Chinese meat imports climb, but pace slowing

Wednesday, 16 June 2021

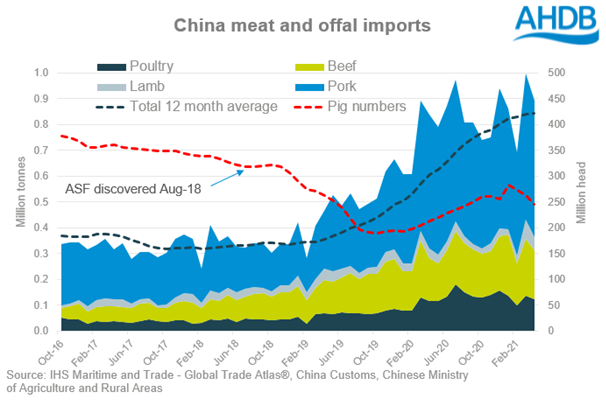

Import demand in China for all meats has continued to climb, despite the marked recovery in domestic pig herd numbers. However, there are signs that the rise in import demand is beginning to slow.

Clean pig numbers in April (the latest month for which trade data is available) were still 23% below August 2018, when ASF was first discovered in China. However, they had climbed to 30% higher than in October 2019, when the herd was at its smallest. Pig numbers have since continued to recover further.

Imported meat volumes have only increased, despite the slow recovery in domestic pork production. In April 2021, total imports of meat and offal were 75% higher than in October 2019 and 164% higher than when ASF was first discovered. Naturally, import demand for pork has grown the most dramatically, by 227% since ASF was first discovered.

The major beneficiaries of this huge increase in Chinese import demand will surprise few; Brazil, Spain, the United States, Denmark, Netherlands, and to a lesser extent Argentina and New Zealand have all increased exports to China in the last three years. Until ASF was discovered within its own borders, Germany too had been making great inroads into the Chinese market. Meat trade with China has come to underpin many other markets too, including our own.

There are signs that this import growth is beginning to slow. The 12-month rolling average for monthly imports is flattening. China has a stated aim of 95% self-sufficiency in pork, and market analysis, from Rabobank to the USDA, and including our own pork market outlook, expect imports to cool in 2021.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.