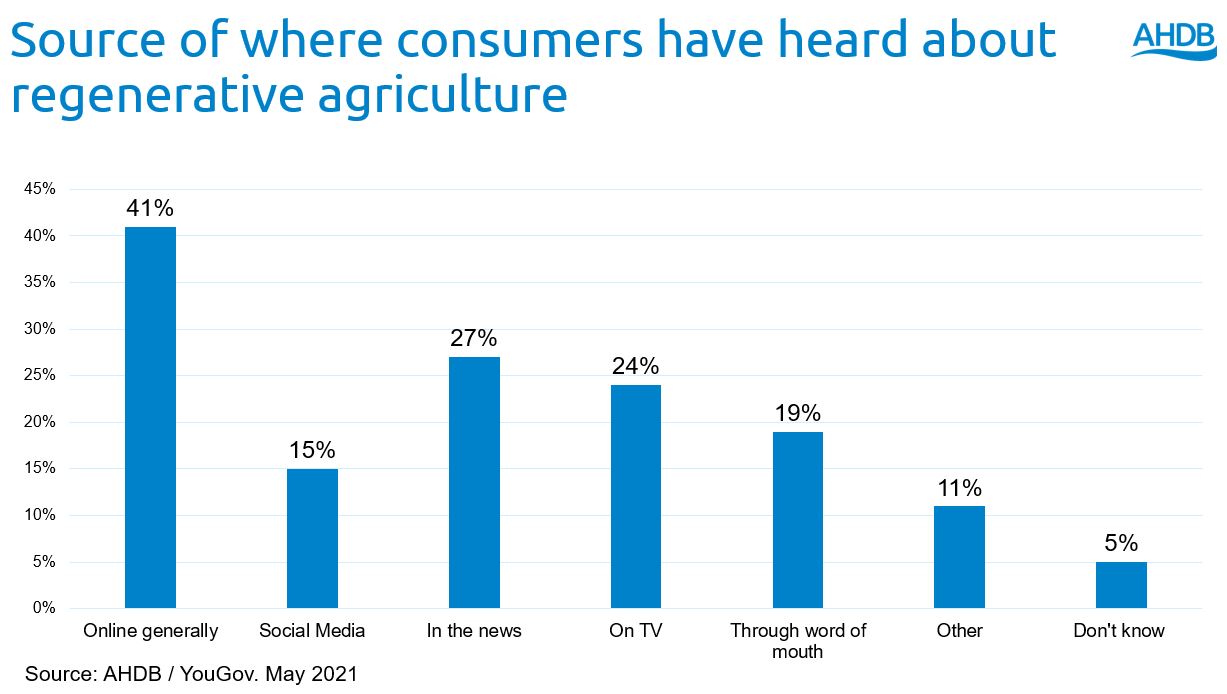

Amongst those who have heard of regenerative agriculture, (49%) of consumers have heard via online sources*, followed by in the news, or on TV. Of those, 69% say they would find an on pack or product claim appealing, which suggests there may be an opportunity to use regenerative agriculture in consumer facing marketing.

* ‘Online sources’ is the net figure of respondents who answered either online generally or via social media.

**Percentages add up to more than 100% as respondents could select all answers that applied.

Those aged 16-44 are more aware (16%) of regenerative agriculture, compared to those aged 45+ (13%). From our wider studies, we have identified that the shopper decision making process for red meat and dairy is primarily influenced by purchase drivers such as price, knowing how to cook, and appearance. Wider reputational factors such as environmental credentials and animal welfare are seen as ‘nice to have’. However, as products which carry these claims often hold a price premium, they can lose out to cheaper products, as price is more of a priority for many shoppers when purchasing meat and dairy. In turn, if something is of lower priority, consumers are less likely to have researched or understand the topic.

Location also impacted awareness, with Welsh consumers more likely to have heard of regenerative agriculture, at 21% compared to the UK average of 14%. Nationally, the goal for Net Zero commands wide appeal amongst those most concerned about the impact of farming on the environment (AHDB/ Blue Marble, 2020).

In a previous study, AHDB found that there is some interest in farming’s impact on the environment with 1 in 3 being concerned. The same study found there is also consumer appetite for potential on-farm initiatives, which could mitigate concern, such as planting more trees and hedgerows (67% of those most concerned about farming and the environment) and helping the soil to absorb more carbon (59%). This is significant as both of these practises can fall under the banner of ‘regenerative agriculture’.

Effective communication

73% of consumers believe British farmers and growers have done a good job in producing food for consumers during the Covid-19 pandemic (AHDB/ YouGov May 2021) and farmers are by far the most trusted parts of the supply chain (AHDB/ Blue Marble, 2020). However, farmers are the group within the supply chain that consumers have the least interaction with. This suggests there is room for the industry to highlight initiatives, agricultural practices and production methods used to produce food and drink in a more regenerative way, allowing consumers to make informed purchase decisions.

To encourage shoppers to choose regenerative produced food and drink, consumer knowledge and understanding of product benefits needs to be improved, to justify the price premium.

Previous reports conducted by the AHDB have found that the shopper decision making process is influenced by different factors between at-home planning and in-store purchase:

Topics:

Sectors:

Tags: